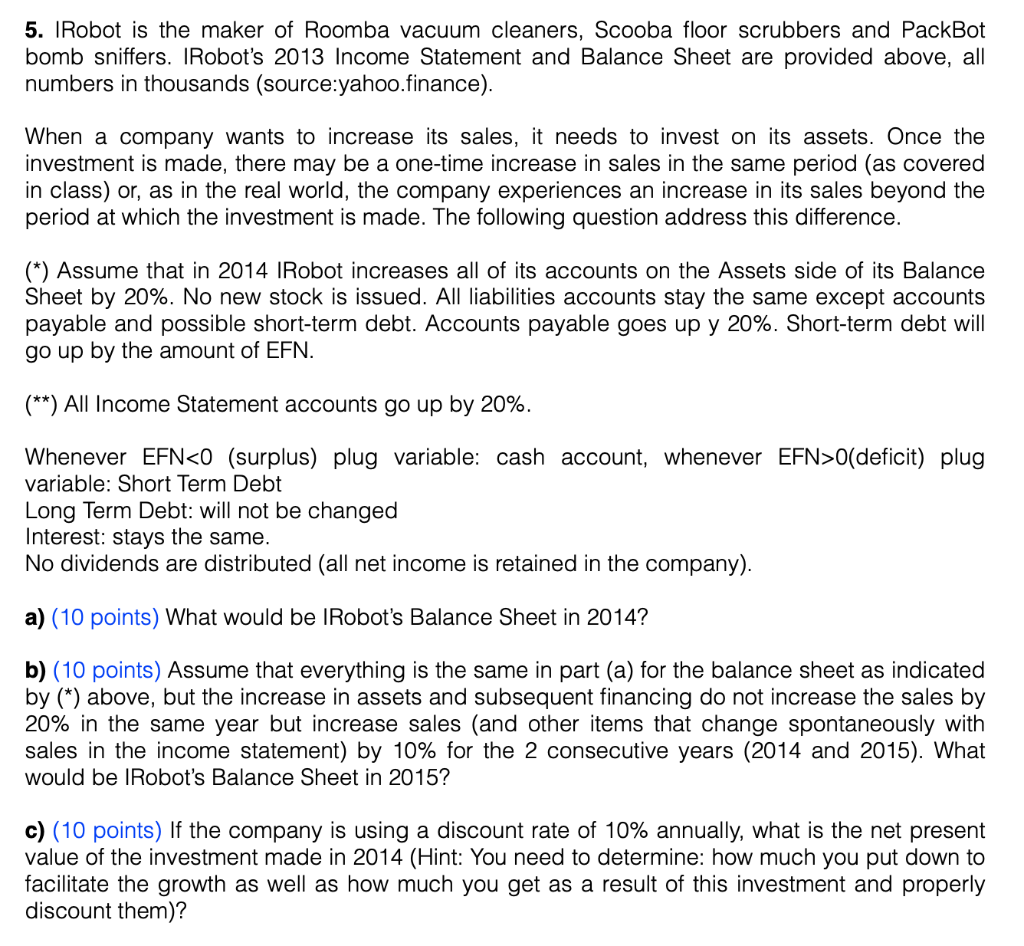

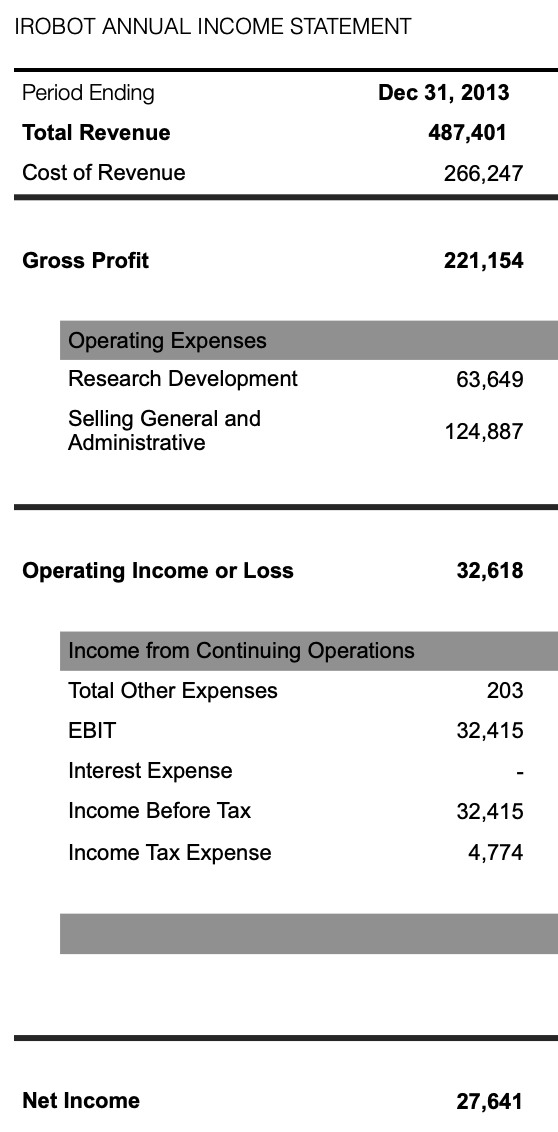

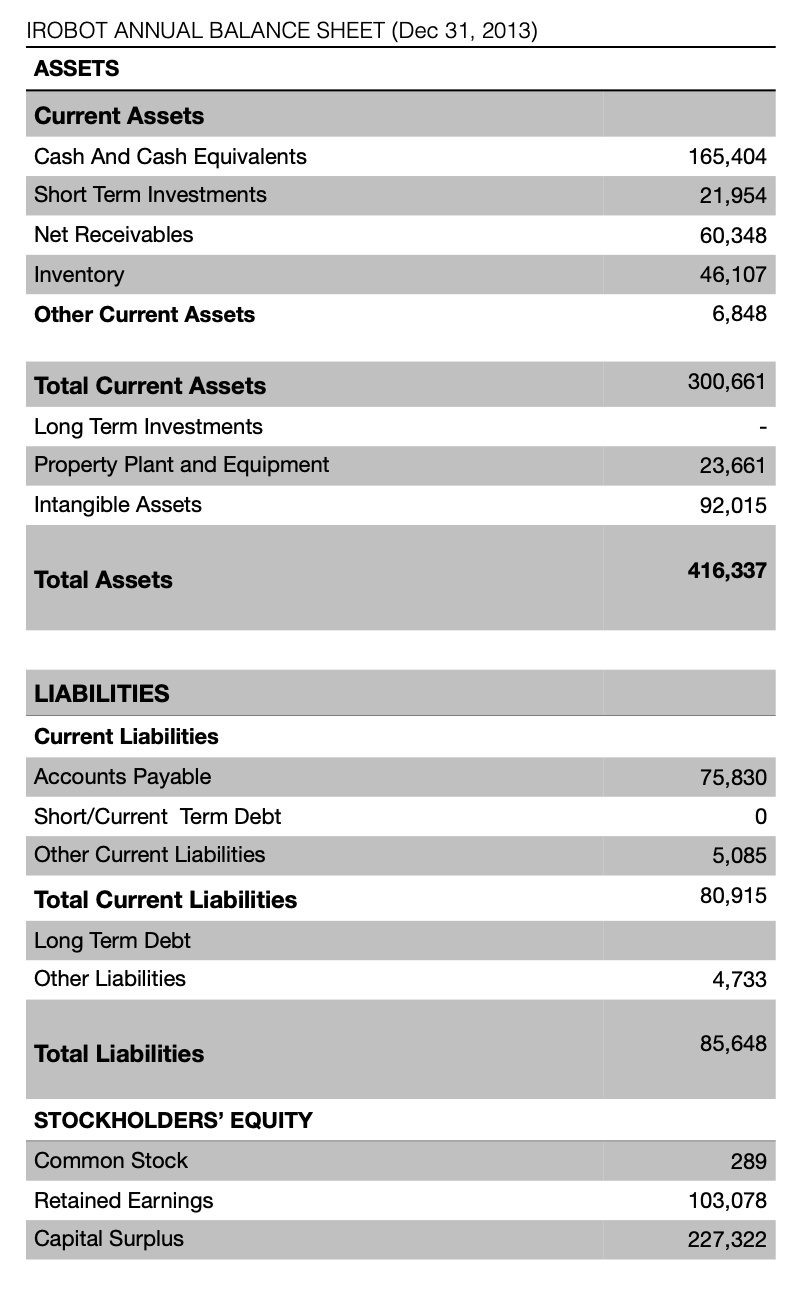

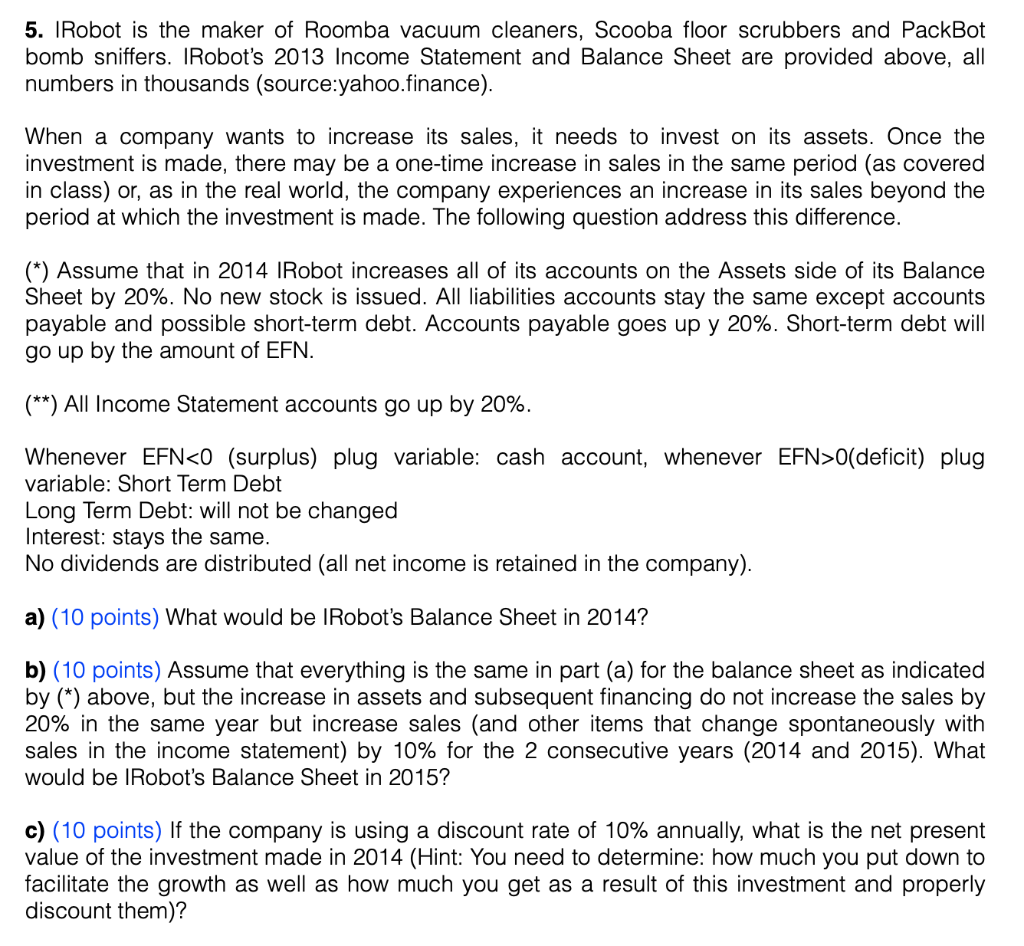

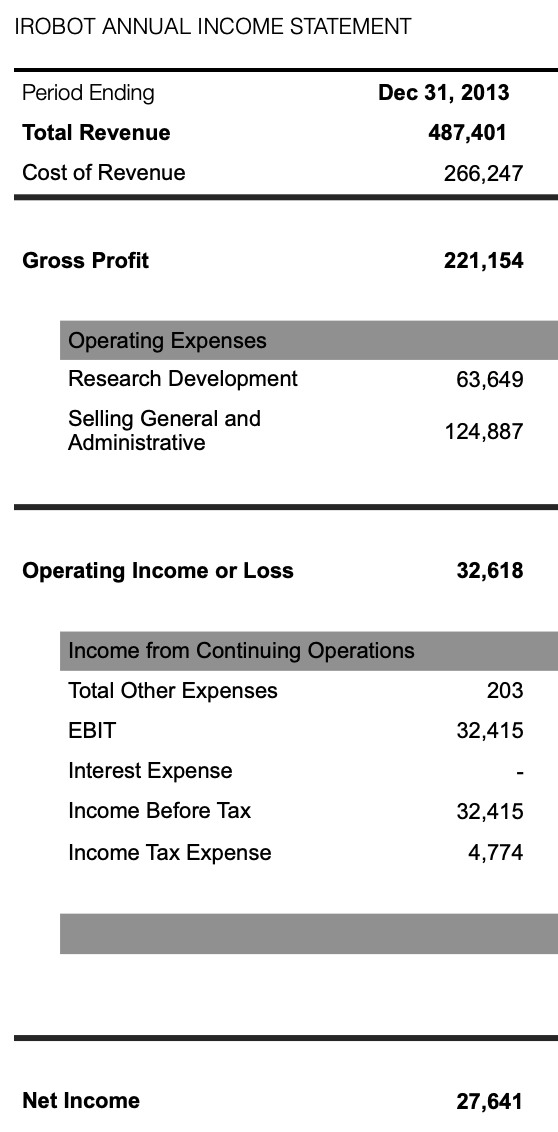

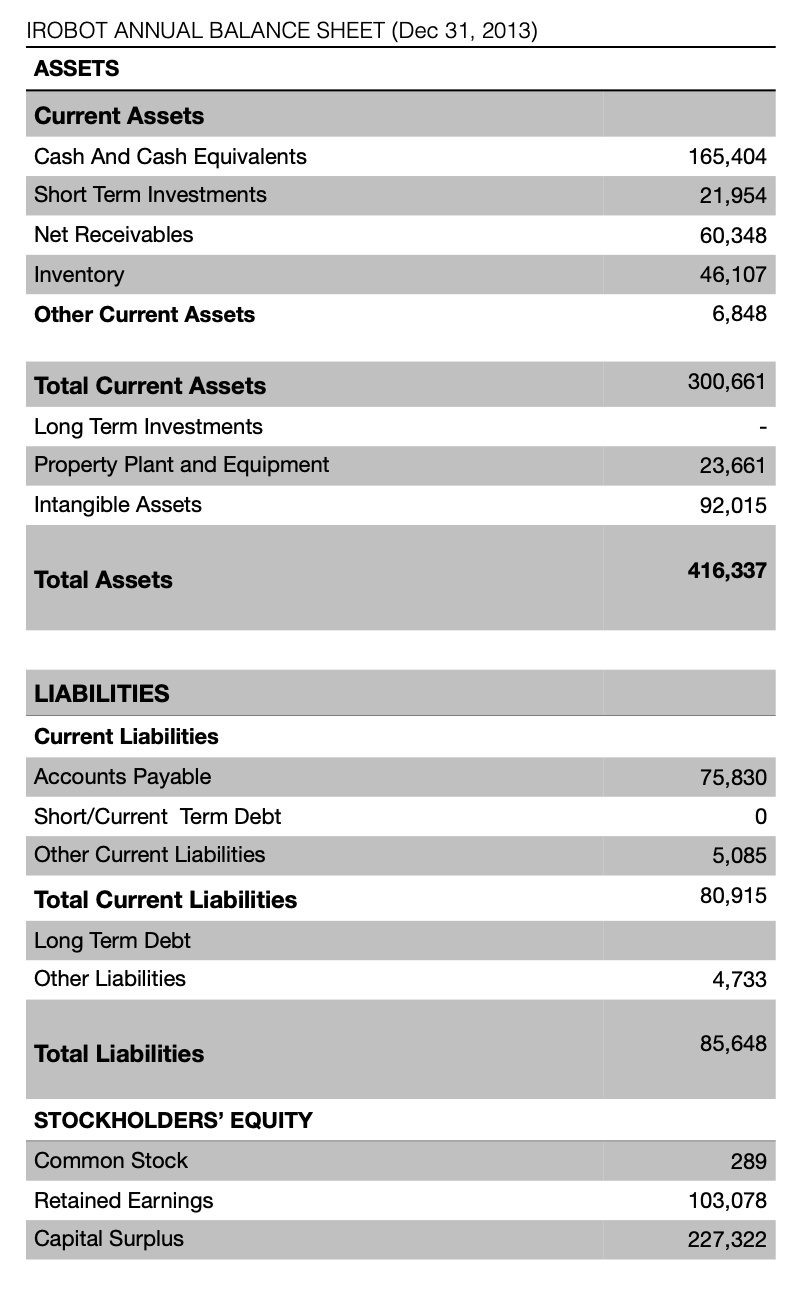

5. IRobot is the maker of Roomba vacuum cleaners, Scooba floor scrubbers and PackBot bomb sniffers. IRobot's 2013 Income Statement and Balance Sheet are provided above, all numbers in thousands (source:yahoo.finance). When a company wants to increase its sales, it needs to invest on its assets. Once the investment is made, there may be a one-time increase in sales in the same period (as covered in class) or, as in the real world, the company experiences an increase in its sales beyond the period at which the investment is made. The following question address this difference. (*) Assume that in 2014 IRobot increases all of its accounts on the Assets side of its Balance Sheet by 20%. No new stock is issued. All liabilities accounts stay the same except accounts payable and possible short-term debt. Accounts payable goes up y 20%. Short-term debt will go up by the amount of EFN. (**) All Income Statement accounts go up by 20%. Whenever EFN0(deficit) plug