Question

5. Hedged exchange rates and capital budgeting Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore.

5. Hedged exchange rates and capital budgeting

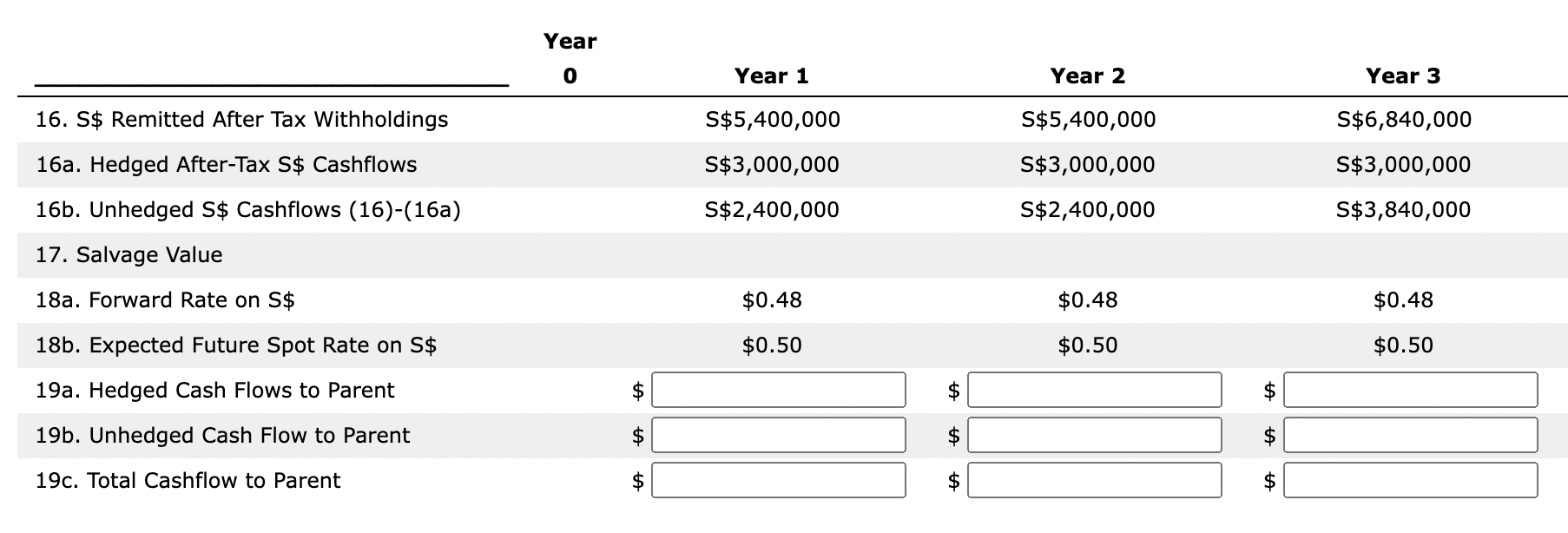

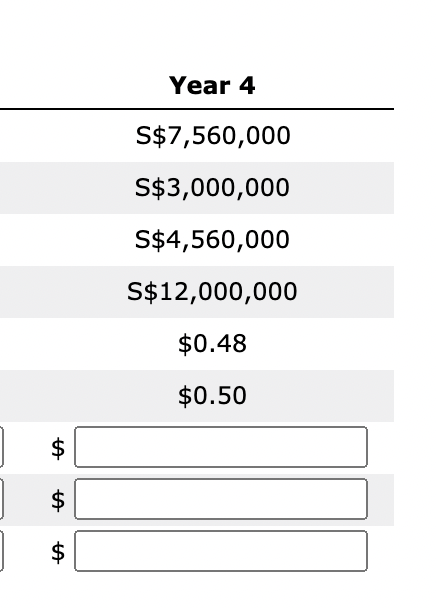

Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with a salvage value of $12,000,000. This salvage value would be paid by the government in Singapore to Kittle in exchange for ownership of the subsidiary. The expected exchange rate of the Singapore dollar of $0.50 over the life of the project.

Kittle managers are worried about the uncertainty of the value of the Singapore dollar. While they expect that the exchange rate will be $0.50, they recognize that this value may fluctuate. Thus, they decide to S$3,000,000 in cash flows per year, while any additional cash flows beyond this threshold would not be hedged. The forward rate that Kittle will use to hedge the S$3,000,000 is $0.48.

The following table shows a key subsection of Kittles capital budgeting analysis that is affected by this hedging strategy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started