Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors

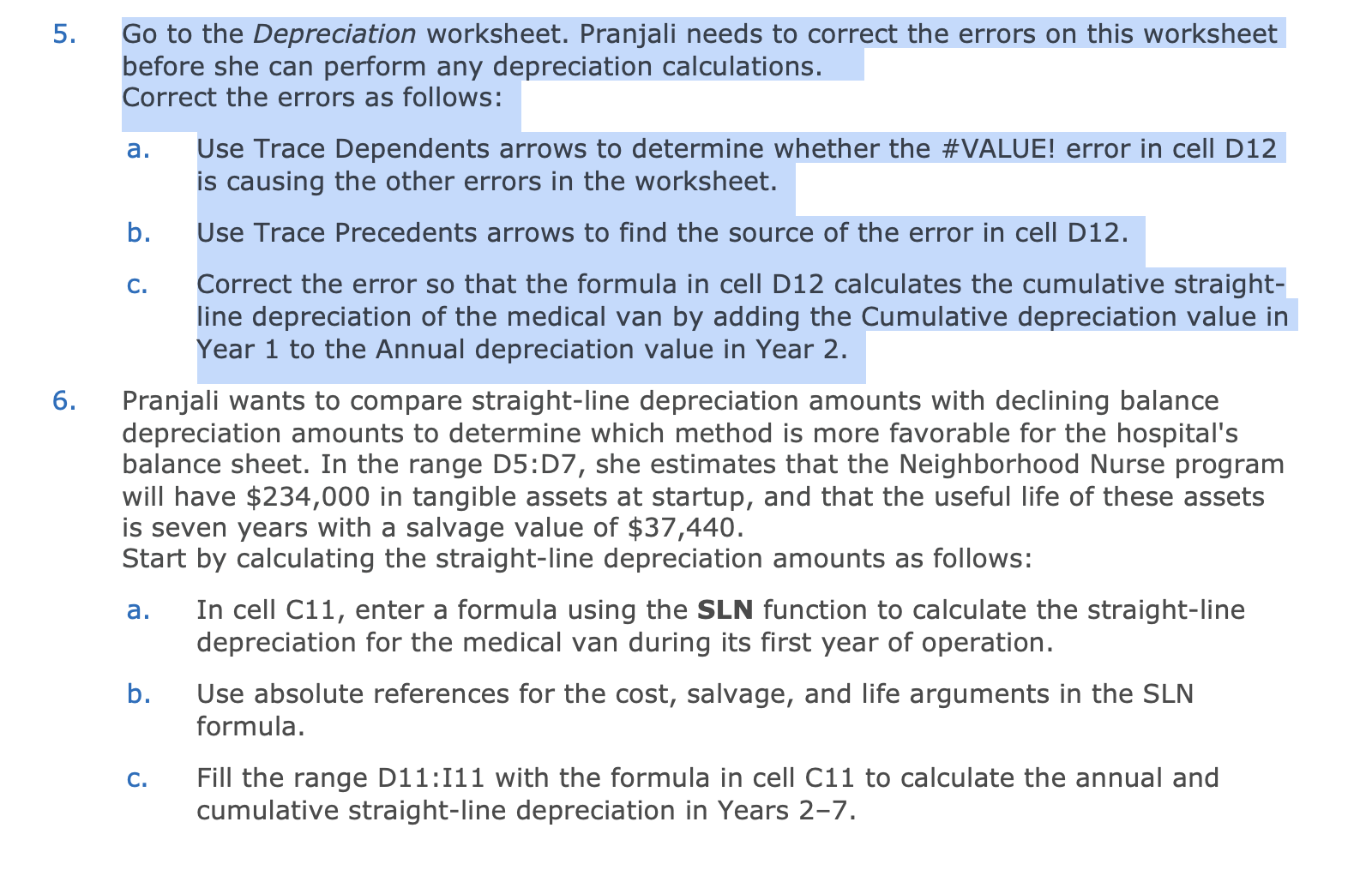

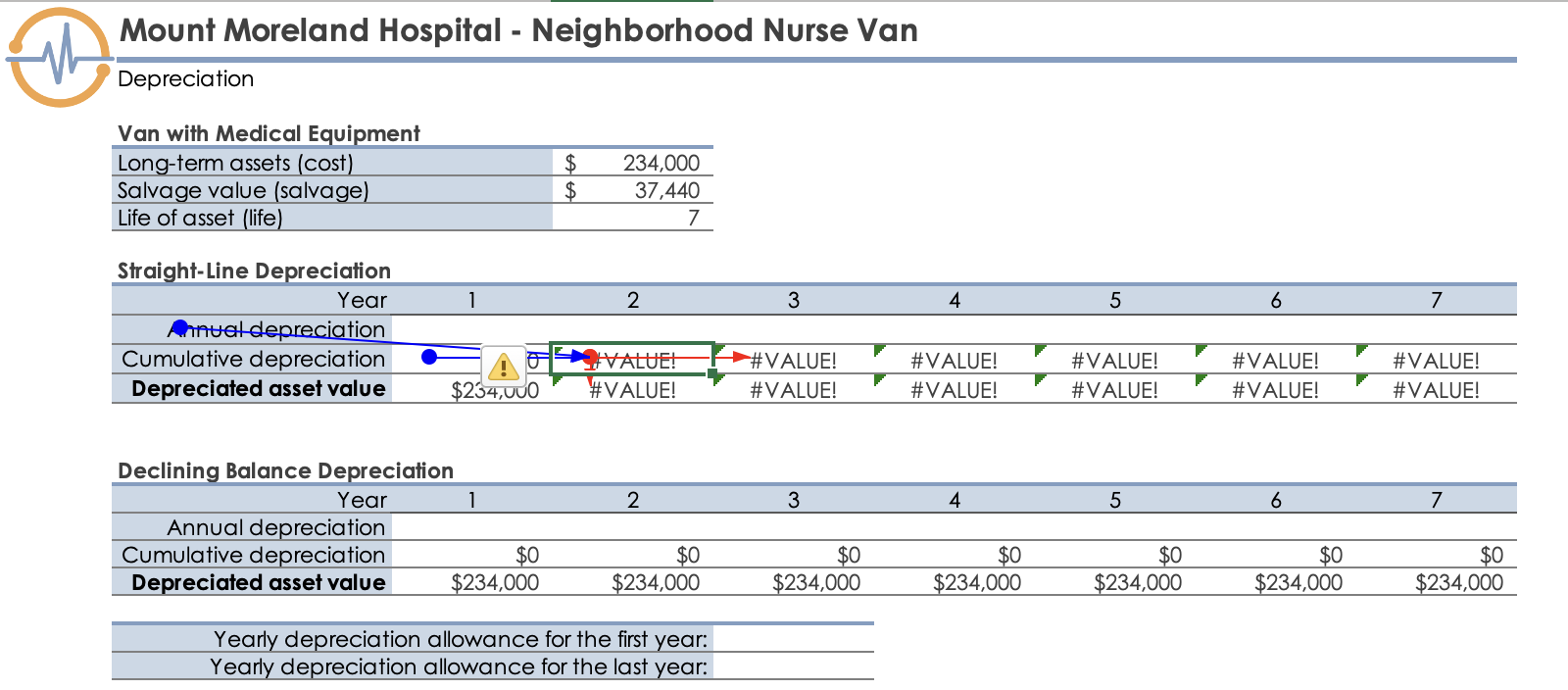

5. Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors as follows: a. Use Trace Dependents arrows to determine whether the \#VALUE! error in cell D12 is causing the other errors in the worksheet. b. Use Trace Precedents arrows to find the source of the error in cell D12. c. Correct the error so that the formula in cell D12 calculates the cumulative straightline depreciation of the medical van by adding the Cumulative depreciation value in Year 1 to the Annual depreciation value in Year 2. 6. Pranjali wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for the hospital's balance sheet. In the range D5:D7, she estimates that the Neighborhood Nurse program will have $234,000 in tangible assets at startup, and that the useful life of these assets is seven years with a salvage value of $37,440. Start by calculating the straight-line depreciation amounts as follows: a. In cell C11, enter a formula using the SLN function to calculate the straight-line depreciation for the medical van during its first year of operation. b. Use absolute references for the cost, salvage, and life arguments in the SLN formula. c. Fill the range D11:I11 with the formula in cell C11 to calculate the annual and cumulative straight-line depreciation in Years 2-7. Mount Moreland Hospital - Neighborhood Nurse Van Depreciation Van with Mediral Faninment 5. Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors as follows: a. Use Trace Dependents arrows to determine whether the \#VALUE! error in cell D12 is causing the other errors in the worksheet. b. Use Trace Precedents arrows to find the source of the error in cell D12. c. Correct the error so that the formula in cell D12 calculates the cumulative straightline depreciation of the medical van by adding the Cumulative depreciation value in Year 1 to the Annual depreciation value in Year 2. 