Answered step by step

Verified Expert Solution

Question

1 Approved Answer

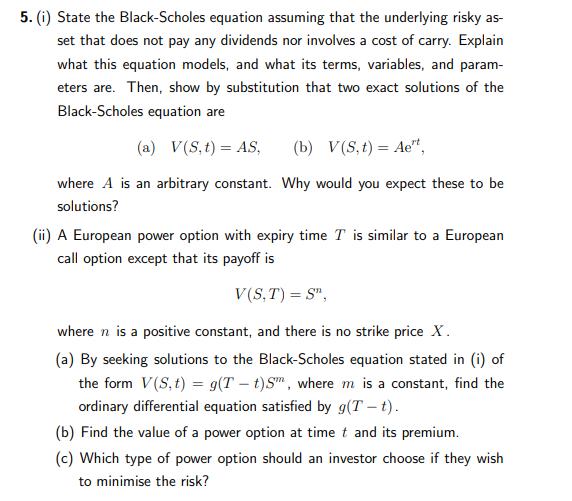

5. (i) State the Black-Scholes equation assuming that the underlying risky as- set that does not pay any dividends nor involves a cost of

5. (i) State the Black-Scholes equation assuming that the underlying risky as- set that does not pay any dividends nor involves a cost of carry. Explain what this equation models, and what its terms, variables, and param- eters are. Then, show by substitution that two exact solutions of the Black-Scholes equation are (a) V(S,t) = AS, (b) V(S, t) = Ae", where A is an arbitrary constant. Why would you expect these to be solutions? (ii) A European power option with expiry time T is similar to a European call option except that its payoff is V(S,T) = S", where n is a positive constant, and there is no strike price X. (a) By seeking solutions to the Black-Scholes equation stated in (i) of the form V(S, t) = g(Tt)Sm, where m is a constant, find the ordinary differential equation satisfied by g(T-t). (b) Find the value of a power option at time t and its premium. (c) Which type of power option should an investor choose if they wish to minimise the risk?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i The BlackScholes equation is a partial differential equation used to model the pricing of options Assuming that the underlying risky asset does not ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started