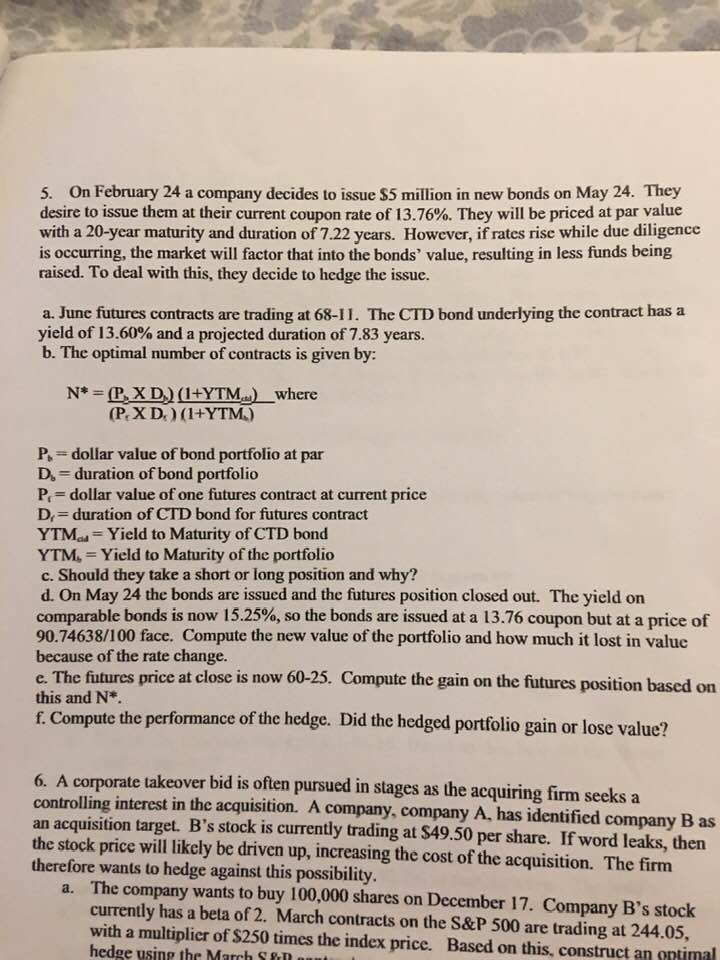

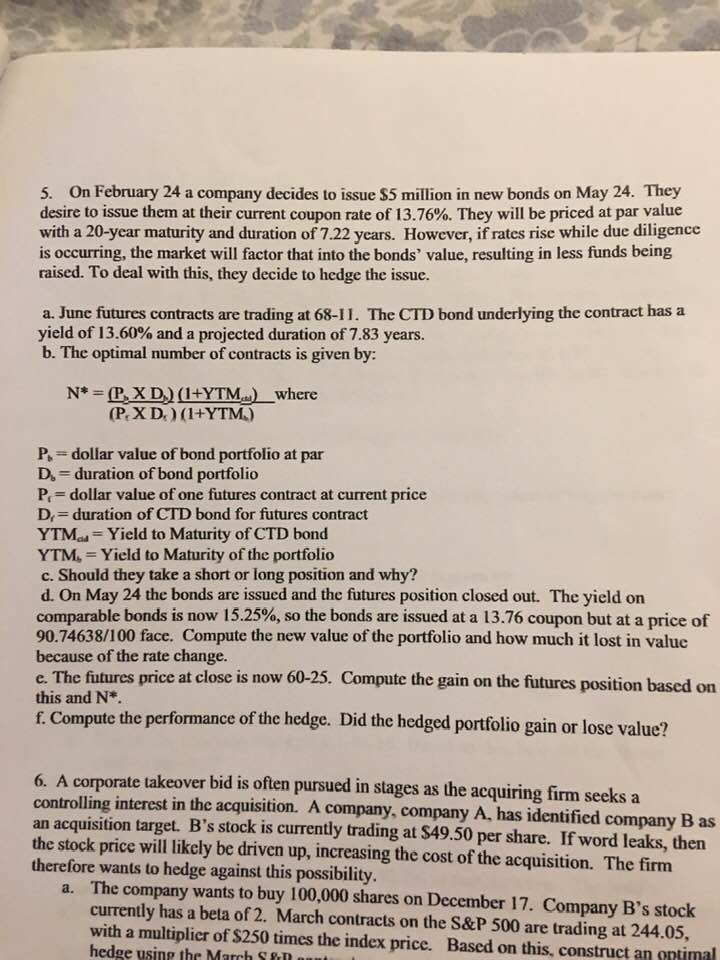

5. On February 24 a company decides to issue $5 million in new bonds on May 24. They desire to issue them at their current coupon rate of 13.76%. They will be priced at par value with a 20-ycar maturity and duration of 7.22 years. However, if rates rise while due diligence is occurring, the market will factor that into the bonds' value, resulting in less funds being raised. To deal with this, they decide to hedge the issue. a. June futures contracts are trading at 68-11. The CTD bond underlying the contract has a yield of 13.60% and a projected duration of 7.83 years. b. The optimal number of contracts is given by: N#2LxD)(1+YTMe) where (P.XD,)+YTM.) P, dollar value of bond portfolio at par D. duration of bond portfolico P dollar value of one futures contract at current price D, duration of CTD bond for futures contract YTMa Yield to Maturity of CTD bond YTM, Yield to Maturity of the portfolio c. Should they take a short or long position and why? d. On May 24 the bonds are issued and the futures position closed out. The yield on comparable bonds is now 15.25%, so the bonds are issued at a 13.76 coupon but at a price of 90.74638/100 face. Compute the new value of the portfolio and how much it lost in valuc because of the rate change. e. The futures price at close is now 60-25. Compute the gain on the futures position based on this and N f. Compute the performance of the hedge. Did the hedged portfolio gain or lose value? 6. A corporate takeover bid is often pursued in stages as the acquiring firm seeks a controlling interest in the acquisition. A company, company A, has identified company B as an acquisition target. B's stock is currently trading at $49.50 per share. If word leaks, then the stock price will likely be driven up, increasing the cost of the acquisition. The firm therefore wants to hedge against this possibility. The company wants to buy 100,000 shares on December 17. Company B's stock currently has a beta of 2. March contracts on the S&P 500 are trading at 244.05 with a multiplicr of $250 times the index price. Based on this, construct