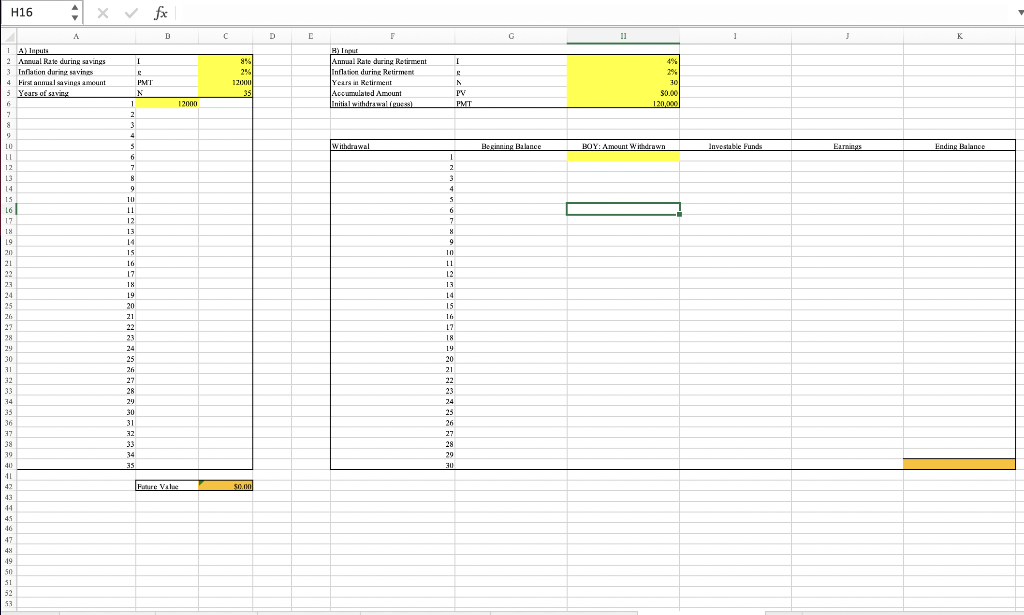

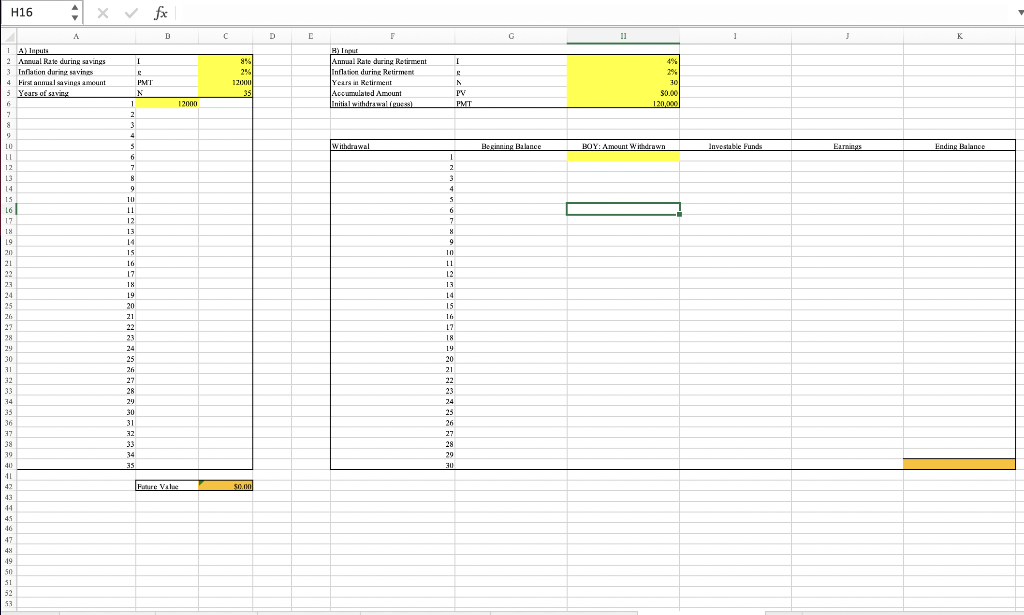

5. Growing Annuity Assume you want to retire in 35 years and save a $12,000 at the end of the first year. Assume you will earn 8% annually on your investment and you expect 2% inflation before retirement. After you retired, you expect to live for another 30 years. Assume you can earn a nominal annual rate of 4% and you expect inflation to be 2% during retirement. a) Calculate how much money you are accumulating by the time you retire if you increase your annual savings by the inflation rate. b) Calculate your real annual withdrawals over the next 30 years so as to maintain a constant standard of living. Assume the first withdrawal is made at the beginning of the year. H16 4x fx A D C D G 11 1 J K I 1 1 Alus 2 Annual Rate during savings 3 Inflation during savines 4 First annual savings aunt 5 Years of saving 8% 2% % 120MM 35 B) Inger Annual Rate during Retirent inflation during Retirment Years Retirment Accumulated Amunt Initial withdrawal) N PV PMT 301 50.00 120,000 12000 7 8 Withdrawal Berianing Balance BOY: Amount Withdrawn Investable Funds Ears Ending Balance 1 LO IL 12 13 15 L6 17 18 19 20 21 PMT N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 1X * 19 20 21 22 23 24 25 26 27 28 . 29 30 31 -- 32 23 24 25 26 27 28 29 30 31 32 2 3 4 3 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 34 35 36 37 38 39 40 11 42 43 34 35 30 Future Vale $0.00 40 47 48 19 50 31 52 53 5. Growing Annuity Assume you want to retire in 35 years and save a $12,000 at the end of the first year. Assume you will earn 8% annually on your investment and you expect 2% inflation before retirement. After you retired, you expect to live for another 30 years. Assume you can earn a nominal annual rate of 4% and you expect inflation to be 2% during retirement. a) Calculate how much money you are accumulating by the time you retire if you increase your annual savings by the inflation rate. b) Calculate your real annual withdrawals over the next 30 years so as to maintain a constant standard of living. Assume the first withdrawal is made at the beginning of the year. H16 4x fx A D C D G 11 1 J K I 1 1 Alus 2 Annual Rate during savings 3 Inflation during savines 4 First annual savings aunt 5 Years of saving 8% 2% % 120MM 35 B) Inger Annual Rate during Retirent inflation during Retirment Years Retirment Accumulated Amunt Initial withdrawal) N PV PMT 301 50.00 120,000 12000 7 8 Withdrawal Berianing Balance BOY: Amount Withdrawn Investable Funds Ears Ending Balance 1 LO IL 12 13 15 L6 17 18 19 20 21 PMT N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 1X * 19 20 21 22 23 24 25 26 27 28 . 29 30 31 -- 32 23 24 25 26 27 28 29 30 31 32 2 3 4 3 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 34 35 36 37 38 39 40 11 42 43 34 35 30 Future Vale $0.00 40 47 48 19 50 31 52 53