Answered step by step

Verified Expert Solution

Question

1 Approved Answer

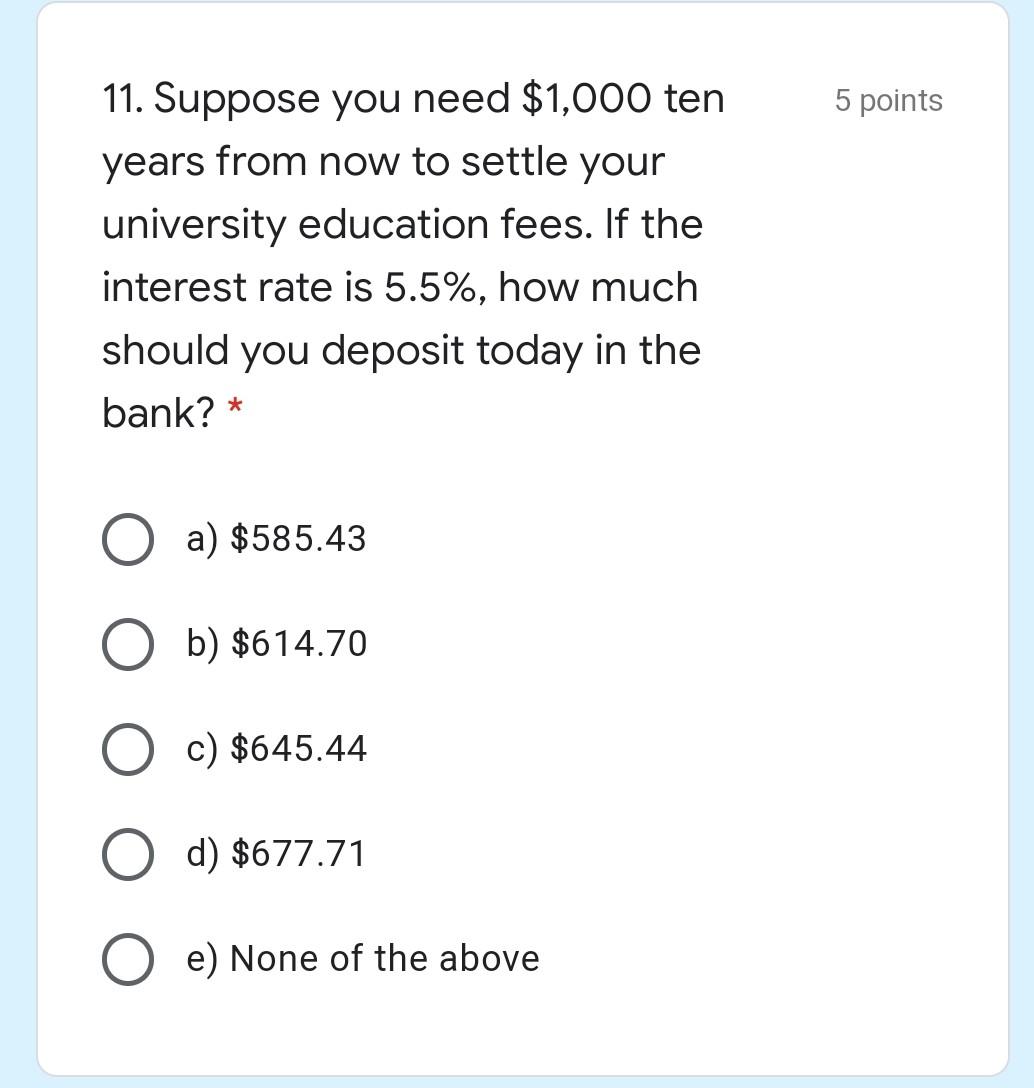

5 points 11. Suppose you need $1,000 ten years from now to settle your university education fees. If the interest rate is 5.5%, how much

