Answered step by step

Verified Expert Solution

Question

1 Approved Answer

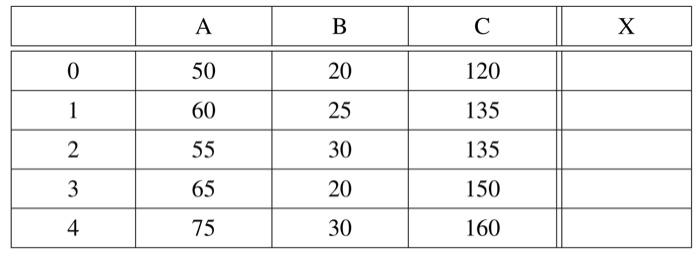

5. Given the five-stage prices of the three assets A, B, and C shown in the following table, consider a 5-unit A, a 10-unit B,

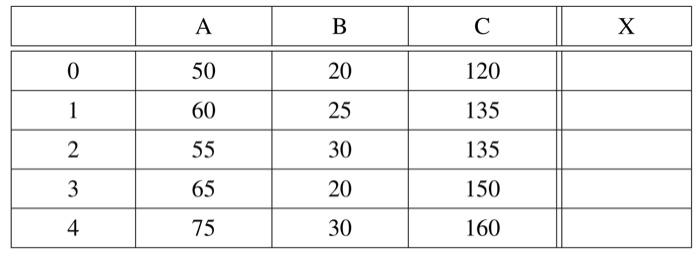

5. Given the five-stage prices of the three assets A, B, and C shown in the following table, consider a 5-unit A, a 10-unit B, and a 2-unit C portfolio X.

A B C X 0 50 20 120 1 60 25 135 2. 55 30 135 3 65 20 150 4 75 30 160 AHR ALD A B X A B X 1 2 3 4 4 A B X HR(0,5) AM(0,5) GM(0,5) AHR(0,5) ALD(0,5) B 1 2 0 2 OOO 0 3 5 10 4 0 0 10 A B C X 0 50 20 120 1 60 25 135 2. 55 30 135 3 65 20 150 4 75 30 160 AHR ALD A B X A B X 1 2 3 4 4 A B X HR(0,5) AM(0,5) GM(0,5) AHR(0,5) ALD(0,5) B 1 2 0 2 OOO 0 3 5 10 4 0 0 10 Table 1 Asset prices

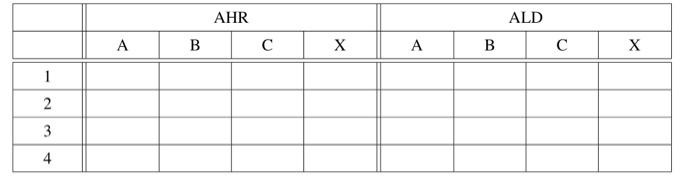

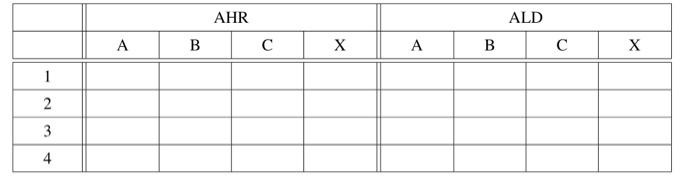

(1) to calculate and tabulate the four one-term return rates of a, b, c and x, AHR and ALD:

One-term rate of return

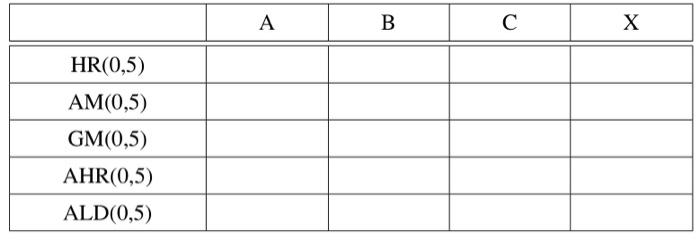

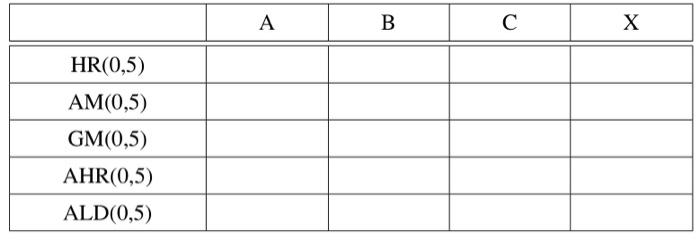

(2) Please calculate the multi-period rates of return for consolidation of columns A, B, C and X:

Multiperiod rate of return

(3) to prove that the AHR(O,5) of x is the weighted sum of the ahrs (o, 5) of a, b and c, and to point out what the weights are.

(4) It is proved that ALD(0,5) of X is the weighted sum of single-stage ALD, and what the weights are.

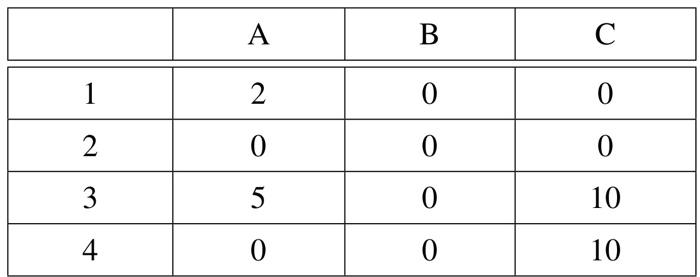

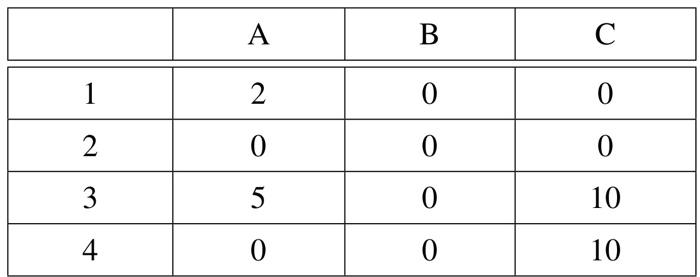

(5) The loss calculated from the asset prices of each period in Table 1 is called "capital gain" or "capital gain loss". However, some assets pay interest or dividends in addition to the loss caused by price changes. Assuming that the interest dividends paid by the three assets in each period are shown in the following table, please recalculate Item 1, Item 2.

Table 2 Interest Dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started