variable: Short Term Debt Long Term Debt: will not be changed Interest: stays the same. No dividends are distributed (all net income is retained in the company). a) (10 points) What would be IRobot's Balance Sheet in 2014? b) (10 points) Assume that everything is the same in part (a) for the balance sheet as indicated by (*) above, but the increase in assets and subsequent financing do not increase the sales by 20% in the same year but increase sales (and other items that change spontaneously with sales in the income statement) by 10% for the 2 consecutive years (2014 and 2015). What would be IRobot's Balance Sheet in 2015? c) (10 points) If the company is using a discount rate of 10% annually, what is the net present value of the investment made in 2014 (Hint: You need to determine: how much you put down to facilitate the growth as well as how much you get as a result of this investment and properly discount them)? IROBOT ANNUAL INCOME STATEMENT Period Ending Total Revenue Cost of Revenue Dec 31, 2013 487,401 266,247 Gross Profit 221,154 Operating Expenses Research Development Selling General and Administrative 63,649 124,887 Operating Income or Loss 32,618 Income from Continuing Operations Total Other Expenses 203 32,415 EBIT Interest Expense Income Before Tax 32,415 4,774 Income Tax Expense Net Income 27,641 IROBOT ANNUAL BALANCE SHEET (Dec 31, 2013) ASSETS Current Assets Cash And Cash Equivalents Short Term Investments 165,404 21,954 Net Receivables 60,348 46,107 Inventory Other Current Assets 6,848 300,661 Total Current Assets Long Term Investments Property Plant and Equipment Intangible Assets 23,661 92,015 Total Assets 416,337 LIABILITIES Current Liabilities 75,830 Accounts Payable Short/Current Term Debt Other Current Liabilities 0 5,085 80,915 Total Current Liabilities Long Term Debt Other Liabilities 4,733 Total Liabilities 85,648 STOCKHOLDERS' EQUITY Common Stock Retained Earnings Capital Surplus 289 103,078 227,322 5. IRobot is the maker of Roomba vacuum cleaners, Scooba floor scrubbers and PackBot bomb sniffers. IRobot's 2013 Income Statement and Balance Sheet are provided above, all numbers in thousands (source:yahoo.finance). When a company wants to increase its sales, it needs to invest on its assets. Once the investment is made, there may be a one-time increase in sales in the same period (as covered in class) or, as in the real world, the company experiences an increase in its sales