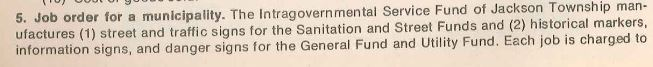

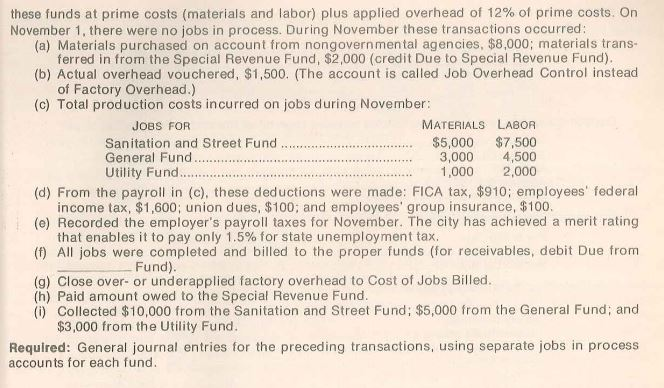

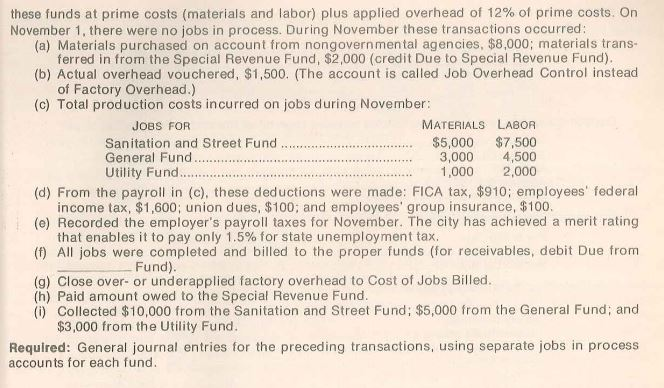

5. Job order fo r a municipality. The Intragovernmental Service Fund of Jackson Township man- ufactures (1) street and traffic signs for the Sanitation and Street Funds and (2) historical markers information signs, and danger signs for the General Fund and Utility Fund. Each job is charged to these funds at prime costs (materials and labor) plus applied overhead of 12% of prime costs. On November 1, there were no jobs in process. During November these transactions occurred (a) Materials purchased on account from nongovernmental agencies, $8,000; materials trans- (b) Actual overhead vouchered, $1,500. (The account is called Job Overhead Control instead (c) Total production costs incurred on jobs during November: ferred in from the Special Revenue Fund, $2,000 (credit Due to Special Revenue Fund) of Factory Overhead.) MATERIALS LABOR $5,000 $7,500 1,000 2,000 JOBS FOR General Fund. Utility Fund.. (d) From the payroll in (c), these deductions were made: FICA tax, $910; employees' federal income tax, $1,600; union dues, $100; and employees' group insurance, $100 (e) Recorded the employer's payroll taxes for November. The city has achieved a merit rating that enables it to pay only 1.5% for state unemployment tax (f) All jobs were completed and billed to the proper funds (for receivables, debit Due from Fund). (g) Close over- or underapplied factory overhead to Cost of Jobs Billed. (h) Paid amount owed to the Special Revenue Fund (i) Collected $10,000 from the Sanitation and Street Fund; $5,000 from the General Fund; and $3,000 from the Utility Fund. Required: General journal entries for the preceding transactions, using separate jobs in process accounts for each fund. 5. Job order fo r a municipality. The Intragovernmental Service Fund of Jackson Township man- ufactures (1) street and traffic signs for the Sanitation and Street Funds and (2) historical markers information signs, and danger signs for the General Fund and Utility Fund. Each job is charged to these funds at prime costs (materials and labor) plus applied overhead of 12% of prime costs. On November 1, there were no jobs in process. During November these transactions occurred (a) Materials purchased on account from nongovernmental agencies, $8,000; materials trans- (b) Actual overhead vouchered, $1,500. (The account is called Job Overhead Control instead (c) Total production costs incurred on jobs during November: ferred in from the Special Revenue Fund, $2,000 (credit Due to Special Revenue Fund) of Factory Overhead.) MATERIALS LABOR $5,000 $7,500 1,000 2,000 JOBS FOR General Fund. Utility Fund.. (d) From the payroll in (c), these deductions were made: FICA tax, $910; employees' federal income tax, $1,600; union dues, $100; and employees' group insurance, $100 (e) Recorded the employer's payroll taxes for November. The city has achieved a merit rating that enables it to pay only 1.5% for state unemployment tax (f) All jobs were completed and billed to the proper funds (for receivables, debit Due from Fund). (g) Close over- or underapplied factory overhead to Cost of Jobs Billed. (h) Paid amount owed to the Special Revenue Fund (i) Collected $10,000 from the Sanitation and Street Fund; $5,000 from the General Fund; and $3,000 from the Utility Fund. Required: General journal entries for the preceding transactions, using separate jobs in process accounts for each fund