an ontimal hedge using the March S a. 5. On February 24 a company decides to issue $5 million in new bonds on May 24. They desire to issue them at their current coupon rate of 13.76%. They will be priced at par value with a 20-ycar maturity and duration of 7.22 years. However, if rates rise while due diligence is occurring, the market will factor that into the bonds' value, resulting in less funds being raised. To deal with this, they decide to hedge the issue. a. June futures contracts are trading at 68-11. The CTD bond underlying the contract has a yield of 13.60% and a projected duration of 7.83 years. b. The optimal number of contracts is given by: N#2LxD)(1+YTMe) where (P.XD,)+YTM.) P, dollar value of bond portfolio at par D. duration of bond portfolico P dollar value of one futures contract at current price D, duration of CTD bond for futures contract YTMa Yield to Maturity of CTD bond YTM, Yield to Maturity of the portfolio c. Should they take a short or long position and why? d. On May 24 the bonds are issued and the futures position closed out. The yield on comparable bonds is now 15.25%, so the bonds are issued at a 13.76 coupon but at a price of 90.74638/100 face. Compute the new value of the portfolio and how much it lost in valuc because of the rate change. e. The futures price at close is now 60-25. Compute the gain on the futures position based on this and N f. Compute the performance of the hedge. Did the hedged portfolio gain or lose value? 6. A corporate takeover bid is often pursued in stages as the acquiring firm seeks a controlling interest in the acquisition. A company, company A, has identified company B as an acquisition target. B's stock is currently trading at $49.50 per share. If word leaks, then the stock price will likely be driven up, increasing the cost of the acquisition. The firm therefore wants to hedge against this possibility. The company wants to buy 100,000 shares on December 17. Company B's stock currently has a beta of 2. March contracts on the S&P 500 are trading at 244.05 with a multiplicr of $250 times the index price. Based on this, construct an ontimal hedge using the March S a