Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. If you capitalize R&D expenses at pharmaceutical firms which of the following, would you expect to happen to the adjusted earnings for these firms?

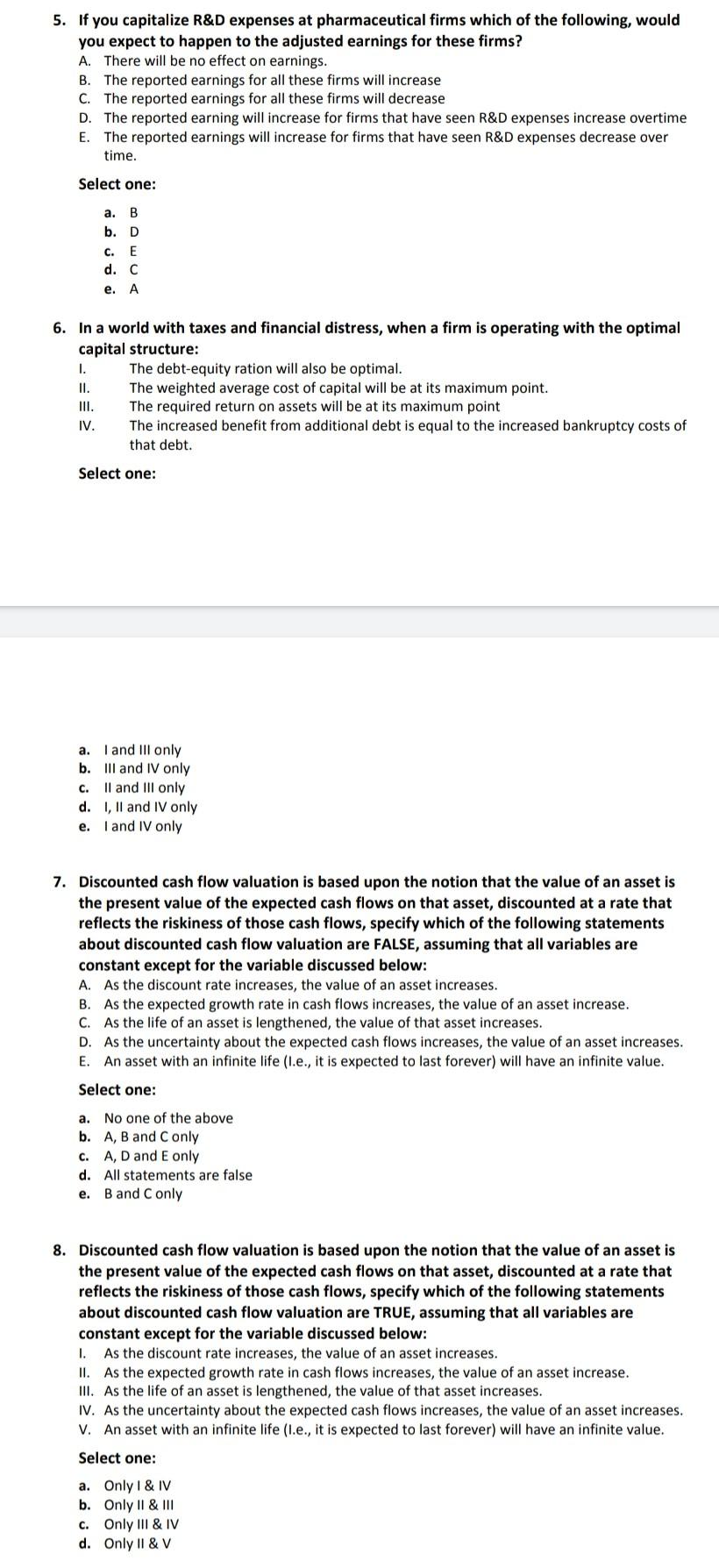

5. If you capitalize R&D expenses at pharmaceutical firms which of the following, would you expect to happen to the adjusted earnings for these firms? A. There will be no effect on earnings. B. The reported earnings for all these firms will increase C. The reported earnings for all these firms will decrease D. The reported earning will increase for firms that have seen R&D expenses increase overtime E. The reported earnings will increase for firms that have seen R&D expenses decrease over time. Select one: a B b. D C. E d. C e. A 6. In a world with taxes and financial distress, when a firm is operating with the optimal capital structure: I. The debt-equity ration will also be optimal. II. The weighted average cost of capital will be at its maximum point. III. The required return on assets will be at its maximum point IV. The increased benefit from additional debt is equal to the increased bankruptcy costs of that debt. Select one: a. I and Ill only b. III and IV only c. ll and Ill only d. I, II and IV only e. I and IV only 7. Discounted cash flow valuation is based upon the notion that the value of an asset is the present value of the expected cash flows on that asset, discounted at a rate that reflects the riskiness of those cash flows, specify which of the following statements about discounted cash flow valuation are FALSE, assuming that all variables are constant except for the variable discussed below: A. As the discount rate increases, the value of an asset increases. B. As the expected growth rate in cash flows increases, the value of an asset increase. C. As the life of an asset is lengthened, the value of that asset increases. D. As the uncertainty about the expected cash flows increases, the value of an asset increases. E. An asset with an infinite life (1.e., it is expected to last forever) will have an infinite value. Select one: a. No one of the above b. A, B and C only c. A, D and E only d. All statements are false e. B and C only 8. Discounted cash flow valuation is based upon the notion that the value of an asset is the present value of the expected cash flows on that asset, discounted at a rate that reflects the riskiness of those cash flows, specify which of the following statements about discounted cash flow valuation are TRUE, assuming that all variables are constant except for the variable discussed below: 1. As the discount rate increases, the value of an asset increases. II. As the expected growth rate in cash flows increases, the value of an asset increase. III. As the life of an asset is lengthened, the value of that asset increases. IV. As the uncertainty about the expected cash flows increases, the value of an asset increases. V. An asset with an infinite life (1.e., it is expected to last forever) will have an infinite value. Select one: a. Only 1 & IV b. Only II & III c. Only Ill & IV d. Only II & V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started