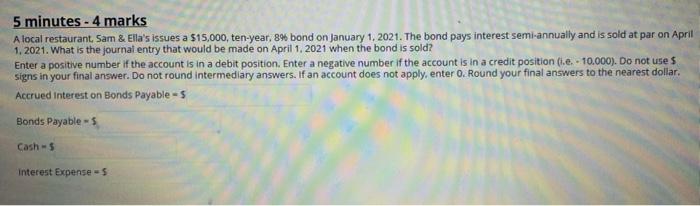

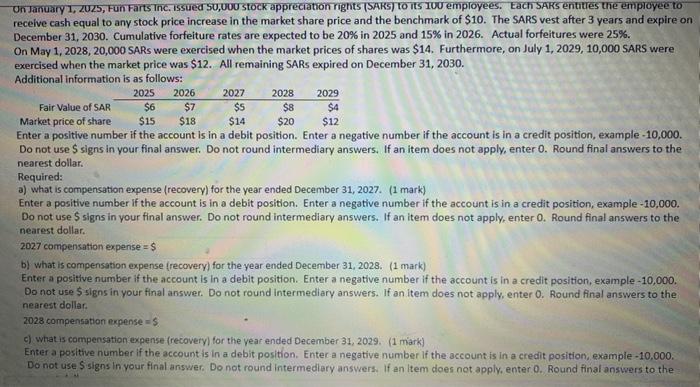

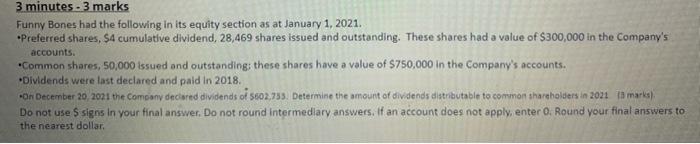

5 minutes - 4 marks A local restaurant Sam & Ella's issues a $15,000, ten-year, 8% bond on January 1, 2021. The bond pays interest semi-annually and is sold at par on April 1.2021. What is the journal entry that would be made on April 1, 2021 when the bond is sold? Enter a positive number if the account is in a debit position. Enter a negative number if the account is in a credit position (.e. - 10.000). Do not use $ signs in your final answer. Do not round intermediary answers. If an account does not apply, enter O. Round your final answers to the nearest dollar. Accrued interest on Bonds Payable - 5 Bonds Payable - 5 Cash - 5 interest Expenses Un January 1, 2025, Fun Farts Tnc. issued 50,000 Stock appreciation Tights TSARST TO TS 100 employees. Each SARS entities the employee to receive cash equal to any stock price increase in the market share price and the benchmark of $10. The SARS vest after 3 years and expire on December 31, 2030. Cumulative forfeiture rates are expected to be 20% in 2025 and 15% in 2026. Actual forfeitures were 25%. On May 1, 2028, 20,000 SARs were exercised when the market prices of shares was $14. Furthermore, on July 1, 2029, 10,000 SARS were exercised when the market price was $12. All remaining SARs expired on December 31, 2030. Additional information is as follows: 2025 $6 $7 $S Market price of share $18 $12 Enter a positive number if the account is in a debit position. Enter a negative number if the account is in a credit position, example -10,000. Do not use S signs in your final answer. Do not round intermediary answers. If an item does not apply, enter 0. Round final answers to the 2026 2027 2028 2029 $4 Fair Value of SAR $8 $20 $15 $14 nearest dollar. Required: a) what is compensation expense (recovery) for the year ended December 31, 2027. (1 mark) Enter a positive number if the account is in a debit position. Enter a negative number if the account is in a credit position, example -10,000. Do not use S signs in your final answer. Do not round intermediary answers. If an item does not apply, enter 0. Round final answers to the nearest dollar. 2027 compensation expense = $ b) what is compensation expense (recovery) for the year ended December 31, 2028. (1 mark) Enter a positive number if the account is in a debit position. Enter a negative number if the account is in a credit position, example -10,000. Do not use S signs in your final answer. Do not round Intermediary answers. If an item does not apply, enter 0. Round final answers to the nearest dollar 2028 compensation expense = 5 c) what is compensation expense (recoveryfor the year ended December 31, 2029. (1 mark) Enter a positive number if the account is in a debit position. Enter a negative number if the account is in a credit position, example -10,000. Do not use S signs in your final answer. Do not round intermediary answers. If an Item does not apply, enter 0. Round final answers to the 3 minutes - 3 marks Funny Bones had the following in its equity section as at January 1, 2021. Preferred shares, S4 cumulative dividend, 28,469 shares issued and outstanding. These shares had a value of $300,000 in the Company's accounts. Common shares, 50,000 issued and outstanding these shares have a value of $750,000 in the Company's accounts. Dividends were last declared and paid in 2018. On December 20, 2021 the Company declared dividends of 5802,733. Determine the amount of dividends distributable to common shareholders in 2021 ta marks) Do not use S signs in your final answer. Do not round intermediary answers. If an account does not apply, enter O. Round your final answers to the nearest dollar