Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Halber Industries is a holding company that have many divisions reporting back to Halber. One of the division is Brock Precision Tool which

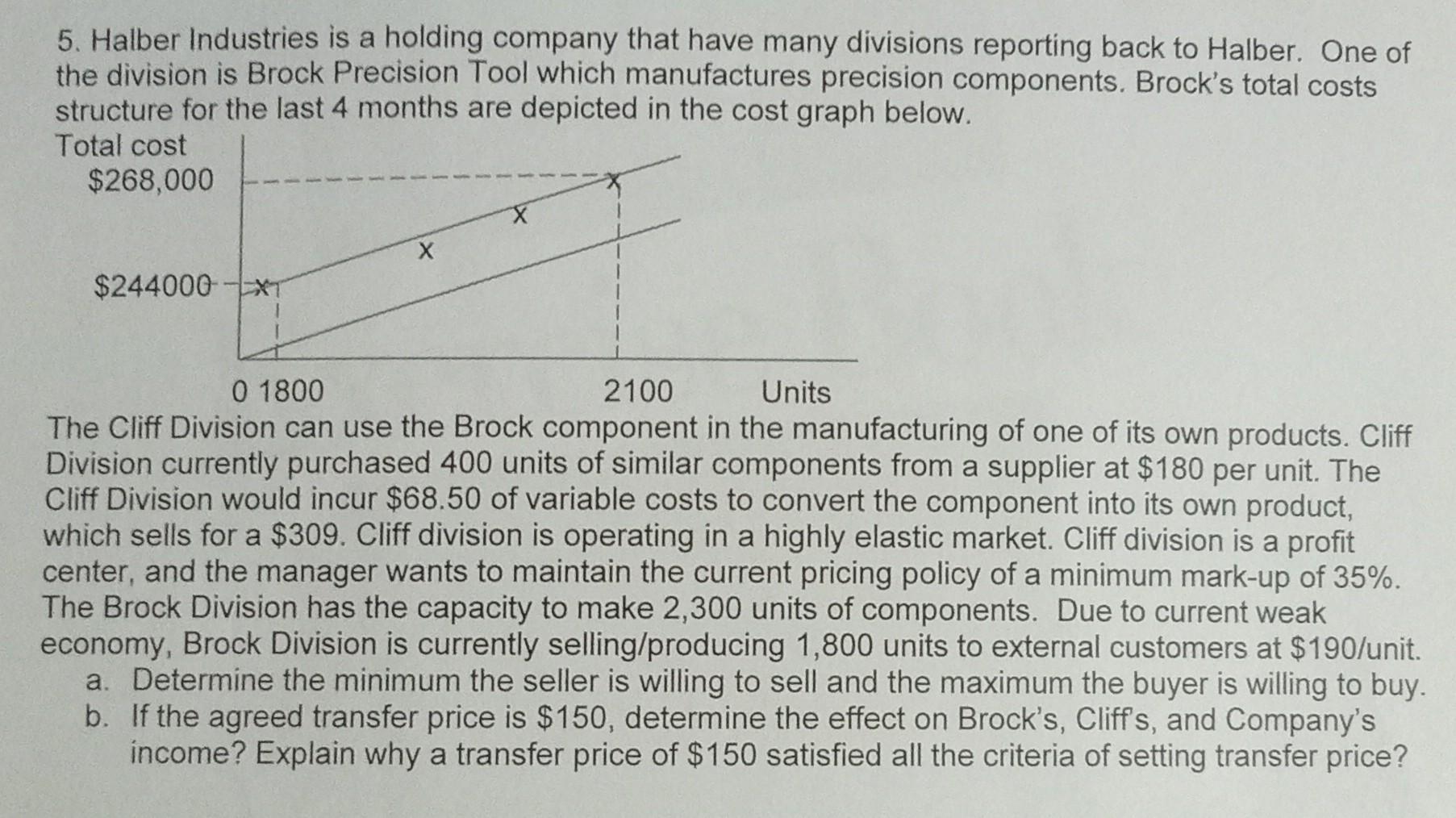

5. Halber Industries is a holding company that have many divisions reporting back to Halber. One of the division is Brock Precision Tool which manufactures precision components. Brock's total costs structure for the last 4 months are depicted in the cost graph below. Total cost $268,000 $244000 XT X 0 1800 2100 Units The Cliff Division can use the Brock component in the manufacturing of one of its own products. Cliff Division currently purchased 400 units of similar components from a supplier at $180 per unit. The Cliff Division would incur $68.50 of variable costs to convert the component into its own product, which sells for a $309. Cliff division is operating in a highly elastic market. Cliff division is a profit center, and the manager wants to maintain the current pricing policy of a minimum mark-up of 35%. The Brock Division has the capacity to make 2,300 units of components. Due to current weak economy, Brock Division is currently selling/producing 1,800 units to external customers at $190/unit. a. Determine the minimum the seller is willing to sell and the maximum the buyer is willing to buy. b. If the agreed transfer price is $150, determine the effect on Brock's, Cliff's, and Company's income? Explain why a transfer price of $150 satisfied all the criteria of setting transfer price?

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Determining the minimum seller is willing to sell and a maximum buyer willing to buy The minimum s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started