Answered step by step

Verified Expert Solution

Question

1 Approved Answer

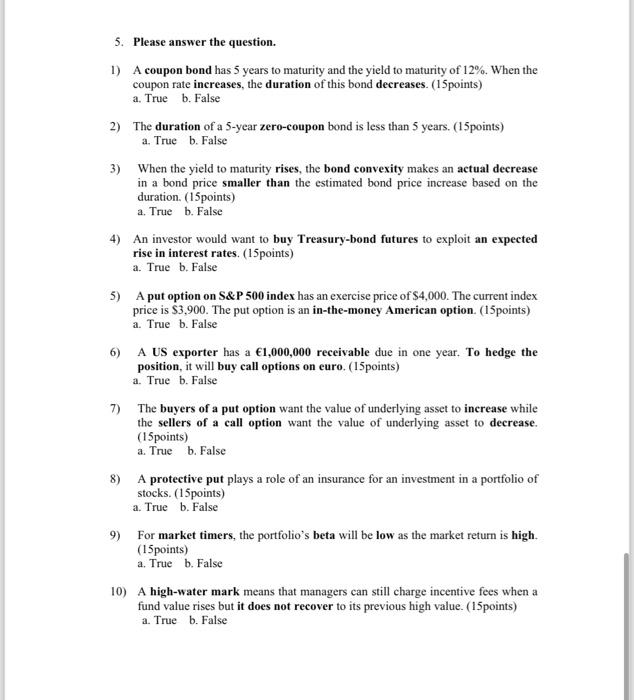

5. Please answer the question. 1) A coupon bond has 5 years to maturity and the yield to maturity of 12%. When the coupon

5. Please answer the question. 1) A coupon bond has 5 years to maturity and the yield to maturity of 12%. When the coupon rate increases, the duration of this bond decreases. (15points) a. True b. False 2) The duration of a 5-year zero-coupon bond is less than 5 years. (15points) a. True b. False 3) When the yield to maturity rises, the bond convexity makes an actual decrease in a bond price smaller than the estimated bond price increase based on the duration. (15points) a. True b. False 4) An investor would want to buy Treasury-bond futures to exploit an expected rise in interest rates. (15points) a. True b. False 5) A put option on S&P 500 index has an exercise price of $4,000. The current index price is $3,900. The put option is an in-the-money American option. (15points) a. True b. False 6) A US exporter has a 1,000,000 receivable due in one year. To hedge the position, it will buy call options on euro. (15points) a. True b. False 7) The buyers of a put option want the value of underlying asset to increase while the sellers of a call option want the value of underlying asset to decrease. (15points) a. True b. False 8) A protective put plays a role of an insurance for an investment in a portfolio of stocks. (15points) a. True b. False 9) For market timers, the portfolio's beta will be low as the market return is high (15points) a. True b. False 10) A high-water mark means that managers can still charge incentive fees when a fund value rises but it does not recover to its previous high value. (15points) a. True b. False 5. Please answer the question. 1) A coupon bond has 5 years to maturity and the yield to maturity of 12%. When the coupon rate increases, the duration of this bond decreases. (15points) a. True b. False 2) The duration of a 5-year zero-coupon bond is less than 5 years. (15points) a. True b. False 3) When the yield to maturity rises, the bond convexity makes an actual decrease in a bond price smaller than the estimated bond price increase based on the duration. (15points) a. True b. False 4) An investor would want to buy Treasury-bond futures to exploit an expected rise in interest rates. (15points) a. True b. False 5) A put option on S&P 500 index has an exercise price of $4,000. The current index price is $3,900. The put option is an in-the-money American option. (15points) a. True b. False 6) A US exporter has a 1,000,000 receivable due in one year. To hedge the position, it will buy call options on euro. (15points) a. True b. False 7) The buyers of a put option want the value of underlying asset to increase while the sellers of a call option want the value of underlying asset to decrease. (15points) a. True b. False 8) A protective put plays a role of an insurance for an investment in a portfolio of stocks. (15points) a. True b. False 9) For market timers, the portfolio's beta will be low as the market return is high (15points) a. True b. False 10) A high-water mark means that managers can still charge incentive fees when a fund value rises but it does not recover to its previous high value. (15points) a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The image shows a list of true or false questions related to finance specifically focusing on bonds options and investment strategies Ill a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started