Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#5 nctructor-Assigned Problems you are using this book in a class, these review problems may be assigned by your instructor for homework, group assignments, class

#5

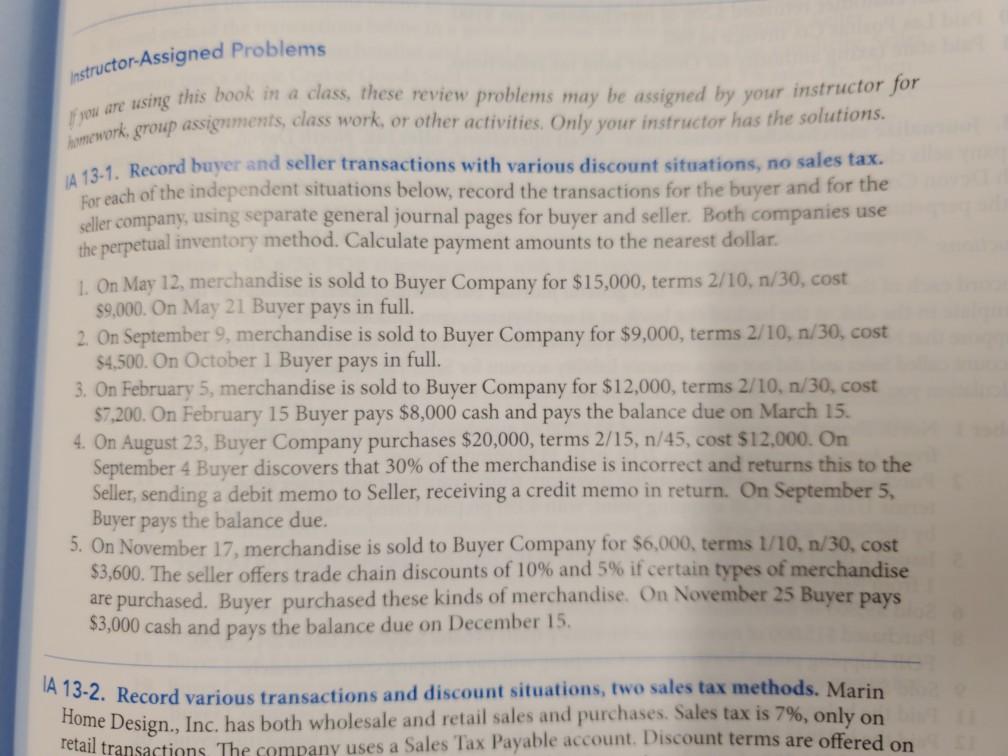

nctructor-Assigned Problems you are using this book in a class, these review problems may be assigned by your instructor for homework, group assignments, class work, or other activities. Only your instructor has the solutions. IA 13-1. Record buyer and seller transactions with various discount situations, no sales tax. Eor each of the independent situations below, record the transactions for the buyer and for the seller company, using separate general journal pages for buyer and seller. Both companies use the nerpetual inventory method. Calculate payment amounts to the nearest dollar. 1. On May 12, merchandise is sold to Buyer Company for $15,000, terms 2/10, n/30, cost S9.000. On May 21 Buyer pays in full. 2. On September 9, merchandise is sold to Buyer Company for $9,000, terms 2/10, n/30, cost $4,500. On October 1 Buyer pays in full. 3. On February 5, merchandise is sold to Buyer Company for $12,000, terms 2/10, n/30, cost $7,200. On February 15 Buyer pays $8,000 cash and pays the balance due on March 15. 4. On August 23, Buyer Company purchases $20,000, terms 2/15, n/45, cost $12,000. On September 4 Buyer discovers that 30 % of the merchandise is incorrect and returns this to the Seller, sending a debit memo to Seller, receiving a credit memo in return. On September 5, Buyer pays the balance due. 5. On November 17, merchandise is sold to Buyer Company for $6,000, terms 1/10, n/30, cost $3,600. The seller offers trade chain discounts of 10% and 5 % if certain types of merchandise are purchased. Buyer purchased these kinds of merchandise. On November 25 Buyer pays $3,000 cash and pays the balance due on December 15. IA 13-2. Record various transactions and discount situations, two sales tax methods. Marin Home Design., Inc. has both wholesale and retail sales and purchases. Sales tax is 7%, only on retail transactions The company uses a Sales Tax Payable account. Discount terms are offered onStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started