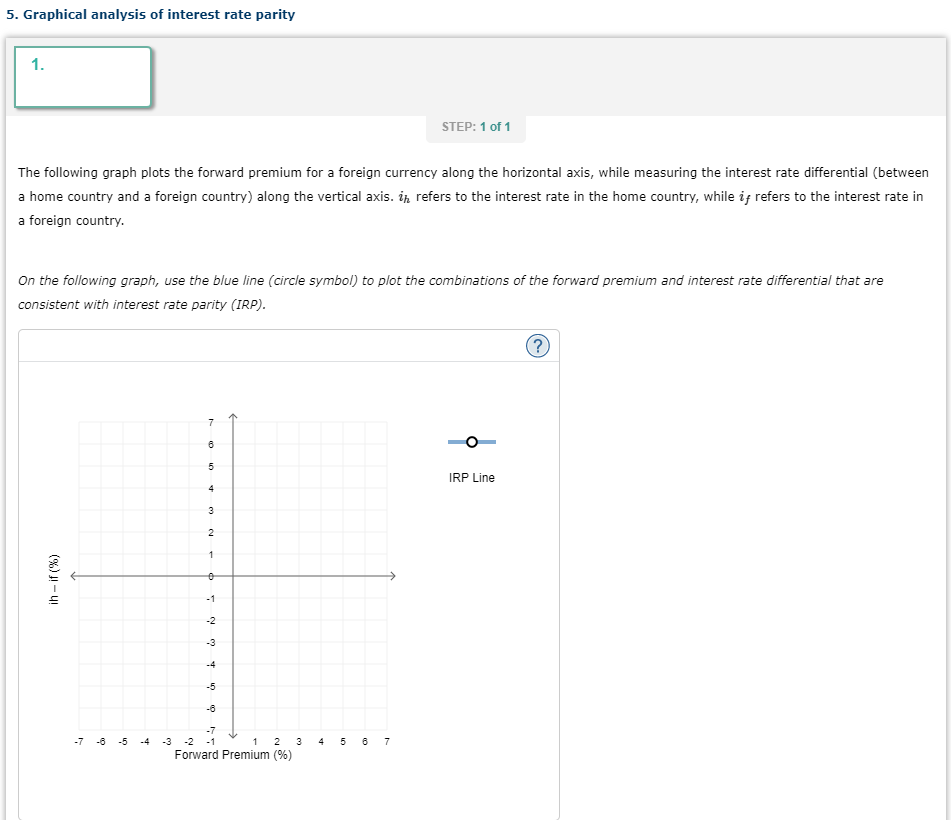

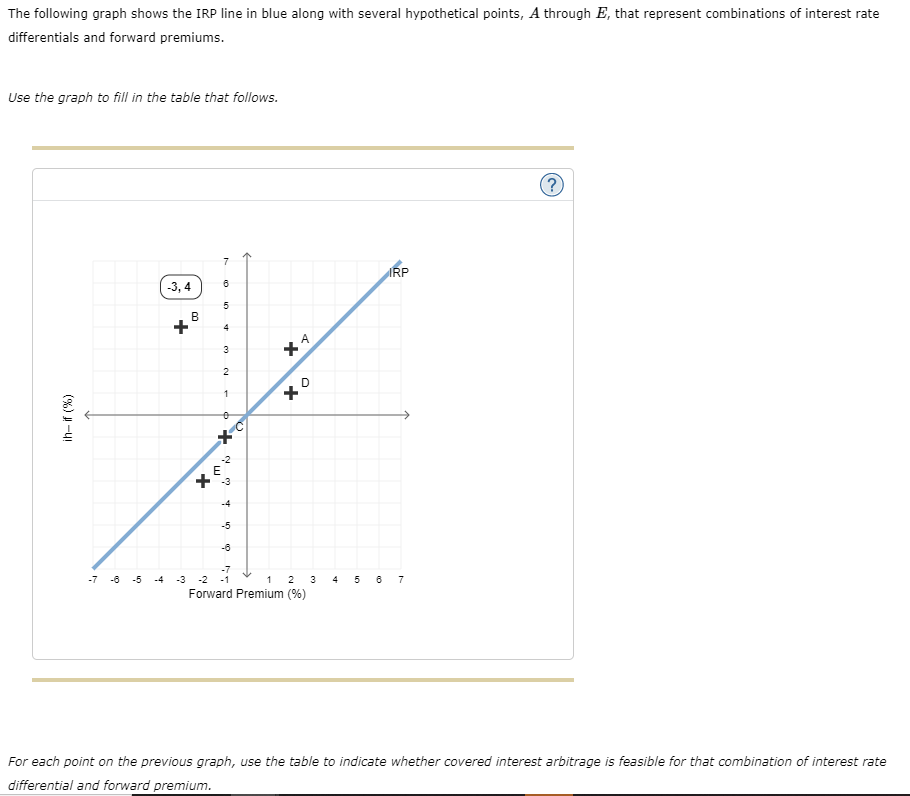

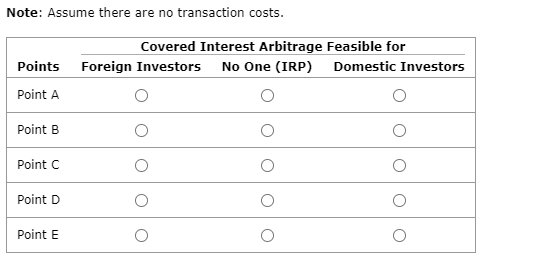

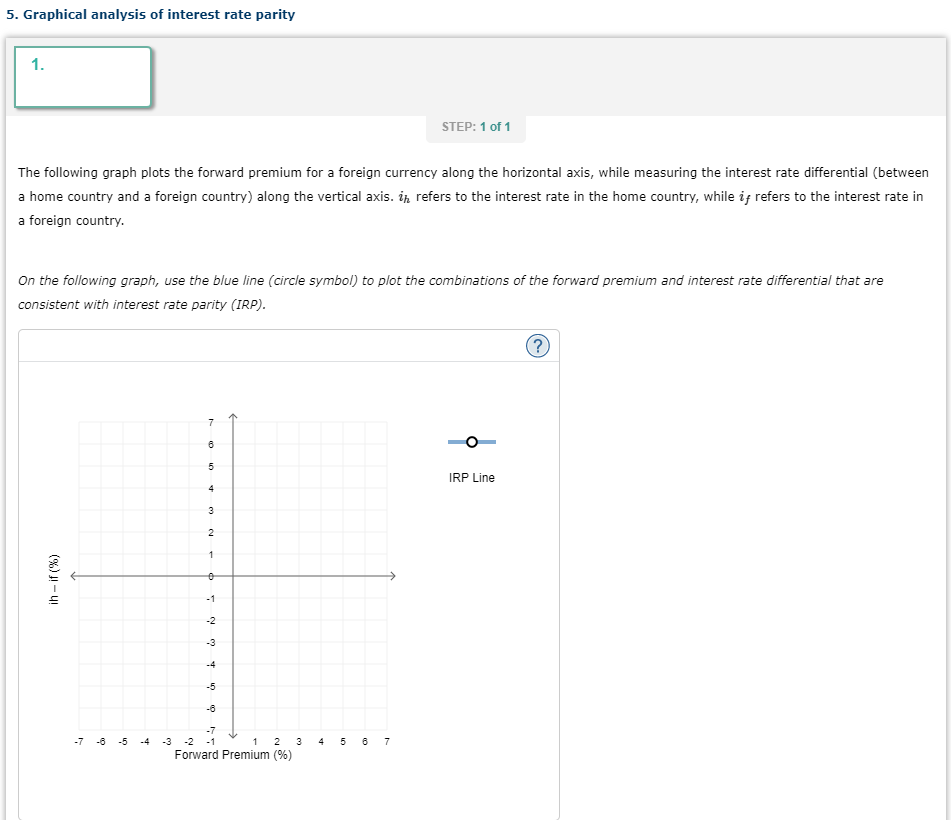

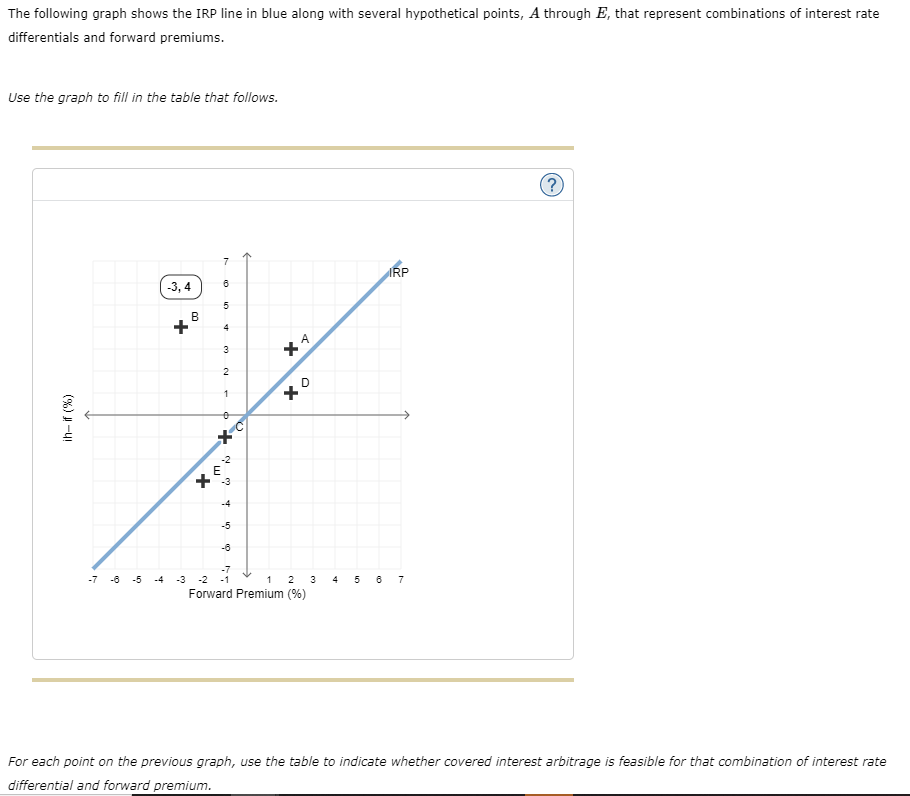

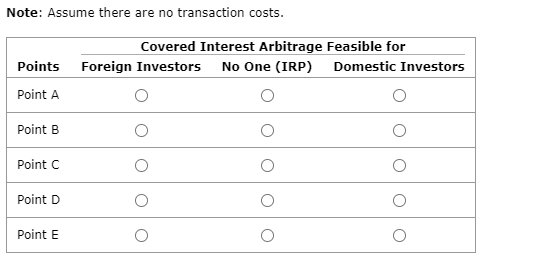

5. Graphical analysis of interest rate parity 1. STEP: 1 of 1 The following graph plots the forward premium for a foreign currency along the horizontal axis, while measuring the interest rate differential (between a home country and a foreign country) along the vertical axis. in refers to the interest rate in the home country, while if refers to the interest rate in a foreign country. On the following graph, use the blue line (circle symbol) to plot the combinations of the forward premium and interest rate differential that are consistent with interest rate parity (IRP). ? 7 8 5 IRP Line 4 3 2 1 (%)!-4! -1 -3 -4 -7 -6 -5 4 -3 4 5 6 7 -2 -1 1 2 3 Forward Premium (%) The following graph shows the IRP line in blue along with several hypothetical points, A through E, that represent combinations of interest rate differentials and forward premiums. Use the graph to fill in the table that follows. ? 