Answered step by step

Verified Expert Solution

Question

1 Approved Answer

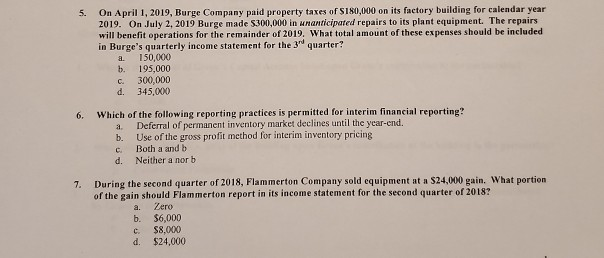

5. On April 1, 2019, Burge Company paid property taxes of S180,000 on its factory building for calendar year 2019. On July 2, 2019 Burge

5. On April 1, 2019, Burge Company paid property taxes of S180,000 on its factory building for calendar year 2019. On July 2, 2019 Burge made 5.900,000 in nanticipated repairs to its plant equipment. The repairs will benefit operations for the remainder of 2019. What total amount of these expenses should be included in Burge's quarterly income statement for the 3 quarter! a 150,000 b. 195.000 c. 300,000 d. 345,000 6. Which of the following reporting practices is permitted for interim financial reporting? a Deferral of permanent inventory market declines until the year-end. b. Use of the gross profit method for interim inventory pricing C. Both a and b d. Neither a norb During the second quarter of 2018, Flammerton Company sold equipment at a $24.000 gain. What portion of the gain should Flammerton report in its income statement for the second quarter of 2018? a. Zero b. $6,000 c. $8,000 d. $24,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started