Question

Consider the following option strategy, called the call spread. It involves buying one call option with a lower strike price and selling one call

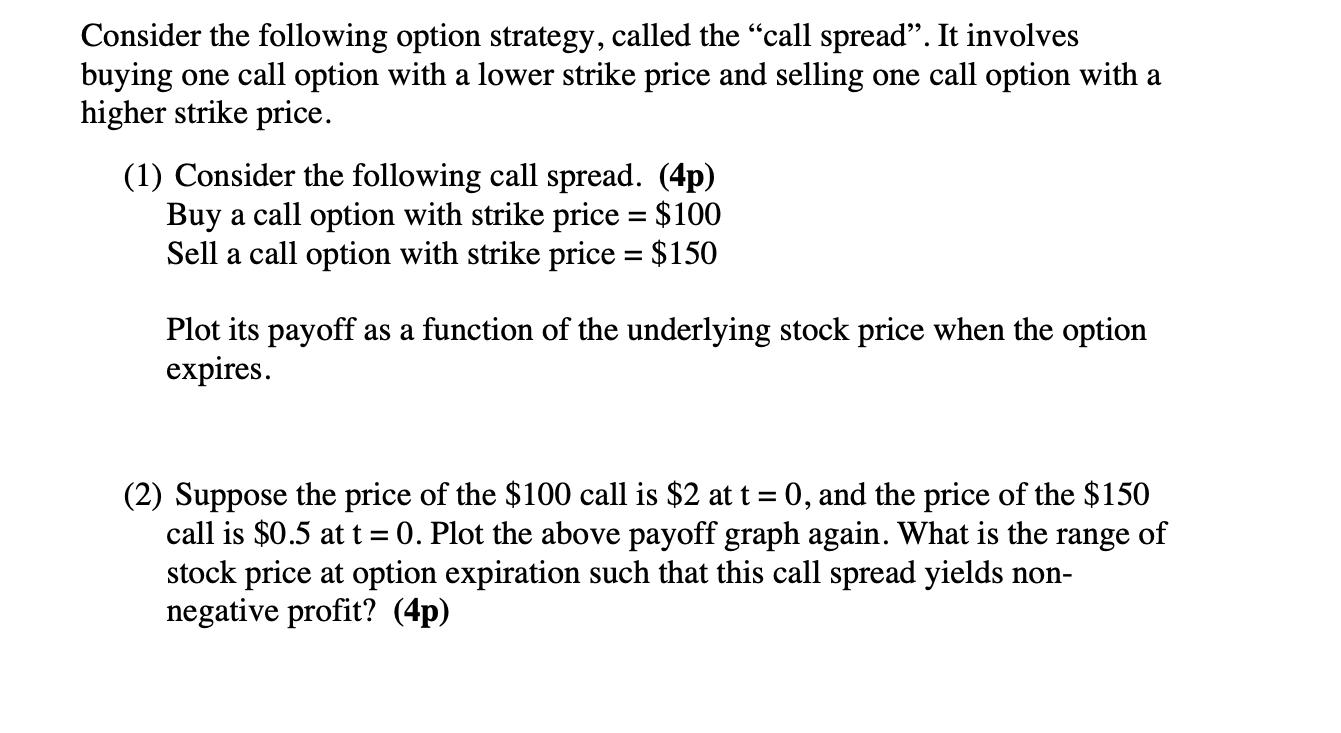

Consider the following option strategy, called the "call spread". It involves buying one call option with a lower strike price and selling one call option with a higher strike price. (1) Consider the following call spread. (4p) Buy a call option with strike price = $100 Sell a call option with strike price = $150 Plot its payoff as a function of the underlying stock price when the option expires. (2) Suppose the price of the $100 call is $2 at t = 0, and the price of the $150 call is $0.5 at t = 0. Plot the above payoff graph again. What is the range of stock price at option expiration such that this call spread yields non- negative profit? (4p)

Step by Step Solution

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting Information for Decision-Making and Strategy Execution

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young

6th Edition

137024975, 978-0137024971

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App