6. Pranjali wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for the hospital's balance sheet. In the range D5:D7, she estimates that the Neighborhood Nurse program will have $234,000 in tangible assets at startup, and that the useful life of these assets is seven years with a salvage value of $37,440. Start by calculating the straight-line depreciation amounts as follows: a. In cell C11, enter a formula using the SLN function to calculate the straight-line depreciation for the medical van during its first year of operation. b. Use absolute references for the cost, salvage, and life arguments in the SLN formula. c. Fill the range D11:I11 with the formula in cell C11 to calculate the annual and cumulative straight-line depreciation in Years 2-7. Mount Moreland Hospital - Neighborhood Nurse Van Depreciation Van with Mediral Faninment

5. Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors as follows: a. Use Trace Dependents arrows to determine whether the \#VALUE! error in cell D12 is causing the other errors in the worksheet. b. Use Trace Precedents arrows to find the source of the error in cell D12. c. Correct the error so that the formula in cell D12 calculates the cumulative straightline depreciation of the medical van by adding the Cumulative depreciation value in Year 1 to the Annual depreciation value in Year 2. 6. Pranjali wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for the hospital's balance sheet. In the range D5:D7, she estimates that the Neighborhood Nurse program will have $234,000 in tangible assets at startup, and that the useful life of these assets is seven years with a salvage value of $37,440. Start by calculating the straight-line depreciation amounts as follows: a. In cell