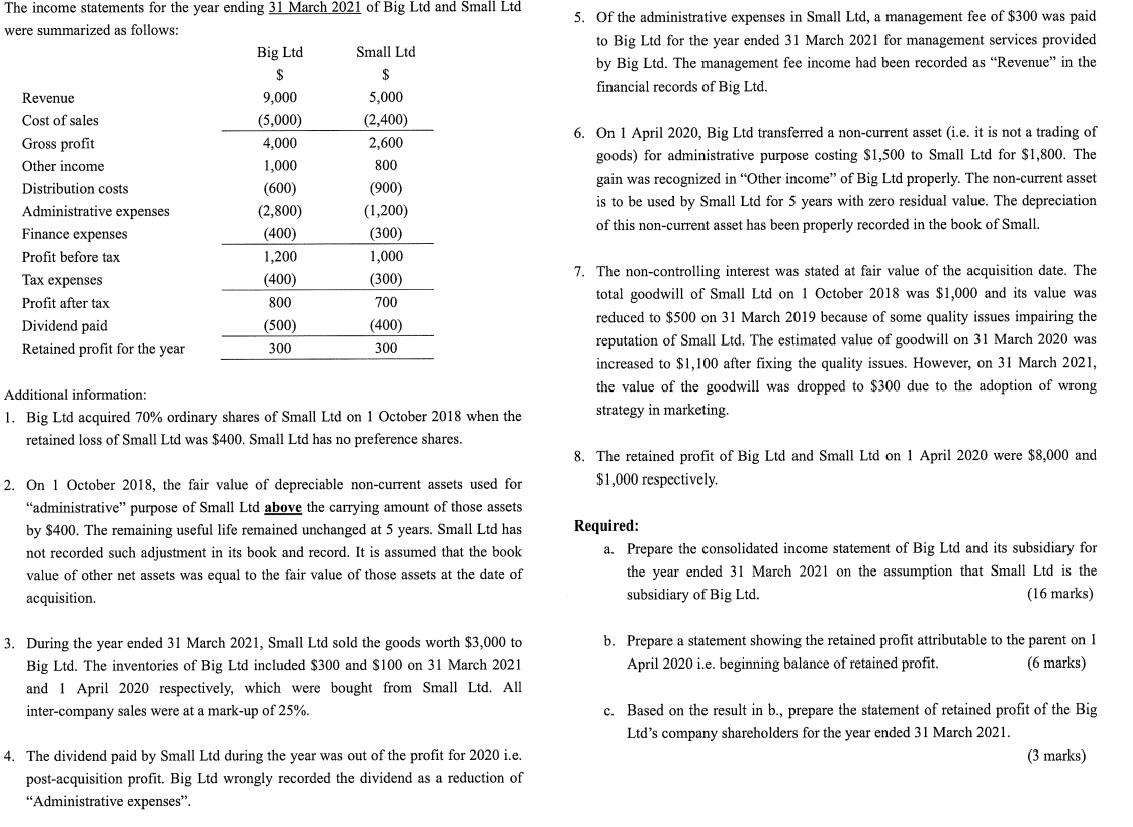

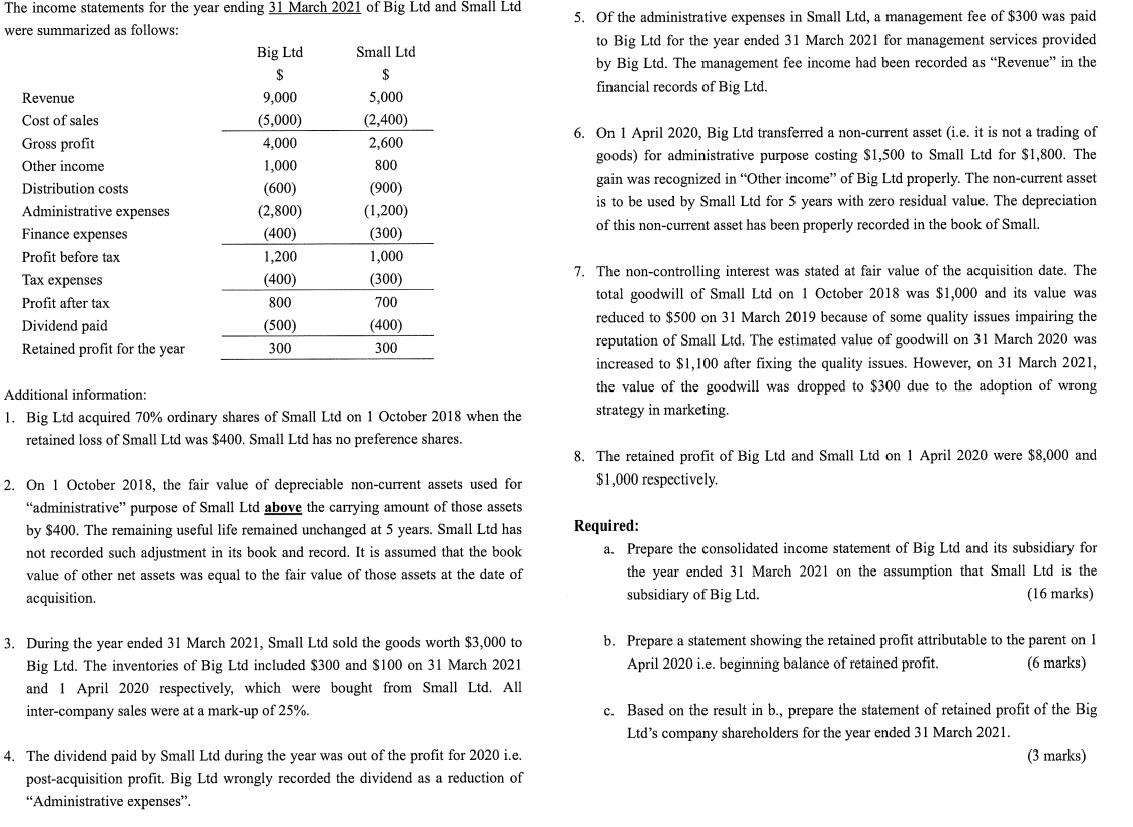

5. Of the administrative expenses in Small Ltd, a management fee of $300 was paid to Big Ltd for the year ended 31 March 2021 for management services provided by Big Ltd. The management fee income had been recorded as "Revenue" in the financial records of Big Ltd. The income statements for the year ending 31 March 2021 of Big Ltd and Small Ltd were summarized as follows: Big Ltd Small Ltd $ $ Revenue 9,000 5,000 Cost of sales (5,000) (2,400) Gross profit 4,000 2,600 Other income 1,000 800 Distribution costs (600) (900) Administrative expenses (2,800) (1,200) Finance expenses (400) (300) Profit before tax 1,200 1,000 Tax expenses (400) (300) Profit after tax 800 700 Dividend paid (500) (400) Retained profit for the year 300 300 6. On 1 April 2020, Big Ltd transferred a non-current asset (i.e. it is not a trading of goods) for administrative purpose costing $1,500 to Small Ltd for $1,800. The gain was recognized in "Other income" of Big Ltd properly. The non-current asset is to be used by Small Ltd for 5 years with zero residual value. The depreciation of this non-current asset has been properly recorded in the book of Small. 7. The non-controlling interest was stated at fair value of the acquisition date. The total goodwill of Small Ltd on 1 October 2018 was $1,000 and its value was reduced to $500 on 31 March 2019 because of some quality issues impairing the reputation of Small Ltd. The estimated value of goodwill on 31 March 2020 was increased to $1,100 after fixing the quality issues. However, on 31 March 2021, the value of the goodwill was dropped to $300 due to the adoption of wrong strategy in marketing. Additional information: 1. Big Ltd acquired 70% ordinary shares of Small Ltd on 1 October 2018 when the retained loss of Small Ltd was $400. Small Ltd has no preference shares. 8. The retained profit of Big Ltd and Small Ltd on 1 April 2020 were $8,000 and $1,000 respectively. 