5

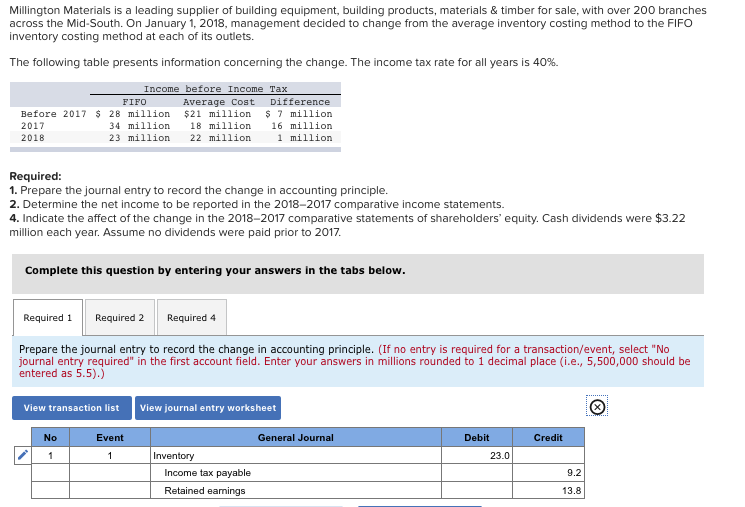

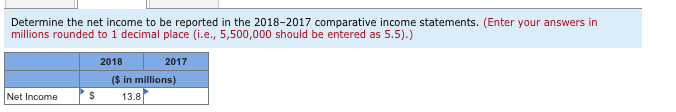

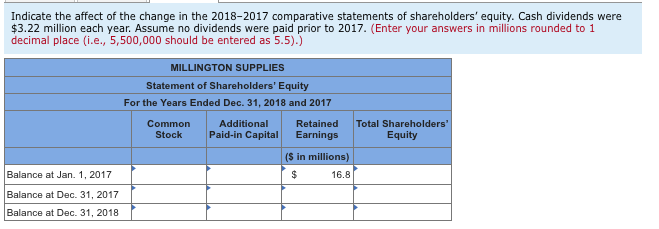

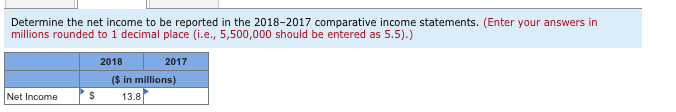

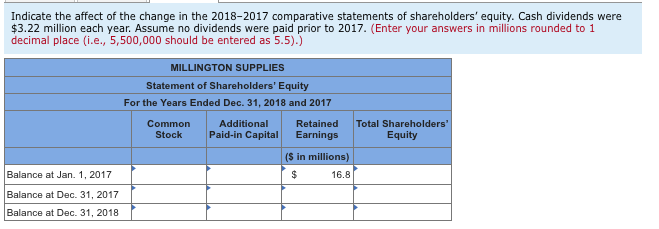

Millington Materials is a leading supplier of building equipment, building products, materials & timber for sale, with over 200 branches across the Mid-South. On January 1, 2018, management decided to change from the average inventory costing method to the FIFO inventory costing method at each of its outlets. The following table presents information concerning the change. The income tax rate for all years is 40%. Income before Income Tax Average Cost $21 million Difference FIFO s 7 million $ 28 million 34 million Before 2017 2017 18 million 16 million 2018 23 million 22 million 1 million Required: 1. Prepare the journal entry to record the change in accounting principle. 2. Determine the net income to be reported in the 2018-2017 comparative income statements. 4. Indicate the affect of the change in the 2018-2017 comparative statements of shareholders' equity. Cash dividends were $3.22 million each year. Assume no dividends were paid prior to 2017 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 4 Prepare the journal entry to record the change in accounting principle. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list View journal entry worksheet No Ex General Journa Debit Credi 1 Inventory 23.0 Income tax payable 9.2 Retained eamings 13.8 Determine the net income to be reported in the 2018-2017 comparative income statements. (Enter your answers in millions rounded to 1 decimal place i.e., 5,500,000 should be entered as 5.5).) 2018 2017 ($ in millions) Net Income 13.8 Indicate the affect of the change in the 2018-2017 comparative statements of shareholders' equity. Cash dividends were $3.22 million each year. Assume no dividends were paid prior to 2017. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) MILLINGTON SUPPLIES Statement of Shareholders' Equity For the Years Ended Dec. 31, 2018 and 2017 Additional Paid-in Capital Common Retained Total Shareholders' Stock Earnings Equity (S in millions) Balance at Jan. 1, 2017 16.8 Balance at Dec. 31, 2017 Balance at Dec. 31, 2018