Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. If you own 3 stocks A, B, and C. What is your total return of your portfolio? Stock $ invested Return A $ 6,000

5. If you own 3 stocks A, B, and C. What is your total return of your portfolio? Stock $ invested Return A $ 6,000 6 % B 9,000 9 % C 15,000 11 %

6. Explain the RISK/ REWARD theory?

7. GM issued a $ 1,000, 30-year bond 5 years ago at 9 % interest. Comparable bonds yield 6 % today. What should GM bond sell for now?

8. Define each variable in the equation P = (D1 + P1) / (1 + R)

9. Solve the NPV and solve for the Payback YR Cash Flow 0 -$26,000 1 11,000 2 14,000 3 11,000 with the required rate equal to 6%

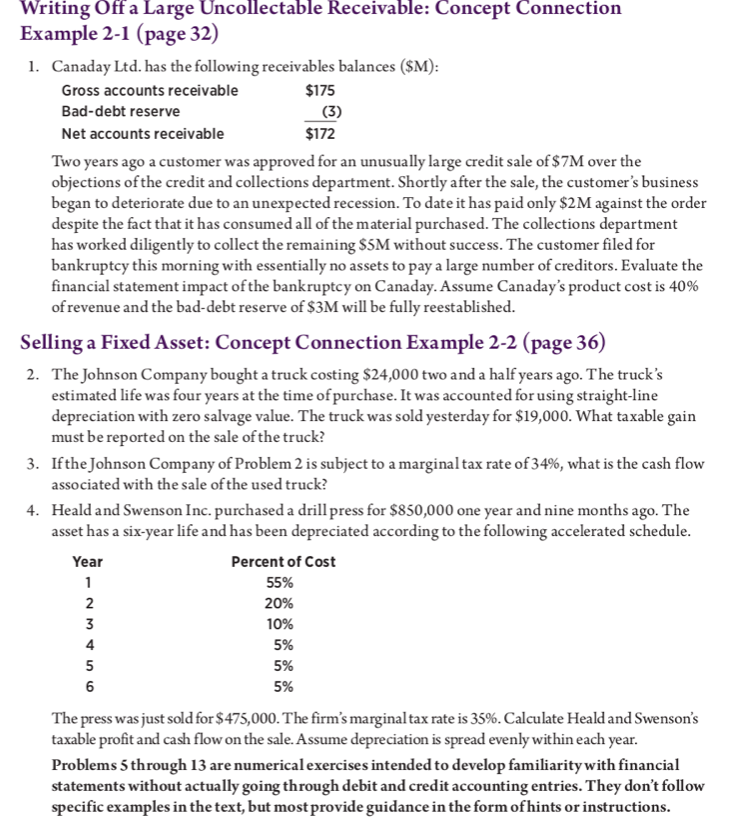

$175 Writing Off a Large Uncollectable Receivable: Concept Connection Example 2-1 (page 32) 1. Canaday Ltd. has the following receivables balances ($M): Gross accounts receivable Bad-debt reserve Net accounts receivable $172 Two years ago a customer was approved for an unusually large credit sale of $7M over the objections of the credit and collections department. Shortly after the sale, the customer's business began to deteriorate due to an unexpected recession. To date it has paid only $2 M against the order despite the fact that it has consumed all of the material purchased. The collections department has worked diligently to collect the remaining $5M without success. The customer filed for bankruptcy this morning with essentially no assets to pay a large number of creditors. Evaluate the financial statement impact of the bankruptcy on Canaday. Assume Canaday's product cost is 40% of revenue and the bad-debt reserve of $3M will be fully reestablished. Selling a Fixed Asset: Concept Connection Example 2-2 (page 36) 2. The Johnson Company bought a truck costing $24,000 two and a half years ago. The truck's estimated life was four years at the time of purchase. It was accounted for using straight-line depreciation with zero salvage value. The truck was sold yesterday for $19,000. What taxable gain must be reported on the sale of the truck? 3. If the Johnson Company of Problem 2 is subject to a marginal tax rate of 34%, what is the cash flow associated with the sale of the used truck? 4. Heald and Swenson Inc. purchased a drill press for $850,000 one year and nine months ago. The asset has a six-year life and has been depreciated according to the following accelerated schedule. Percent of Cost 55% 20% 10% Year OU AWN- 5% The press was just sold for $475,000. The firm's marginal tax rate is 35%. Calculate Heald and Swenson's taxable profit and cash flow on the sale. Assume depreciation is spread evenly within each year. Problems 5 through 13 are numerical exercises intended to develop familiarity with financial statements without actually going through debit and credit accounting entries. They don't follow specific examples in the text, but most provide guidance in the form of hints or instructions. $175 Writing Off a Large Uncollectable Receivable: Concept Connection Example 2-1 (page 32) 1. Canaday Ltd. has the following receivables balances ($M): Gross accounts receivable Bad-debt reserve Net accounts receivable $172 Two years ago a customer was approved for an unusually large credit sale of $7M over the objections of the credit and collections department. Shortly after the sale, the customer's business began to deteriorate due to an unexpected recession. To date it has paid only $2 M against the order despite the fact that it has consumed all of the material purchased. The collections department has worked diligently to collect the remaining $5M without success. The customer filed for bankruptcy this morning with essentially no assets to pay a large number of creditors. Evaluate the financial statement impact of the bankruptcy on Canaday. Assume Canaday's product cost is 40% of revenue and the bad-debt reserve of $3M will be fully reestablished. Selling a Fixed Asset: Concept Connection Example 2-2 (page 36) 2. The Johnson Company bought a truck costing $24,000 two and a half years ago. The truck's estimated life was four years at the time of purchase. It was accounted for using straight-line depreciation with zero salvage value. The truck was sold yesterday for $19,000. What taxable gain must be reported on the sale of the truck? 3. If the Johnson Company of Problem 2 is subject to a marginal tax rate of 34%, what is the cash flow associated with the sale of the used truck? 4. Heald and Swenson Inc. purchased a drill press for $850,000 one year and nine months ago. The asset has a six-year life and has been depreciated according to the following accelerated schedule. Percent of Cost 55% 20% 10% Year OU AWN- 5% The press was just sold for $475,000. The firm's marginal tax rate is 35%. Calculate Heald and Swenson's taxable profit and cash flow on the sale. Assume depreciation is spread evenly within each year. Problems 5 through 13 are numerical exercises intended to develop familiarity with financial statements without actually going through debit and credit accounting entries. They don't follow specific examples in the text, but most provide guidance in the form of hints or instructionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started