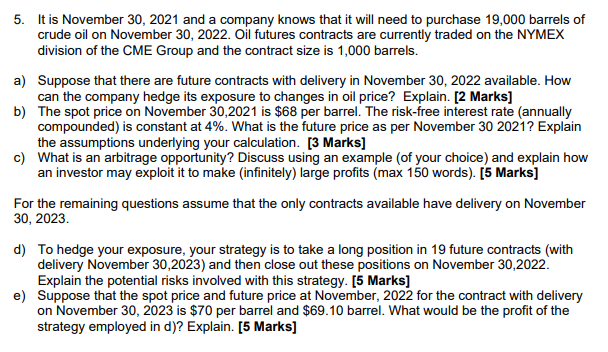

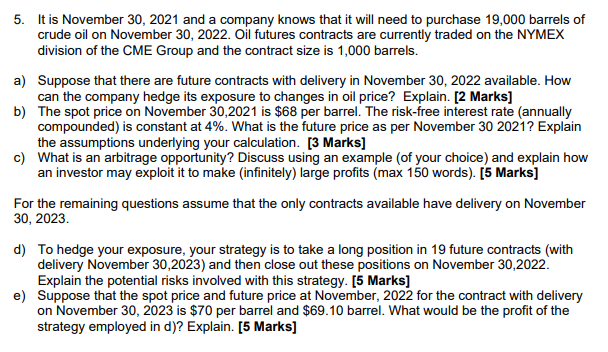

5. It is November 30, 2021 and a company knows that it will need to purchase 19,000 barrels of crude oil on November 30, 2022. Oil futures contracts are currently traded on the NYMEX division of the CME Group and the contract size is 1,000 barrels. a) Suppose that there are future contracts with delivery in November 30, 2022 available. How can the company hedge its exposure to changes in oil price? Explain. [2 marks] b) The spot price on November 30,2021 is $68 per barrel. The risk-free interest rate (annually compounded) is constant at 4%. What is the future price as per November 30 2021? Explain the assumptions underlying your calculation. [3 Marks] c) What is an arbitrage opportunity? Discuss using an example of your choice) and explain how an investor may exploit it to make (infinitely) large profits (max 150 words). [5 Marks] For the remaining questions assume that the only contracts available have delivery on November 30, 2023. d) To hedge your exposure, your strategy is to take a long position in 19 future contracts (with delivery November 30,2023) and then close out these positions on November 30,2022. Explain the potential risks involved with this strategy. [5 Marks] e) Suppose that the spot price and future price at November, 2022 for the contract with delivery on November 30, 2023 is $70 per barrel and $69.10 barrel. What would be the profit of the strategy employed in d)? Explain. [5 Marks] 5. It is November 30, 2021 and a company knows that it will need to purchase 19,000 barrels of crude oil on November 30, 2022. Oil futures contracts are currently traded on the NYMEX division of the CME Group and the contract size is 1,000 barrels. a) Suppose that there are future contracts with delivery in November 30, 2022 available. How can the company hedge its exposure to changes in oil price? Explain. [2 marks] b) The spot price on November 30,2021 is $68 per barrel. The risk-free interest rate (annually compounded) is constant at 4%. What is the future price as per November 30 2021? Explain the assumptions underlying your calculation. [3 Marks] c) What is an arbitrage opportunity? Discuss using an example of your choice) and explain how an investor may exploit it to make (infinitely) large profits (max 150 words). [5 Marks] For the remaining questions assume that the only contracts available have delivery on November 30, 2023. d) To hedge your exposure, your strategy is to take a long position in 19 future contracts (with delivery November 30,2023) and then close out these positions on November 30,2022. Explain the potential risks involved with this strategy. [5 Marks] e) Suppose that the spot price and future price at November, 2022 for the contract with delivery on November 30, 2023 is $70 per barrel and $69.10 barrel. What would be the profit of the strategy employed in d)? Explain. [5 Marks]