Answered step by step

Verified Expert Solution

Question

1 Approved Answer

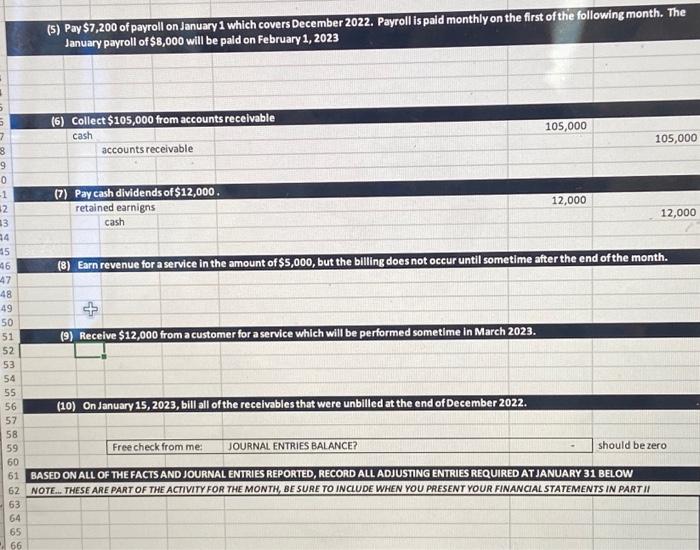

(5) Pay $7,200 of payroll on January 1 which covers December 2022. Payroll is paid monthly on the first of the following month. The January

(5) Pay $7,200 of payroll on January 1 which covers December 2022. Payroll is paid monthly on the first of the following month. The January payroll of $8,000 will be paid on February 1, 2023 (6) Collect $105,000 from accounts receivable cash accounts receivable (7) Pay cash dividends of $12,000. retained earnigns cash (9) Receive $12,000 from a customer for a service which will be performed sometime in March 2023. (10) On January 15, 2023, bill all of the receivables that were unbilled at the end of December 2022. 105,000 (8) Earn revenue for a service in the amount of $5,000, but the billing does not occur until sometime after the end of the month. 55 56 57 58 59 60 61 BASED ON ALL OF THE FACTS AND JOURNAL ENTRIES REPORTED, RECORD ALL ADJUSTING ENTRIES REQUIRED AT JANUARY 31 BELOW 62 NOTE... THESE ARE PART OF THE ACTIVITY FOR THE MONTH, BE SURE TO INCLUDE WHEN YOU PRESENT YOUR FINANCIAL STATEMENTS IN PART II 63 64 65 66 Free check from me: 12,000 JOURNAL ENTRIES BALANCE? 105,000 12,000 should be zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started