Answered step by step

Verified Expert Solution

Question

1 Approved Answer

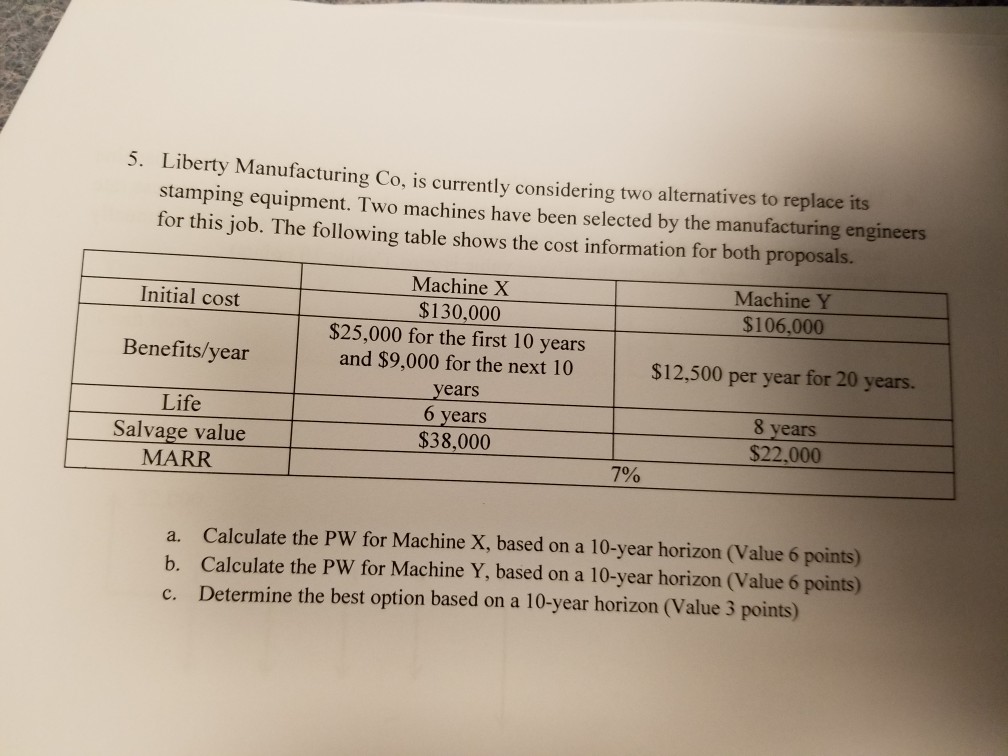

5. Liberty Manufacturing Co, is currently considering two alternatives to replace its stamping equipment. Two machines have been selected by the manufacturing engineers for this

5. Liberty Manufacturing Co, is currently considering two alternatives to replace its stamping equipment. Two machines have been selected by the manufacturing engineers for this job. The following table shows the cost information for both proposals. Machine X S130,000 $25,000 for the first 10 years and $9,000 for the next 10 years 6 years $38,000 Machine Y Initial cost $106,000 $12,500 per year for 20 years. 8 years Benefits/year Life Salvage value MARR $22,000 7% a. b. c. Calculate the PW for Machine X, based on a 10-year horizon (Value 6 points) Calculate the PW for Machine Y, based on a 10-year horizon (Value 6 points) Determine the best option based on a 10-year horizon (Value 3 points) 5. Liberty Manufacturing Co, is currently considering two alternatives to replace its stamping equipment. Two machines have been selected by the manufacturing engineers for this job. The following table shows the cost information for both proposals. Machine X S130,000 $25,000 for the first 10 years and $9,000 for the next 10 years 6 years $38,000 Machine Y Initial cost $106,000 $12,500 per year for 20 years. 8 years Benefits/year Life Salvage value MARR $22,000 7% a. b. c. Calculate the PW for Machine X, based on a 10-year horizon (Value 6 points) Calculate the PW for Machine Y, based on a 10-year horizon (Value 6 points) Determine the best option based on a 10-year horizon (Value 3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started