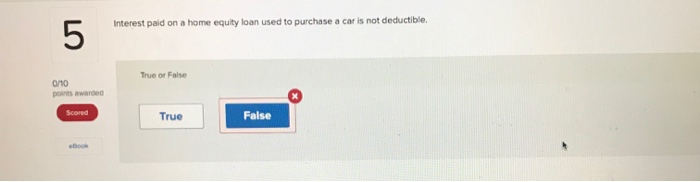

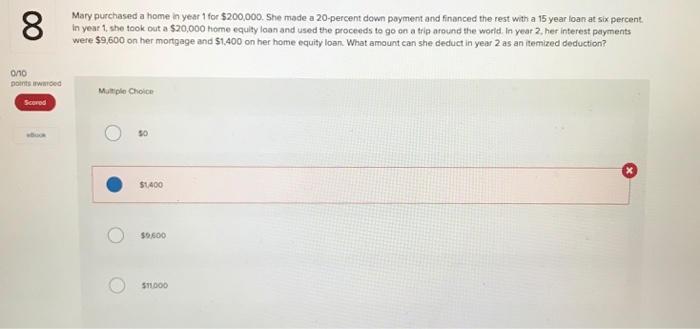

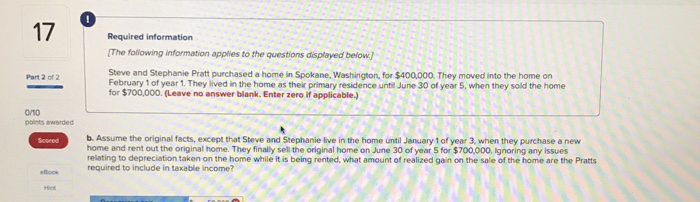

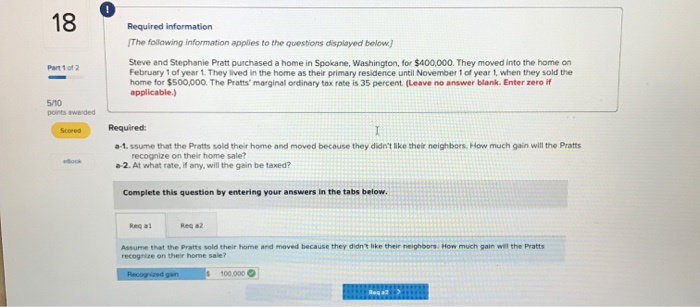

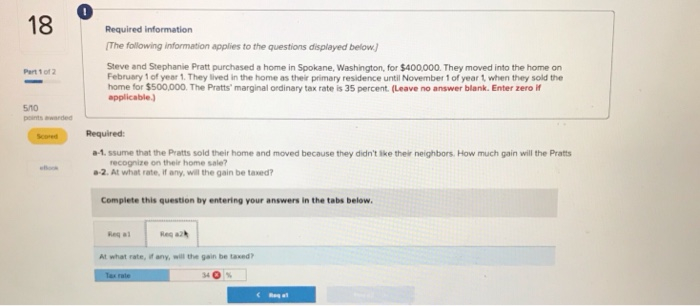

5 Interest paid on a home equity loan used to purchase a car is not deductible, True or False 0/10 False True Mary purchased a home in year 1 for $200,000. She made a 20-percent down payment and financed the rest with a 15 year loan at six percent In year 1, she took out a $20,000 home equity loan and used the proceeds to go on a trip around the world. In year 2, her interest payments were $9,600 on her mortgage and $1,400 on her home equity loan What amount can she deduct in year 2 as an itemized deduction? 0/10 points awarcedMt Choice Multiple Choice so 3 $1400 $9600 11000 0 17 Required information The following information applies to the questions dispayed below. Steve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on February 1 of year 1. They for $700,000. (Leave no answer blank. Enter zero if applicable.) Part 2 of 2 lived in the home as their primary residence until June 30 of year 5, when they sold the home 0n0 points awarded b. Assume the original facts, except that Steve and Stephanie live in the home until January 1 of year 3, when they purchase a new home and rent out the original home. They finally sell the original home on June 30 of year 5 for $700,000, Ignoring any issues relating to depreciation taken on the home while it is being rented, what amount of realized gain on the sale of the home are the Pratts o required to include in taxable income? 18 Required information The following information applies to the questions displayed below Steve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1, when they sold the home for $500,000. The Pratts' marginal ordinary tox rate is 35 percent (Leave no answer blank. Enter zero if applicable.) Part 1 of 2 5/10 points awerded ScoredRequired a-1. ssume that the Pratts sold their home and moved because they didn't like their neighbors. How much gain will the Pratts recognize on their home sale? a-2. At what rate, if any, will the gain be taxed? Complete this question by entering your answers in the tabs below Req a2 Req a1 Assume that the Pratts sold their home and moved because they didnt like their neighbors How much gain will the Pratts recognize on their home sale? s 100,000 0 Required information The following information applies to the questions displayed below. Steve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1 when they sold the home for $500,000. The Pratts marginal ordinary tax rate is 35 percent (Leave no answer blank. Enter zero if Part 1 of 2 510 points ewarded Scoed Required -1. ssume that the Pratts sold their home and moved because they didn't like their neighbors. How much gain will the Prats recognize on their home sale a-2. At what rate, if any, will the gain be taxed? Complete this question by entering your answers in the tabs below At what rate, if any, will the gain be taxed? 340%