Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. How to handle investment risk - The risk pyramid and your investmentphilosophy For most types of investments, a greater degree of risk corresponds

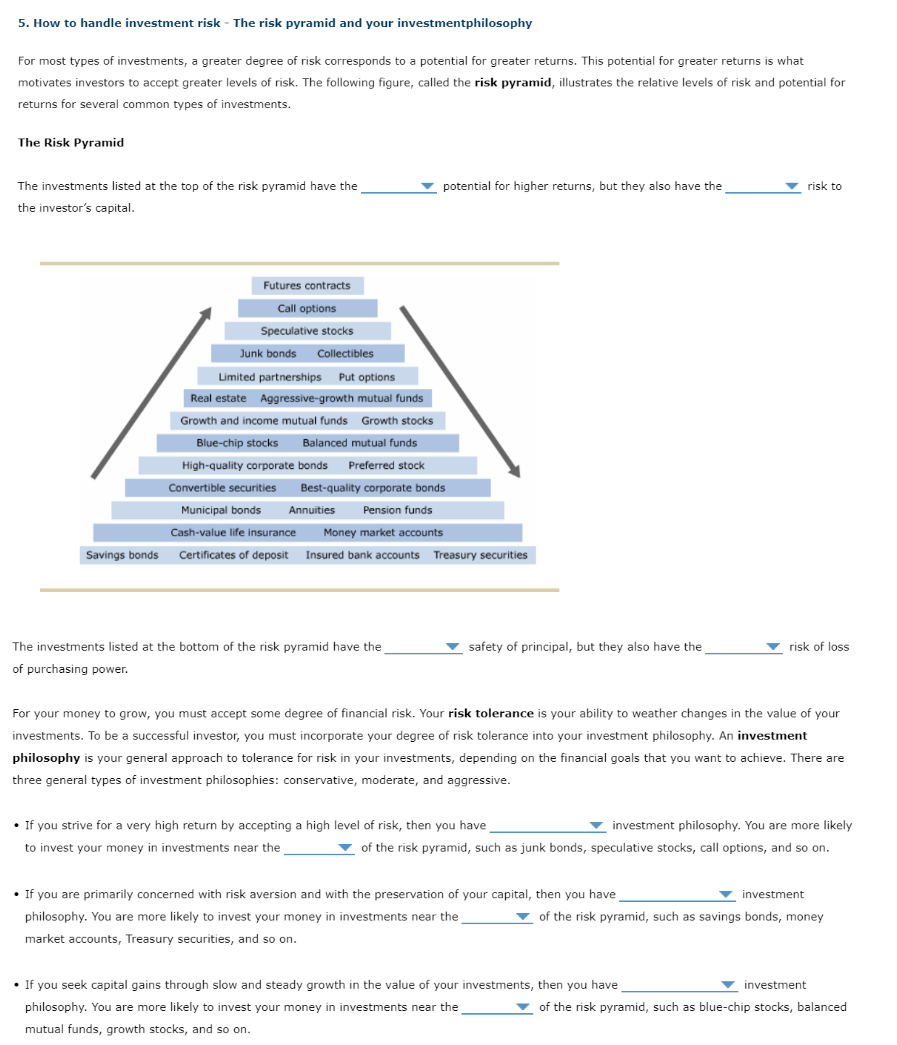

5. How to handle investment risk - The risk pyramid and your investmentphilosophy For most types of investments, a greater degree of risk corresponds to a potential for greater returns. This potential for greater returns is what motivates investors to accept greater levels of risk. The following figure, called the risk pyramid, illustrates the relative levels of risk and potential for returns for several common types of investments. The Risk Pyramid The investments listed at the top of the risk pyramid have the the investor's capital. potential for higher returns, but they also have the Futures contracts Call options Speculative stocks Junk bonds Collectibles Limited partnerships Put options Real estate Aggressive-growth mutual funds Growth and income mutual funds Growth stocks Blue-chip stocks Balanced mutual funds High-quality corporate bonds Preferred stock Convertible securities Best-quality corporate bonds Municipal bonds Annuities Pension funds Cash-value life insurance Money market accounts Savings bonds Certificates of deposit Insured bank accounts Treasury securities The investments listed at the bottom of the risk pyramid have the of purchasing power. safety of principal, but they also have the If you strive for a very high return by accepting a high level of risk, then you have to invest your money in investments near the For your money to grow, you must accept some degree of financial risk. Your risk tolerance is your ability to weather changes in the value of your investments. To be a successful investor, you must incorporate your degree of risk tolerance into your investment philosophy. An investment philosophy is your general approach to tolerance for risk in your investments, depending on the financial goals that you want to achieve. There are three general types of investment philosophies: conservative, moderate, and aggressive. risk to investment philosophy. You are more likely of the risk pyramid, such as junk bonds, speculative stocks, call options, and so on. If you are primarily concerned with risk aversion and with the preservation of your capital, then you have philosophy. You are more likely to invest your money in investments near the market accounts, Treasury securities, and so on. risk of loss If you seek capital gains through slow and steady growth in the value of your investments, philosophy. You are more likely to invest your money in investments near the mutual funds, growth stocks, and so on. investment of the risk pyramid, such as savings bonds, money then you have investment of the risk pyramid, such as blue-chip stocks, balanced

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The passage outlines the concept of investment risk and how it relates to potential returns along wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started