C11, enter a formula using the SLN function to calculate the straight-line depreciation for the medical van during its first year of operation. b. Use absolute references for the cost, salvage, and life arguments in the SLN formula. c. Fill the range D11:I11 with the formula in cell C11 to calculate the annual and cumulative straight-line depreciation in Years 2-7. Mount Moreland Hospital - Neighborhood Nurse Van Depreciation Van with Mediral Faninment 5. Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors as follows: a. Use Trace Dependents arrows to determine whether the \#VALUE! error in cell D12 is causing the other errors in the worksheet. b. Use Trace Precedents arrows to find the source of the error in cell D12. c. Correct the error so that the formula in cell D12 calculates the cumulative straightline depreciation of the medical van by adding the Cumulative depreciation value in Year 1 to the Annual depreciation value in Year 2. 6. Pranjali wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for the hospital's balance sheet. In the range D5:D7, she estimates that the Neighborhood Nurse program will have $234,000 in tangible assets at startup, and that the useful life of these assets is seven years with a salvage value of $37,440. Start by calculating the straight-line depreciation amounts as follows: a. In cell C11, enter a formula using the SLN function to calculate the straight-line depreciation for the medical van during its first year of operation. b. Use absolute references for the cost, salvage, and life arguments in the SLN formula. c. Fill the range D11:I11 with the formula in cell C11 to calculate the annual and cumulative straight-line depreciation in Years 2-7. Mount Moreland Hospital - Neighborhood Nurse Van Depreciation Van with Mediral Faninment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started