beyond the period at which the investment is made. The following question address this difference. (*) Assume that in 2014 IRobot increases all of its accounts on the Assets side of its Balance Sheet by 20%. No new stock is issued. All liabilities accounts stay the same except accounts payable and possible short-term debt. Accounts payable goes up y 20%. Short-term debt will go up by the amount of EFN. (**) All Income Statement accounts go up by 20%. Whenever EFN0(deficit) plug variable: Short Term Debt Long Term Debt: will not be changed Interest: stays the same. No dividends are distributed (all net income is retained in the company). a) (10 points) What would be IRobot's Balance Sheet in 2014? b) (10 points) Assume that everything is the same in part (a) for the balance sheet as indicated by (*) above, but the increase in assets and subsequent financing do not increase the sales by 20% in the same year but increase sales (and other items that change spontaneously with sales in the income statement) by 10% for the 2 consecutive years (2014 and 2015). What would be IRobot's Balance Sheet in 2015? c) (10 points) If the company is using a discount rate of 10% annually, what is the net present value of the investment made in 2014 (Hint: You need to determine: how much you put down to facilitate the growth as well as how much you get as a result of this investment and properly discount them)? IROBOT ANNUAL INCOME STATEMENT Period Ending Total Revenue Cost of Revenue Dec 31, 2013 487,401 266,247 Gross Profit 221,154 Operating Expenses Research Development Selling General and Administrative 63,649 124,887 Operating Income or Loss 32,618 Income from Continuing Operations Total Other Expenses 203 32,415 EBIT Interest Expense Income Before Tax 32,415 4,774 Income Tax Expense Net Income 27,641 IROBOT ANNUAL BALANCE SHEET (Dec 31, 2013) ASSETS Current Assets Cash And Cash Equivalents Short Term Investments 165,404 21,954 Net Receivables 60,348 46,107 Inventory Other Current Assets 6,848 300,661 Total Current Assets Long Term Investments Property Plant and Equipment Intangible Assets 23,661 92,015 Total Assets 416,337 LIABILITIES Current Liabilities 75,830 Accounts Payable Short/Current Term Debt Other Current Liabilities 0 5,085 80,915 Total Current Liabilities Long Term Debt Other Liabilities 4,733 Total Liabilities 85,648 STOCKHOLDERS' EQUITY Common Stock Retained Earnings Capital Surplus 289 103,078 227,322