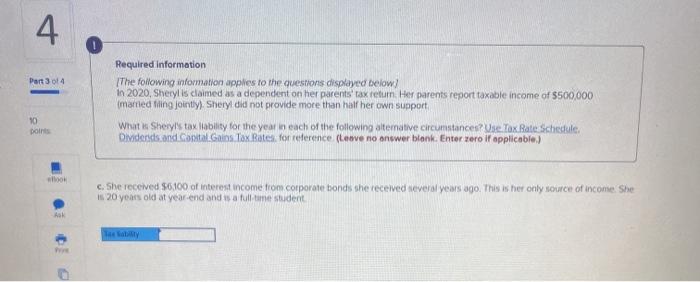

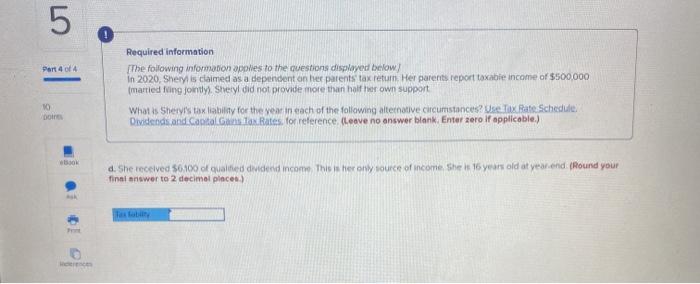

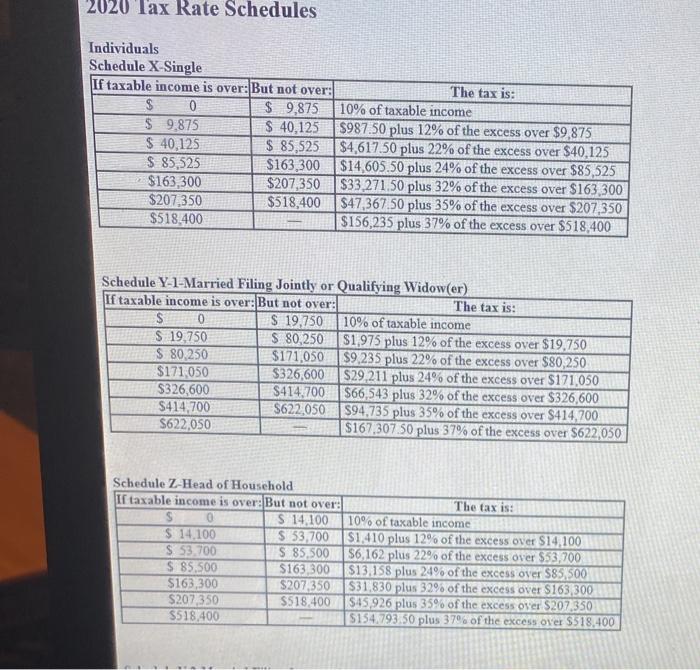

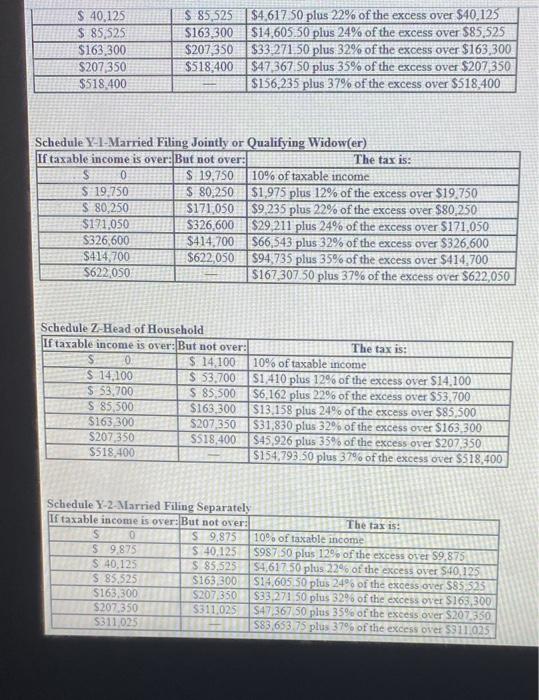

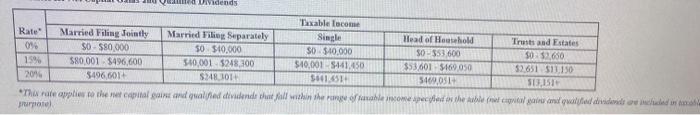

5 Part 4 of 4 Required information The following information applies to the questions displayed below) in 2020, Shery is claimed as a dependent on her parents tax return. Her parents report taxable income of $500,000 married Iving jointly) Sheryl did not provide more than half her own support What is Shery's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule Dividends and Capital Gas Rates for reference. Leave no answer blank Enter zero If applicable) boire d. She received 50100 of qualified divided income This is her only source of income. She is 16 years old at year.end(Round your finni answer to 2 decimal places) Dividends Taxable Tacone Rate" Married Filing Jointly Married File Separately Single Head of Household Trust and Estates 09 50-550.000 50 510.000 $0 $10,000 30-353 600 $0 $2.650 15% $80,001 $496,600 5-10.001 $248,300 $10,000 441.450 $53,601 5169.050 52651 $11.150 2016 5496,601 SM 101 5601. 5469,051 S13,151 The rate applies to the capital gain adalad dividend that fall with the goale come specified the local and quailed dividenden otel 5 Part 4 of 4 Required information The following information applies to the questions displayed below) in 2020, Shery is claimed as a dependent on her parents tax return. Her parents report taxable income of $500,000 married Iving jointly) Sheryl did not provide more than half her own support What is Shery's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule Dividends and Capital Gas Rates for reference. Leave no answer blank Enter zero If applicable) boire d. She received 50100 of qualified divided income This is her only source of income. She is 16 years old at year.end(Round your finni answer to 2 decimal places) Dividends Taxable Tacone Rate" Married Filing Jointly Married File Separately Single Head of Household Trust and Estates 09 50-550.000 50 510.000 $0 $10,000 30-353 600 $0 $2.650 15% $80,001 $496,600 5-10.001 $248,300 $10,000 441.450 $53,601 5169.050 52651 $11.150 2016 5496,601 SM 101 5601. 5469,051 S13,151 The rate applies to the capital gain adalad dividend that fall with the goale come specified the local and quailed dividenden otel