Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help asap. thank you Rao Investments has 6.5 percent coupon bonds outstanding with a current market price of $1,089.34. Interest is paid semi-annually. The

please help asap. thank you

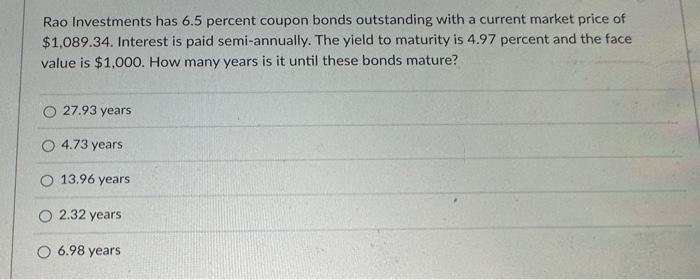

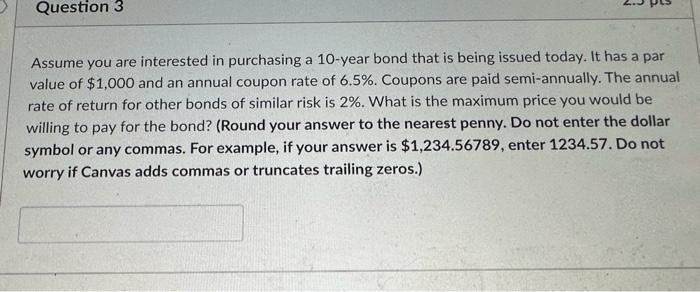

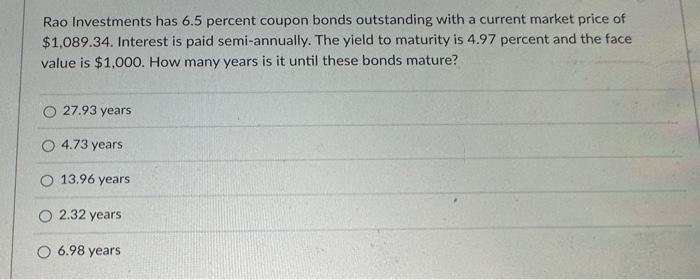

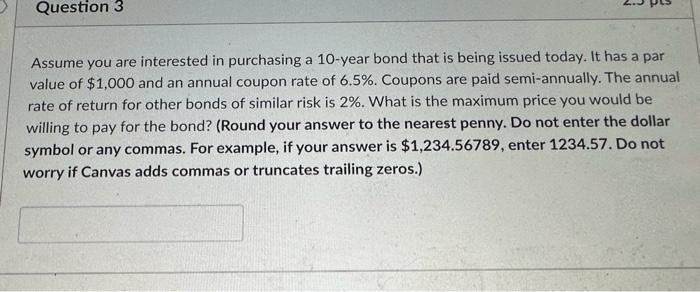

Rao Investments has 6.5 percent coupon bonds outstanding with a current market price of $1,089.34. Interest is paid semi-annually. The yield to maturity is 4.97 percent and the face value is $1,000. How many years is it until these bonds mature? 27.93 years 4.73 years 13.96 years 2.32 years 6.98 years Assume you are interested in purchasing a 10-year bond that is being issued today. It has a par value of $1,000 and an annual coupon rate of 6.5%. Coupons are paid semi-annually. The annual rate of return for other bonds of similar risk is 2%. What is the maximum price you would be willing to pay for the bond? (Round your answer to the nearest penny. Do not enter the dollar symbol or any commas. For example, if your answer is $1,234.56789, enter 1234.57 . Do not worry if Canvas adds commas or truncates trailing zeros.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started