Answered step by step

Verified Expert Solution

Question

1 Approved Answer

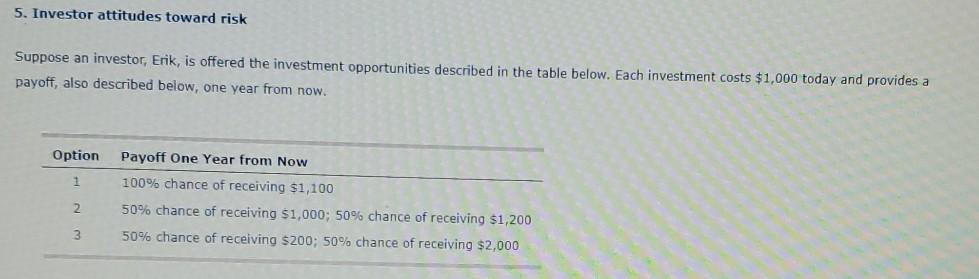

5. Investor attitudes toward risk Suppose an investor, Erik, is offered the investment opportunities described in the table below. Each investment costs $1,000 today and

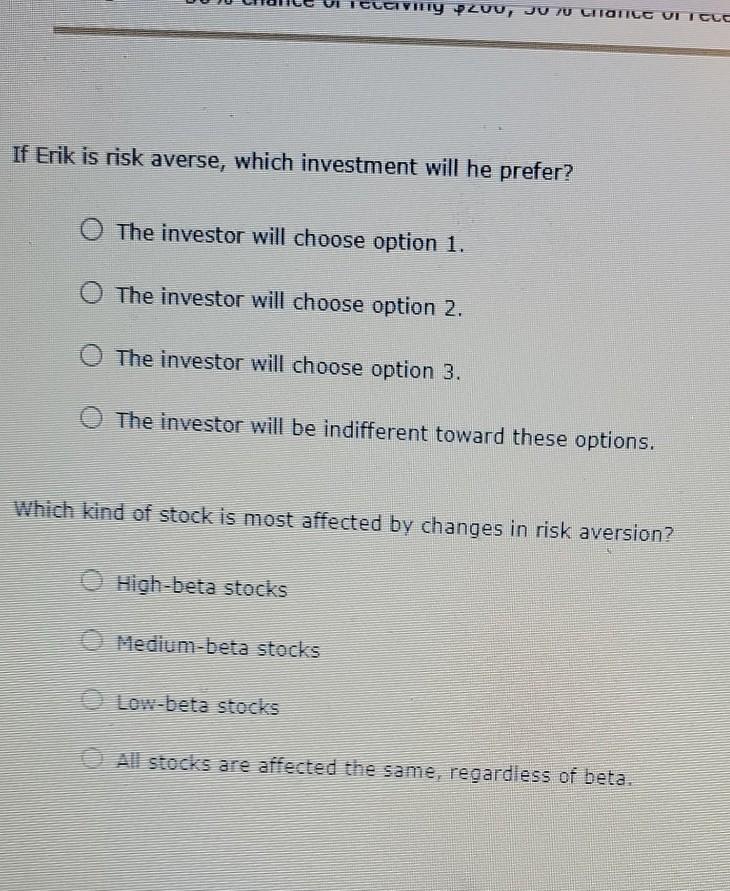

5. Investor attitudes toward risk Suppose an investor, Erik, is offered the investment opportunities described in the table below. Each investment costs $1,000 today and provides a payoff, also described below, one year from now. Option Payoff One Year from Now 1 100% chance of receiving $1,100 2 50% chance of receiving $1,000; 50% chance of receiving $1,200 3 50% chance of receiving $200; 50% chance of receiving $2,000 Hy ZVUJU U CITATICC VITELE If Erik is risk averse, which investment will he prefer? O The investor will choose option 1. The investor will choose option 2. The investor will choose option 3. The investor will be indifferent toward these options. Which kind of stock is most affected by changes in risk aversion? High-beta stocks Medium-beta stocks Low-bete stocks A stocks are affected the same, regardless of beta

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started