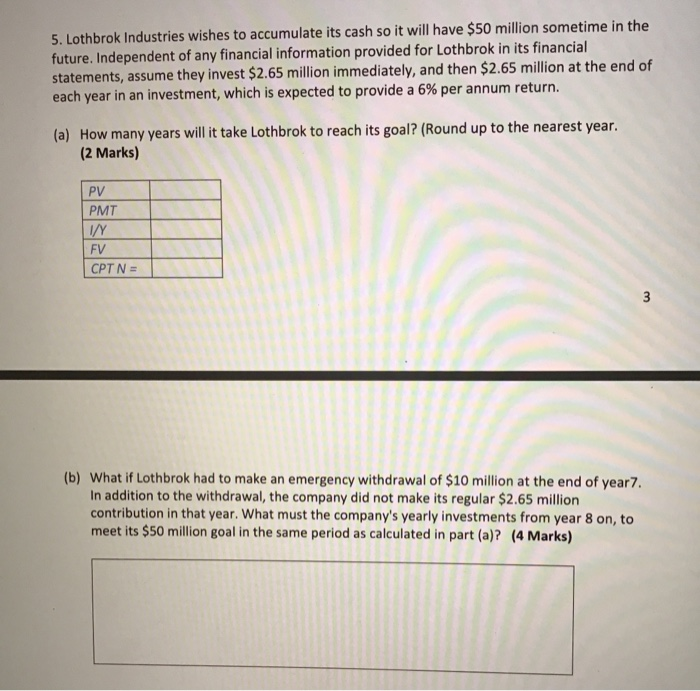

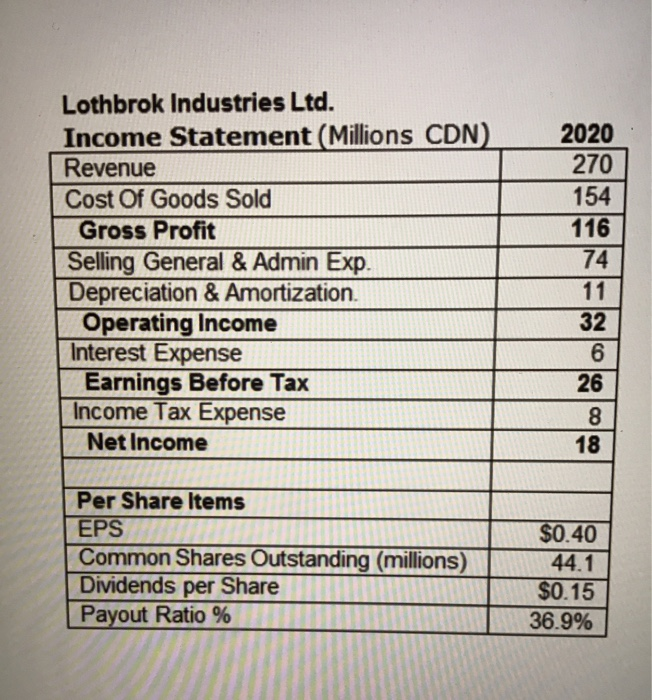

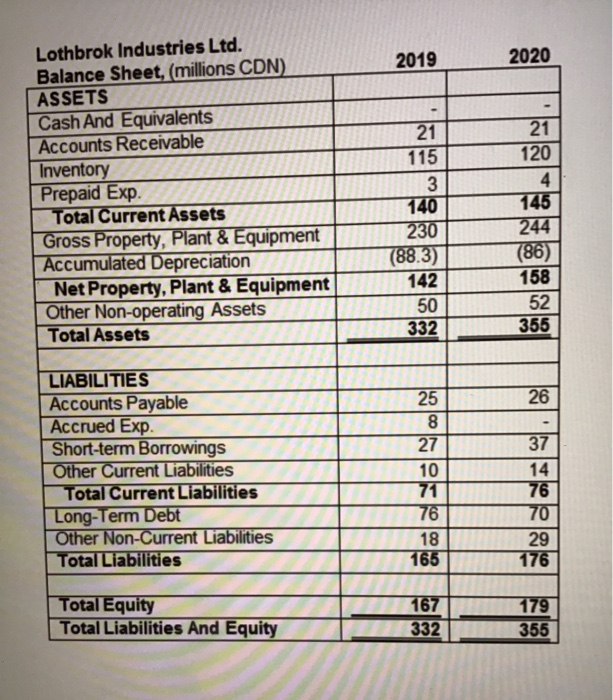

5. Lothbrok Industries wishes to accumulate its cash so it will have $50 million sometime in the future. Independent of any financial information provided for Lothbrok in its financial statements, assume they invest $2.65 million immediately, and then $2.65 million at the end of each year in an investment, which is expected to provide a 6% per annum return. (a) How many years will it take Lothbrok to reach its goal? (Round up to the nearest year. (2 Marks) PV PMT INY FV CPT N = 3 (b) What if Lothbrok had to make an emergency withdrawal of $10 million at the end of year7. In addition to the withdrawal, the company did not make its regular $2.65 million contribution in that year. What must the company's yearly investments from year 8 on, to meet its $50 million goal in the same period as calculated in part (a)? (4 Marks) Lothbrok Industries Ltd. Income Statement (Millions CDN). Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 6 26 colo ooo Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp Total Current Assets Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4 145 244 (86) 158 52 356 26 LIABILITIES Accounts Payable Accrued Exp. Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355 5. Lothbrok Industries wishes to accumulate its cash so it will have $50 million sometime in the future. Independent of any financial information provided for Lothbrok in its financial statements, assume they invest $2.65 million immediately, and then $2.65 million at the end of each year in an investment, which is expected to provide a 6% per annum return. (a) How many years will it take Lothbrok to reach its goal? (Round up to the nearest year. (2 Marks) PV PMT INY FV CPT N = 3 (b) What if Lothbrok had to make an emergency withdrawal of $10 million at the end of year7. In addition to the withdrawal, the company did not make its regular $2.65 million contribution in that year. What must the company's yearly investments from year 8 on, to meet its $50 million goal in the same period as calculated in part (a)? (4 Marks) Lothbrok Industries Ltd. Income Statement (Millions CDN). Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 6 26 colo ooo Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp Total Current Assets Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4 145 244 (86) 158 52 356 26 LIABILITIES Accounts Payable Accrued Exp. Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355