Answered step by step

Verified Expert Solution

Question

1 Approved Answer

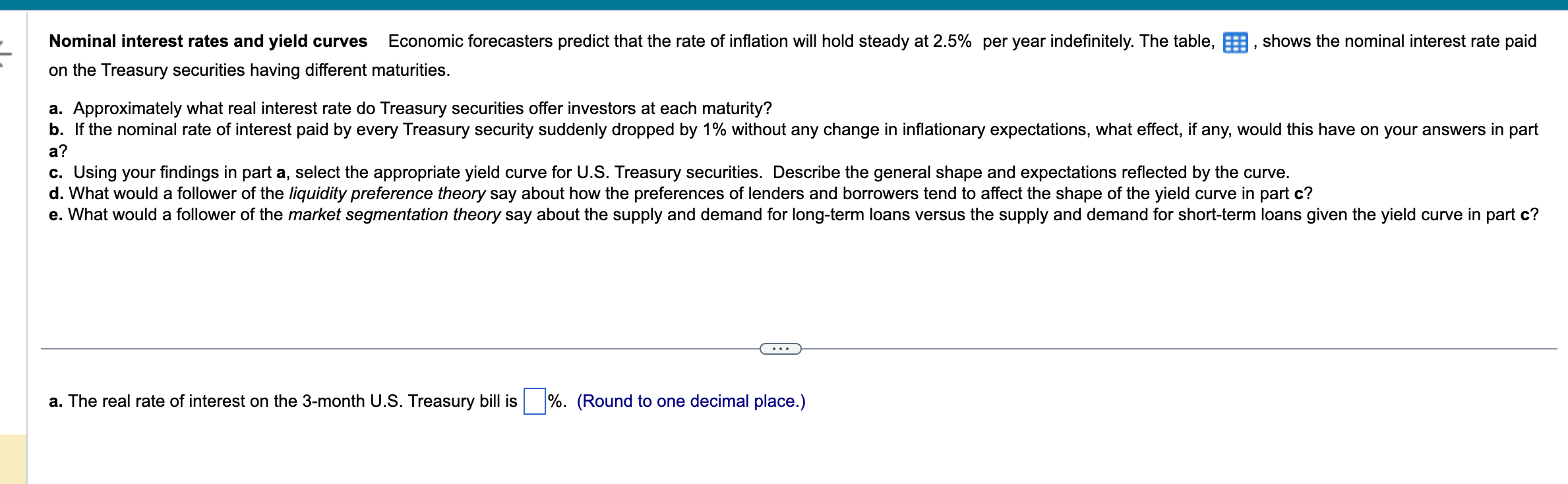

5.. on the Treasury securities having different maturities. a. Approximately what real interest rate do Treasury securities offer investors at each maturity? a? c. Using

5..

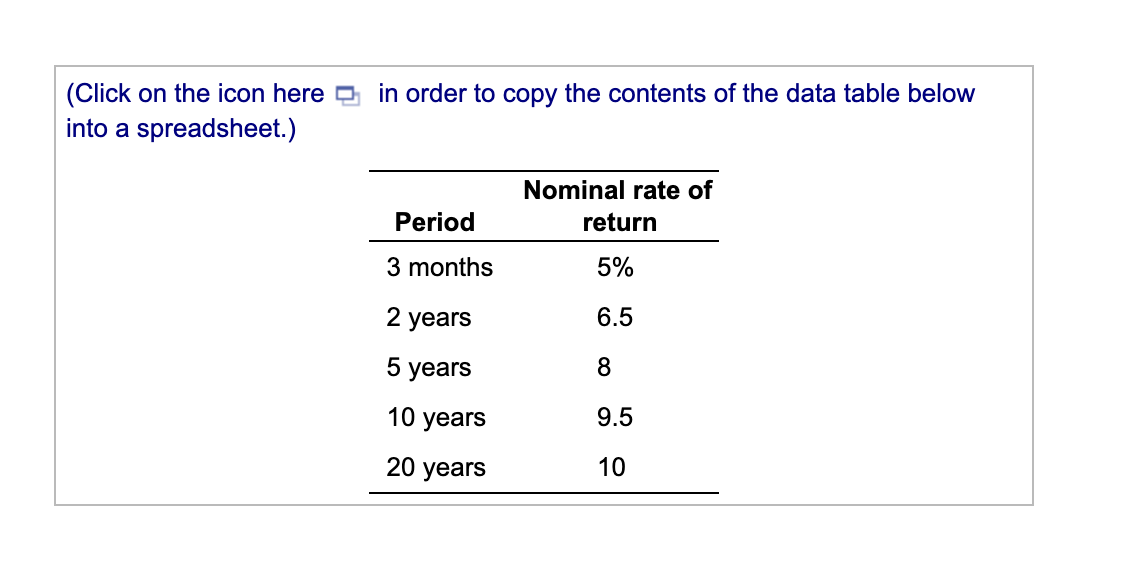

on the Treasury securities having different maturities. a. Approximately what real interest rate do Treasury securities offer investors at each maturity? a? c. Using your findings in part a, select the appropriate yield curve for U.S. Treasury securities. Describe the general shape and expectations reflected by the curve. d. What would a follower of the liquidity preference theory say about how the preferences of lenders and borrowers tend to affect the shape of the yield curve in part c? a. The real rate of interest on the 3-month U.S. Treasury bill is \%. (Round to one decimal place.) (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below

on the Treasury securities having different maturities. a. Approximately what real interest rate do Treasury securities offer investors at each maturity? a? c. Using your findings in part a, select the appropriate yield curve for U.S. Treasury securities. Describe the general shape and expectations reflected by the curve. d. What would a follower of the liquidity preference theory say about how the preferences of lenders and borrowers tend to affect the shape of the yield curve in part c? a. The real rate of interest on the 3-month U.S. Treasury bill is \%. (Round to one decimal place.) (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started