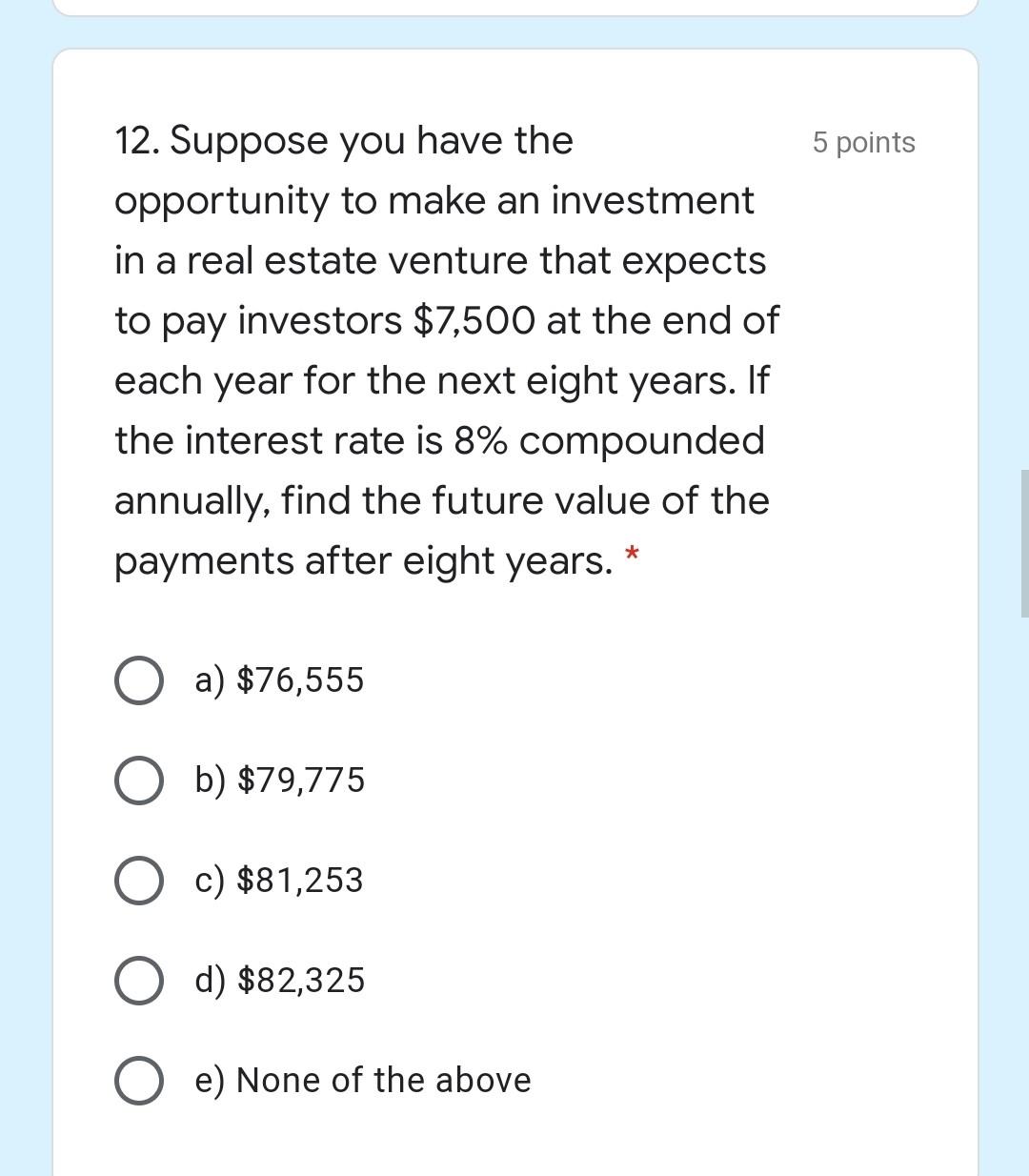

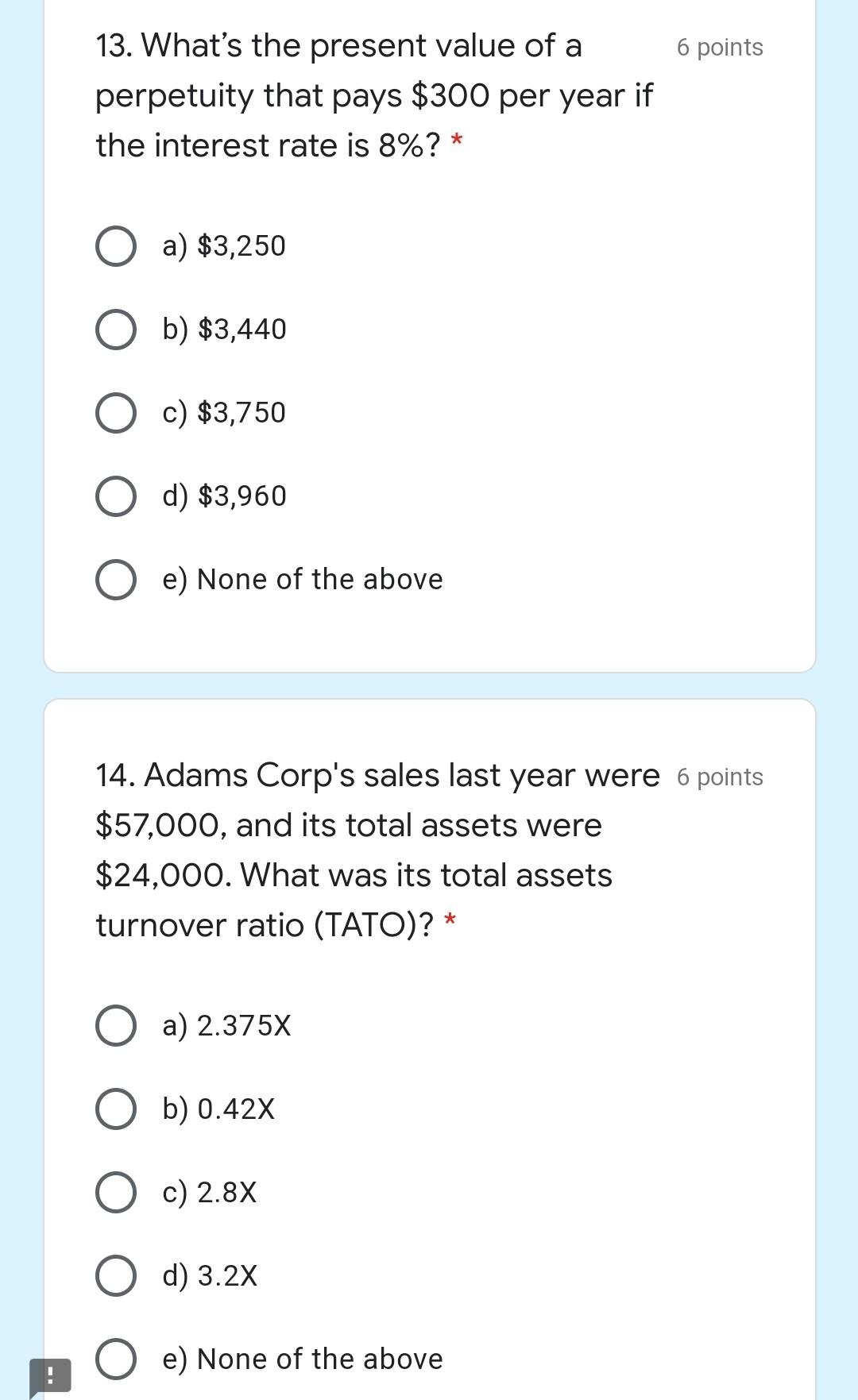

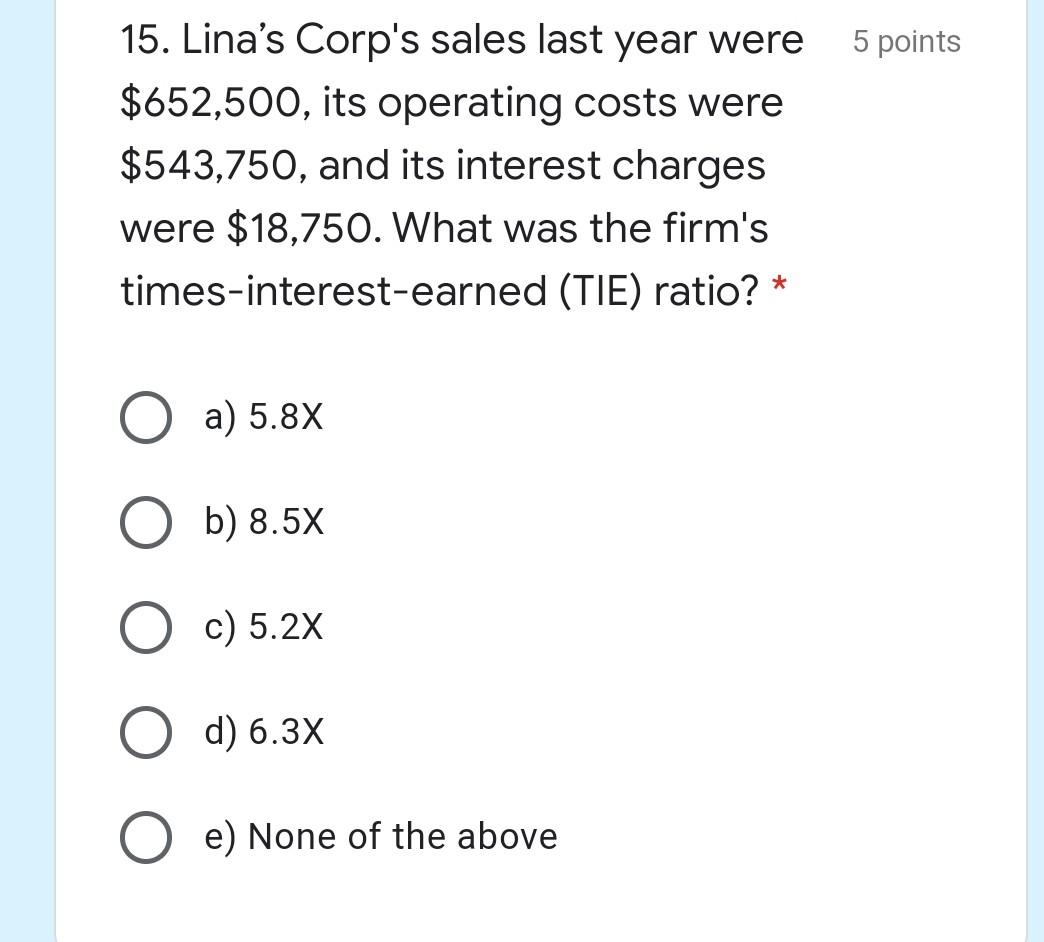

5 points 11. Suppose you need $1,000 ten years from now to settle your university education fees. If the interest rate is 5.5%, how much should you deposit today in the bank? * a) $585.43 b) $614.70 c) $645.44 O d) $677.71 e) None of the above 5 points 12. Suppose you have the opportunity to make an investment in a real estate venture that expects to pay investors $7,500 at the end of each year for the next eight years. If the interest rate is 8% compounded annually, find the future value of the payments after eight years. * a) $76,555 b) $79,775 c) $81,253 d) $82,325 e) None of the above 6 points 13. What's the present value of a perpetuity that pays $300 per year if the interest rate is 8%?* O a) $3,250 b) $3,440 O c) $3,750 d) $3,960 e) None of the above 14. Adams Corp's sales last year were 6 points $57,000, and its total assets were $24,000. What was its total assets turnover ratio (TATO)? * a) 2.375X b) 0.42% c) 2.8% O d) 3.2x e) None of the above 5 points 15. Lina's Corp's sales last year were $652,500, its operating costs were $543,750, and its interest charges were $18,750. What was the firm's times-interest-earned (TIE) ratio? a) 5.8x b) 8.5X c) 5.2x d) 6.3x O e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started