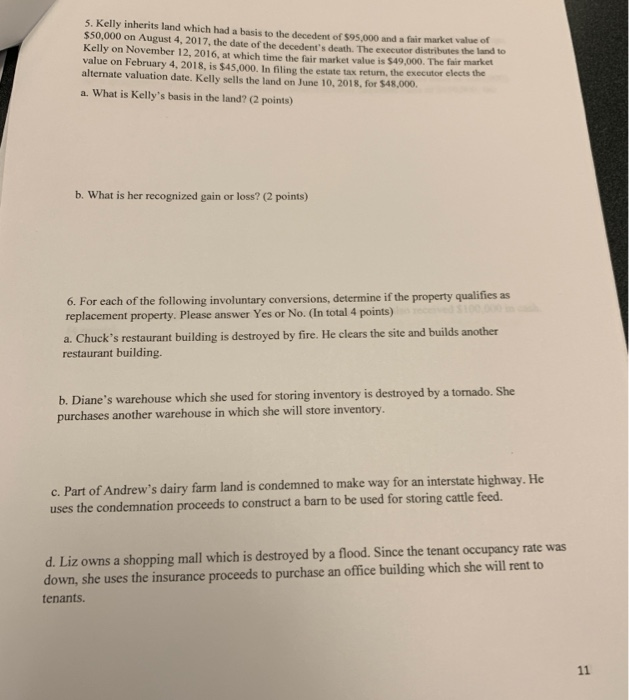

5. Kelly inherits land which had a basis to the decedent of $95,000 and a fair market value of $50,000 on August 4, 2017, the date of the decedent's death. The executor distributes the land to Kelly on November 12, 2016, at which time the fair market value is $49,000. The fair market value on February 4, 2018, is $45,000. In filing the estate tax return, the executor elects the alternate valuation date. Kelly sells the land on June 10, 2018, for $48,000. a. What is Kelly's basis in the land? (2 points) b. What is her recognized gain or loss? (2 points) 6. For each of the following involuntary conversions, determine if the property qualifies as replacement property. Please answer Yes or No. (In total 4 points) a. Chuck's restaurant building is destroyed by fire. He clears the site and builds another restaurant building. b. Diane's warehouse which she used for storing inventory is destroyed by a tornado. She purchases another warehouse in which she will store inventory c. Part of Andrew's dairy farm land is condemned to make way for an interstate highway. He uses the condemnation proceeds to construct a barn to be used for storing cattle feed d. Liz owns a shopping mall which is destroyed by a flood. Since the tenant occupancy rate was down, she uses the insurance proceeds to purchase an office building which she will rent to tenants 5. Kelly inherits land which had a basis to the decedent of $95,000 and a fair market value of $50,000 on August 4, 2017, the date of the decedent's death. The executor distributes the land to Kelly on November 12, 2016, at which time the fair market value is $49,000. The fair market value on February 4, 2018, is $45,000. In filing the estate tax return, the executor elects the alternate valuation date. Kelly sells the land on June 10, 2018, for $48,000. a. What is Kelly's basis in the land? (2 points) b. What is her recognized gain or loss? (2 points) 6. For each of the following involuntary conversions, determine if the property qualifies as replacement property. Please answer Yes or No. (In total 4 points) a. Chuck's restaurant building is destroyed by fire. He clears the site and builds another restaurant building. b. Diane's warehouse which she used for storing inventory is destroyed by a tornado. She purchases another warehouse in which she will store inventory c. Part of Andrew's dairy farm land is condemned to make way for an interstate highway. He uses the condemnation proceeds to construct a barn to be used for storing cattle feed d. Liz owns a shopping mall which is destroyed by a flood. Since the tenant occupancy rate was down, she uses the insurance proceeds to purchase an office building which she will rent to tenants