Answered step by step

Verified Expert Solution

Question

1 Approved Answer

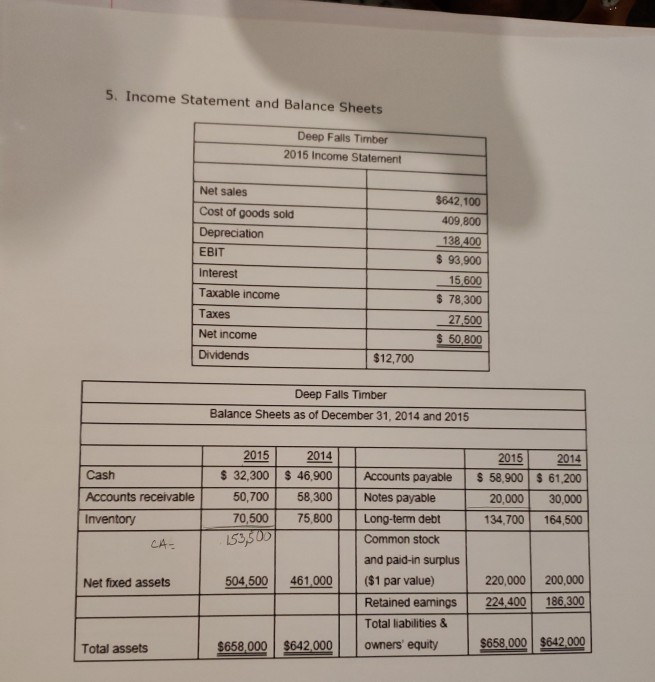

5. Income Statement and Balance Sheets Deep Falls Timber 2015 Income Statement Net sales Cost of goods sold Depreciation EBIT Interest Taxable income Taxes Net

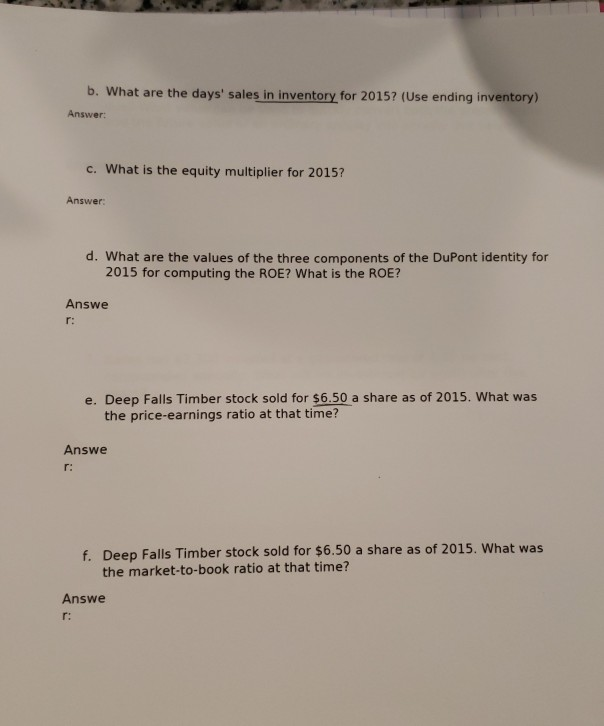

5. Income Statement and Balance Sheets Deep Falls Timber 2015 Income Statement Net sales Cost of goods sold Depreciation EBIT Interest Taxable income Taxes Net income Dividends $642,100 409,800 138,400 $ 93,900 15 600 $ 78,300 27.500 $ 50,800 $12,700 Deep Falls Timber Balance Sheets as of December 31, 2014 and 2015 Cash Accounts receivable Inventory CA- 2015 $ 32,300 50,700 70,500 2014 $ 46,900 58,300 75,800 2015 $ 58,900 20,000 134,700 2014 $ 61,200 30,000 164,500 153,500 Accounts payable Notes payable Long-term debt Common stock and paid-in surplus ($1 par value) Retained eamings Total liabilities & owners' equity Net fixed assets 504,500 461,000 220,000 224,400 200,000 186 300 Total assets $658.000 $642.000 $658,000 $642,000 b. What are the days' sales in inventory for 2015? (Use ending inventory) Answer: c. What is the equity multiplier for 2015? Answer: d. What are the values of the three components of the DuPont identity for 2015 for computing the ROE? What is the ROE? Answe e. Deep Falls Timber stock sold for $6.50 a share as of 2015. What was the price-earnings ratio at that time? Answe f. Deep Falls Timber stock sold for $6.50 a share as of 2015. What was the market-to-book ratio at that time? Answe r

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started