7 IRP -3,4 6 5 B + 4 3 2 + 1 in- if (%) 0 + E + -3 -4 -5 -6 -7 -8 -5 -4 3 -7 -2 -1 4 5 6 7 1 2 3 Forward Premium (%) For each point on the previous graph, use the table to indicate whether covered interest arbitrage is feasible for that combination of interest rate differential and forward premium. Note: Assume there are no transaction costs. Covered Interest Arbitrage Feasible for Foreign Investors No One (IRP) Domestic Investors Points Point A Point B Point C Point D Point E o 5. Graphical analysis of interest rate parity 1. STEP: 1 of 1 The following graph plots the forward premium for a foreign currency along the horizontal axis, while measuring the interest rate differential (between a home country and a foreign country) along the vertical axis. in refers to the interest rate in the home country, while if refers to the interest rate in a foreign country. On the following graph, use the blue line (circle symbol) to plot the combinations of the forward premium and interest rate differential that are consistent with interest rate parity (IRP). ? 7 8 5 IRP Line 4 3 2 1 (%)!-4! -1 -3 -4 -7 -6 -5 4 -3 4 5 6 7 -2 -1 1 2 3 Forward Premium (%) The following graph shows the IRP line in blue along with several hypothetical points, A through E, that represent combinations of interest rate differentials and forward premiums. Use the graph to fill in the table that follows. ? 7 IRP -3,4 6 5 B + 4 3 2 + 1 in- if (%) 0 + E + -3 -4 -5 -6 -7 -8 -5 -4 3 -7 -2 -1 4 5 6 7 1 2 3 Forward Premium (%) For each point on the previous graph, use the table to indicate whether covered interest arbitrage is feasible for that combination of interest rate differential and forward premium. Note: Assume there are no transaction costs. Covered Interest Arbitrage Feasible for Foreign Investors No One (IRP) Domestic Investors Points Point A Point B Point C Point D Point E o