2. On 1 October 2018, the fair value of depreciable non-current assets used for "administrative" purpose of Small Ltd above the carrying amount of those assets by $400. The remaining useful life remained unchanged at 5 years. Small Ltd has not recorded such adjustment in its book and record. It is assumed that the book value of other net assets was equal to the fair value of those assets at the date of acquisition Required: a. Prepare the consolidated income statement of Big Ltd and its subsidiary for the year ended 31 March 2021 on the assumption that Small Ltd is the subsidiary of Big Ltd. (16 marks) b. Prepare a statement showing the retained profit attributable to the parent on 1 April 2020 i.e. beginning balance of retained profit. (6 marks) 3. During the year ended 31 March 2021, Small Ltd sold the goods worth $3,000 to Big Ltd. The inventories of Big Ltd included $300 and $100 on 31 March 2021 and 1 April 2020 respectively, which were bought from Small Ltd. All inter-company sales were at a mark-up of 25%. c. Based on the result in b., prepare the statement of retained profit of the Big Ltd's company shareholders for the year ended 31 March 2021. (3 marks) 4. The dividend paid by Small Ltd during the year was out of the profit for 2020 i.e. post-acquisition profit. Big Ltd wrongly recorded the dividend as a reduction of "Administrative expenses". 5. Of the administrative expenses in Small Ltd, a management fee of $300 was paid to Big Ltd for the year ended 31 March 2021 for management services provided by Big Ltd. The management fee income had been recorded as "Revenue" in the financial records of Big Ltd. The income statements for the year ending 31 March 2021 of Big Ltd and Small Ltd were summarized as follows: Big Ltd Small Ltd $ $ Revenue 9,000 5,000 Cost of sales (5,000) (2,400) Gross profit 4,000 2,600 Other income 1,000 800 Distribution costs (600) (900) Administrative expenses (2,800) (1,200) Finance expenses (400) (300) Profit before tax 1,200 1,000 Tax expenses (400) (300) Profit after tax 800 700 Dividend paid (500) (400) Retained profit for the year 300 300 6. On 1 April 2020, Big Ltd transferred a non-current asset (i.e. it is not a trading of goods) for administrative purpose costing $1,500 to Small Ltd for $1,800. The gain was recognized in "Other income" of Big Ltd properly. The non-current asset is to be used by Small Ltd for 5 years with zero residual value. The depreciation of this non-current asset has been properly recorded in the book of Small. 