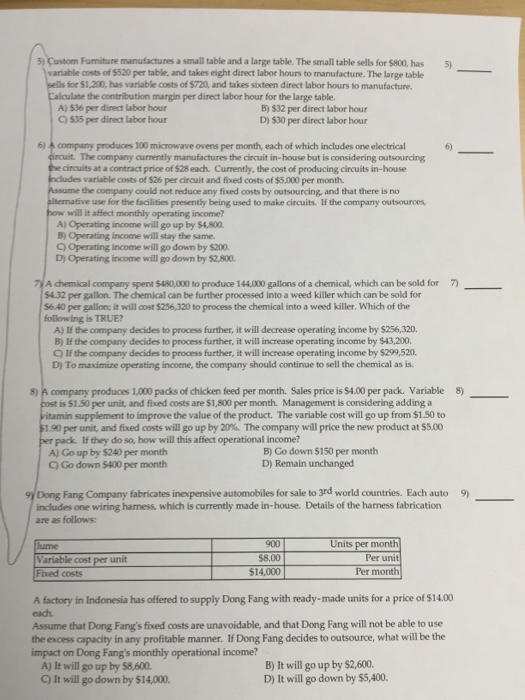

5) Furniture manufactures a small table and a large table. The small table sells for $800, has 5) variable costs of $520 per table, and takes eight direct labor hours to manufacture. The large table sells for $1,200, has variable costs of $720, and takes sixteen direct labor hours to manufacture. the contribution margin per direct labor hour for the large table. A) 536 per direct labor hour C $35 per direct labor hour B) 532 per direct labor hour D) 530 per direct labor hour 6 company produces 100 microwave ovens per month, each of which includes one electrical 6) The company currently manufactures the circuit in-house but is considering outsourcing circuits at a contract price of $28 each. Currently, the cost of producing circuits in-house variable costs of $26 per circuit and fixed costs of $5,000 per month. the company could not reduce any fixed costs by outsourcing, and that there is no use for the facilities presently being used to make circuits. If the company outsources, how will it affect monthly operating income? A) Operating income will go up by $4,800 B) Operating income will stay the same ) Operating income will go down by $200. D) Operating income will go down by $2,800. 7 A chemical company spent $480,000 to produce 144,000 gallons of a chemical, which can be sold for 7) $4.32 per gallon. The chemical can be further processed into a weed killer which can be sold for 56.40 per gallon; it will cost $256,320 to process the chemical into a weed killer. Which of the following is TRUE? A) If the company decides to process further, it will decrease operating income by $256,320. B) If the company decides to process further, it will increase operating income by $43,200. C) If the company decides to process further, it will increase operating income by $299,520. D) To maximize operating income, the company should continue to sell the chemical as is. 8) company produces 1.00 packs of chicken feed per month. Sales price is S4.00 per pack. Variable 8) is $1.50 per unit, and fixed costs are $1,800 per month. Management is considering adding a supplement to improve the value of the product. The variable cost will go up from $1.50 to 1.90 per unit, and fixed costs will go up by 20%. The company will price the new product at S5.00 pack. If they do so, how will this affect operational income? A) Go up by $240 per month C Go down $400 per month B) Go down $150 per month D) Remain unchangerd 9 Dong Fang Company fabricates inexpensive automobiles for sale to 3rd world countries. Each auto includes one wiring hamess, which is currently made in-house. Details of the harness fabrication are as follows 900 $8.00 $14,000 Units per month Per unit Fixed costs Per month A factory in Indonesia has offered to supply Dong Fang with ready-made units for a price of $14.00 each Assume that Dong Fang's fixed costs are unavoidable, and that Dong Fang will not be able to use the excess capacity in any profitable manner. If Dong Fang decides to outsource, what will be the impact on Dong Fang's monthly operational income? A) It will go up by $8,600. C) It will go down by $14,000. B) It will go up by $2,600. D) It will go down by $5,400