Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baidu and Yahoo have a very similar business. We assume that their asset risk is the same. The market values of Baidu's debt and

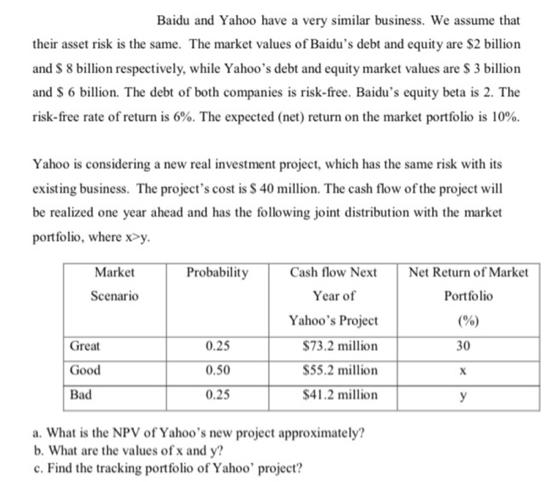

Baidu and Yahoo have a very similar business. We assume that their asset risk is the same. The market values of Baidu's debt and equity are $2 billion and $ 8 billion respectively, while Yahoo's debt and equity market values are $ 3 billion and S 6 billion. The debt of both companies is risk-free. Baidu's equity beta is 2. The risk-free rate of return is 6%. The expected (net) return on the market portfolio is 10%. Yahoo is considering a new real investment project, which has the same risk with its existing business. The project's cost is S 40 million. The cash flow of the project will be realized one year ahead and has the following joint distribution with the market portfolio, where x>y. Market Scenario Great Good Bad Probability 0.25 0.50 0.25 Cash flow Next Year of Yahoo's Project $73.2 million $55.2 million $41.2 million a. What is the NPV of Yahoo's new project approximately? b. What are the values of x and y? c. Find the tracking portfolio of Yahoo' project? Net Return of Market Portfolio (%) 30 X y

Step by Step Solution

★★★★★

3.63 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

a What is the NP V of Yahoo s new project approximately ANS WER The NP V of the project is approxima...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started