Answered step by step

Verified Expert Solution

Question

1 Approved Answer

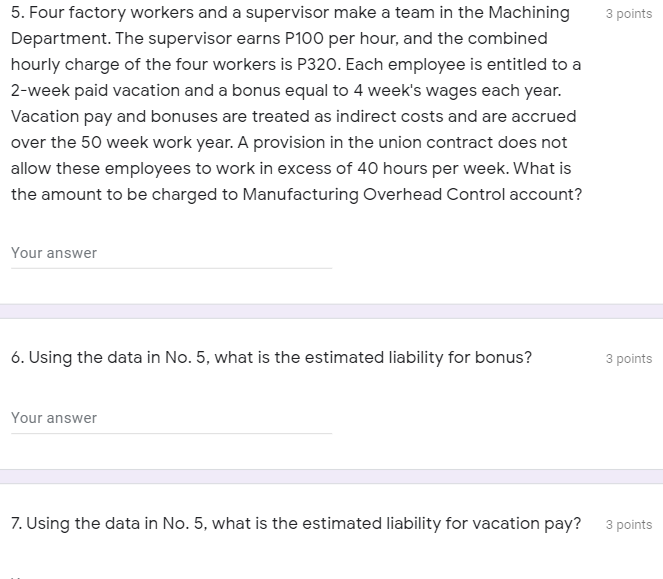

5. Four factory workers and a supervisor make a team in the Machining Department. The supervisor earns P100 per hour, and the combined hourly

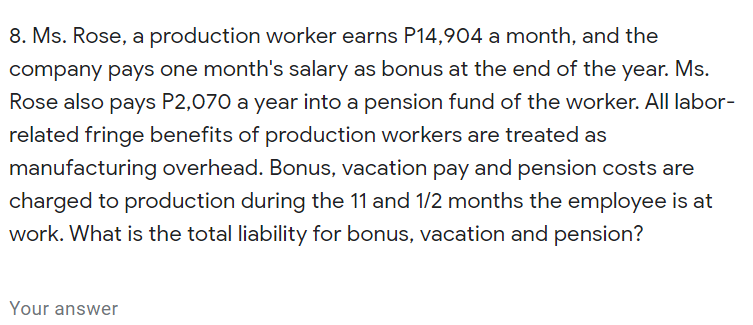

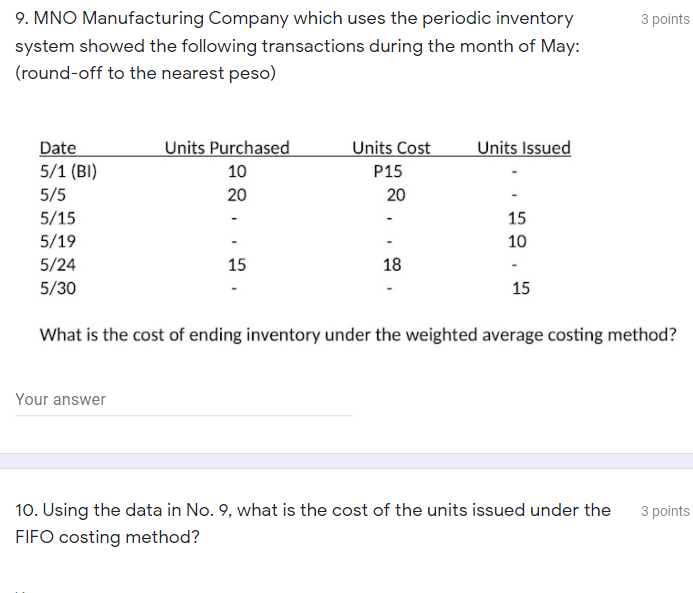

5. Four factory workers and a supervisor make a team in the Machining Department. The supervisor earns P100 per hour, and the combined hourly charge of the four workers is P320. Each employee is entitled to a 2-week paid vacation and a bonus equal to 4 week's wages each year. Vacation pay and bonuses are treated as indirect costs and are accrued over the 50 week work year. A provision in the union contract does not allow these employees to work in excess of 40 hours per week. What is the amount to be charged to Manufacturing Overhead Control account? 3 points Your answer 6. Using the data in No. 5, what is the estimated liability for bonus? 3 points Your answer 7. Using the data in No. 5, what is the estimated liability for vacation pay? 3 points 8. Ms. Rose, a production worker earns P14,904 a month, and the company pays one month's salary as bonus at the end of the year. Ms. Rose also pays P2,070 a year into a pension fund of the worker. All labor- related fringe benefits of production workers are treated as manufacturing overhead. Bonus, vacation pay and pension costs are charged to production during the 11 and 1/2 months the employee is at work. What is the total liability for bonus, vacation and pension? Your answer 9. MNO Manufacturing Company which uses the periodic inventory system showed the following transactions during the month of May: (round-off to the nearest peso) 3 points Date Units Purchased Units Cost Units Issued 5/1 (BI) 5/5 20 10 20 P15 20 5/15 5/19 - 125 15 10 5/24 18 - 5/30 15 15 What is the cost of ending inventory under the weighted average costing method? Your answer 10. Using the data in No. 9, what is the cost of the units issued under the FIFO costing method? 3 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started