Question

(5 marks) Use the information below from Note 12 Inventories and answer the following: a. Prepare a journal entry to record the write-down of inventories.

-

(5 marks) Use the information below from Note 12 Inventories and answer the following:

a. Prepare a journal entry to record the write-down of inventories.

b. Give two examples and explain why a write-down of inventories is necessary for Loblaw.

Note 12 Inventories

For inventories recorded as at December 31, 2016, the Company recorded $22 million as an expense for the write-down of inventories below cost to net realizable value. The write-down was included in cost of merchandise inventories sold.

-

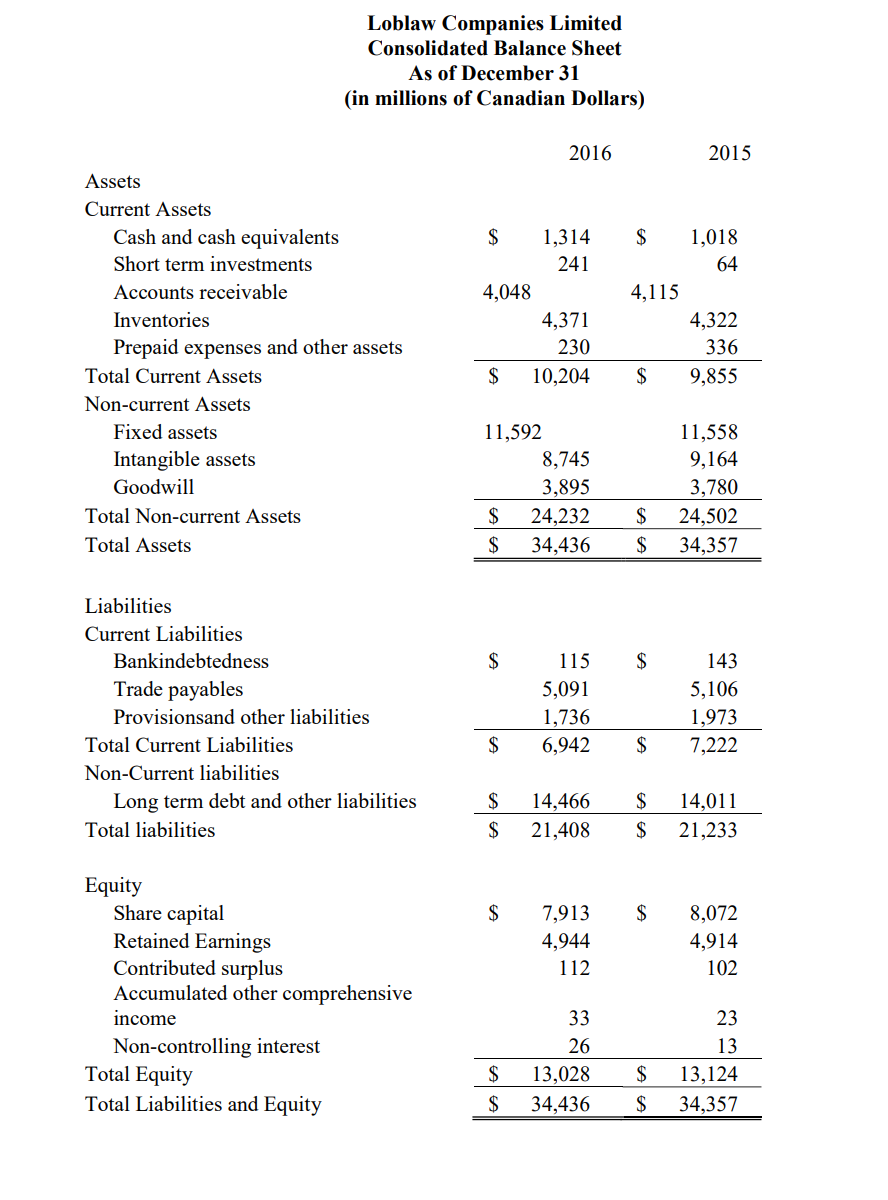

f) (3 marks) Calculate the debt-to-equity ratio for 2016. Explain what this ratio measures and why creditors want to see this ratio.

-

g) (10 marks) Answer the following questions:

-

Loblaw has unlimited number of authorized shares on each class of shares. Why

do many companies today prefer to have an unlimited authorized number of

shares? (2 marks)

-

List and explain three differences between common shares and preferred shares.

(3 marks)

-

Based on the information available, are you able to determine the net income for

the year ended December 31, 2016? Show your detailed calculations or explain

why not. (2 marks)

-

The unit price for Loblaws common shares was $70.33 on December 31, 2016

and $63.92 on December 31, 2015. Note 24 Share Capital (not provided) indicated the following:

What is the dividend yield for common shareholders in each of 2016 and 2015? If you are a common shareholder, are you happy to see the change and why? (3 marks)

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started