Question

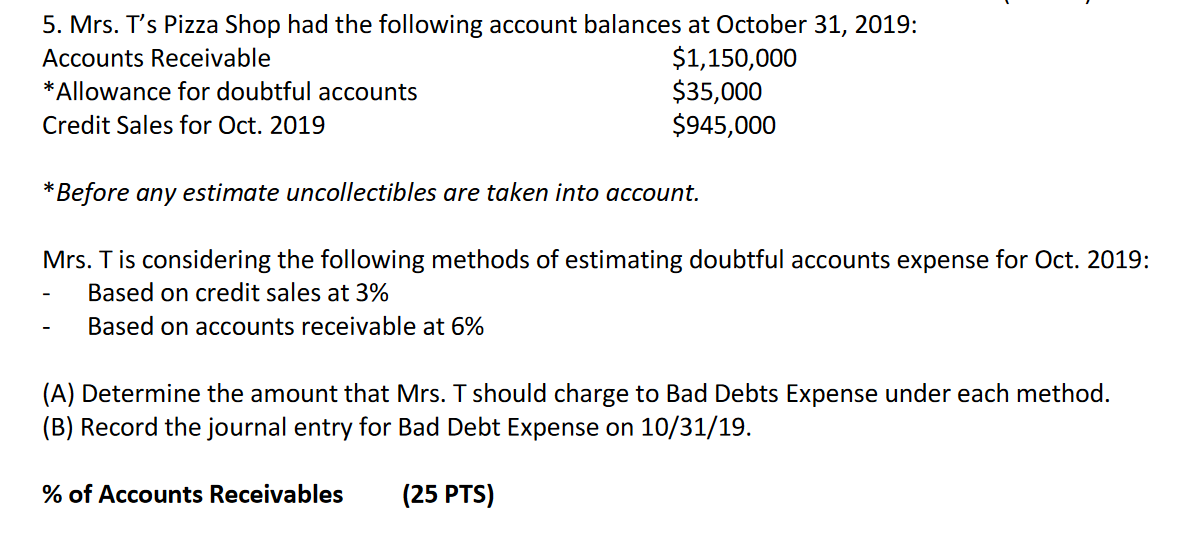

5. Mrs. T's Pizza Shop had the following account balances at October 31, 2019: $1,150,000 $35,000 $945,000 Accounts Receivable *Allowance for doubtful accounts Credit

5. Mrs. T's Pizza Shop had the following account balances at October 31, 2019: $1,150,000 $35,000 $945,000 Accounts Receivable *Allowance for doubtful accounts Credit Sales for Oct. 2019 *Before any estimate uncollectibles are taken into account. Mrs. T is considering the following methods of estimating doubtful accounts expense for Oct. 2019: Based on credit sales at 3% Based on accounts receivable at 6% (A) Determine the amount that Mrs. T should charge to Bad Debts Expense under each method. (B) Record the journal entry for Bad Debt Expense on 10/31/19. % of Accounts Receivables (25 PTS)

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

B E F 2 A Determine the amountthat Mrs T should charge to Bad Debts Expense un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Jeffrey Waybright, Liang Hsuan Chen, Rhonda Pyper

1st Canadian Edition

9780132147538, 132889714, 013214753X , 978-0132889711

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App