7. The non-controlling interest was stated at fair value of the acquisition date. The total goodwill of Small Ltd on 1 October 2018 was $1,000 and its value was reduced to $500 on 31 March 2019 because of some quality issues impairing the reputation of Small Ltd. The estimated value of goodwill on 31 March 2020 was increased to $1,100 after fixing the quality issues. However, on 31 March 2021, the value of the goodwill was dropped to $300 due to the adoption of wrong strategy in marketing. Additional information: 1. Big Ltd acquired 70% ordinary shares of Small Ltd on 1 October 2018 when the retained loss of Small Ltd was $400. Small Ltd has no preference shares. 8. The retained profit of Big Ltd and Small Ltd on 1 April 2020 were $8,000 and $1,000 respectively. 2. On 1 October 2018, the fair value of depreciable non-current assets used for "administrative" purpose of Small Ltd above the carrying amount of those assets by $400. The remaining useful life remained unchanged at 5 years. Small Ltd has not recorded such adjustment in its book and record. It is assumed that the book value of other net assets was equal to the fair value of those assets at the date of acquisition Required: a. Prepare the consolidated income statement of Big Ltd and its subsidiary for the year ended 31 March 2021 on the assumption that Small Ltd is the subsidiary of Big Ltd. (16 marks) b. Prepare a statement showing the retained profit attributable to the parent on 1 April 2020 i.e. beginning balance of retained profit. (6 marks) 3. During the year ended 31 March 2021, Small Ltd sold the goods worth $3,000 to Big Ltd. The inventories of Big Ltd included $300 and $100 on 31 March 2021 and 1 April 2020 respectively, which were bought from Small Ltd. All inter-company sales were at a mark-up of 25%. c. Based on the result in b., prepare the statement of retained profit of the Big Ltd's company shareholders for the year ended 31 March 2021. (3 marks) 4. The dividend paid by Small Ltd during the year was out of the profit for 2020 i.e. post-acquisition profit. Big Ltd wrongly recorded the dividend as a reduction of "Administrative expenses