Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Oman Enterprise depreciates its equipment at the rate of 20% per anum, for each month of ownership. From the capital expenditure information given below,

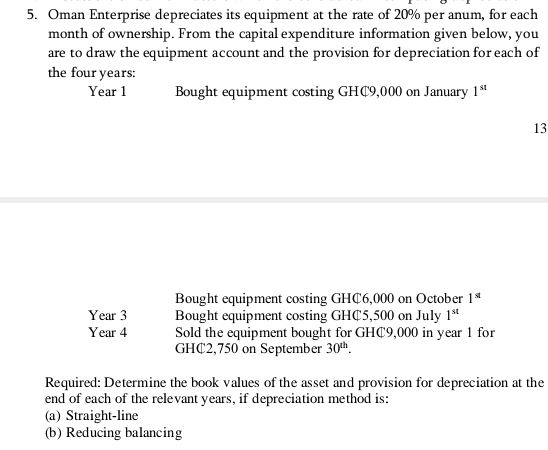

5. Oman Enterprise depreciates its equipment at the rate of 20% per anum, for each month of ownership. From the capital expenditure information given below, you are to draw the equipment account and the provision for depreciation for each of the four years: Year 1 Bought equipment costing GHC9,000 on January 1st Bought equipment costing GHC6,000 on October 1st Year 3 Bought equipment costing GHC5,500 on July 1st Year 4 Sold the equipment bought for GHC9,000 in year 1 for GHC2, 750 on September 30th. Required: Determine the book values of the asset and provision for depreciation at the end of each of the relevant years, if depreciation method is: (a) Straight-line (b) Reducing balancing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started