Question

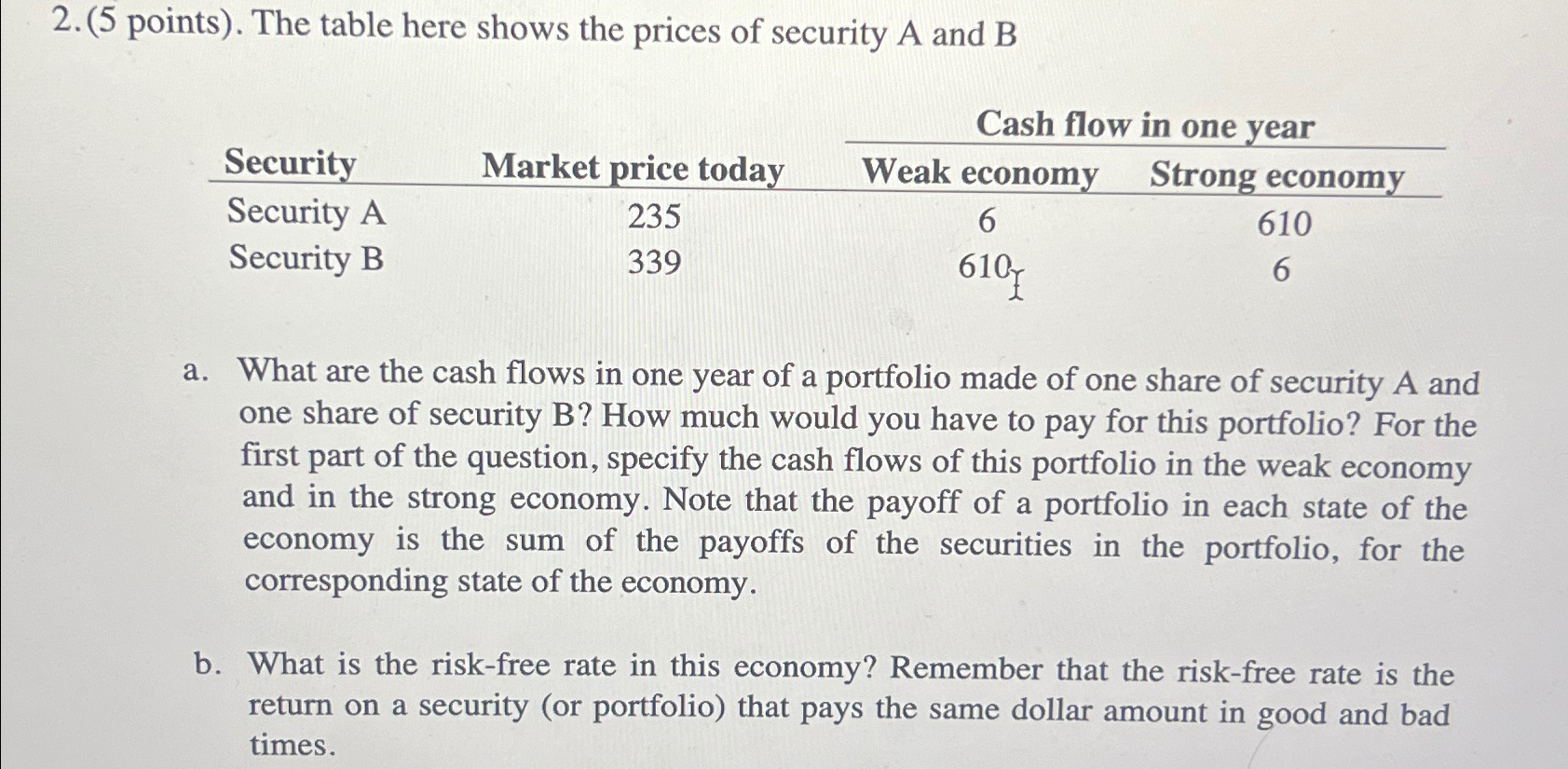

(5 points). The table here shows the prices of security A and B table[[,,Cash flow in one year],[Security,Market,Weak economy,Strong economy],[Security A,235,6,610],[Security B,339,610,6]] a. What

(5 points). The table here shows the prices of security

Aand

B\ \\\\table[[,,Cash flow in one year],[Security,Market,Weak economy,Strong economy],[Security A,235,6,610],[Security B,339,610,6]]\ a. What are the cash flows in one year of a portfolio made of one share of security A and one share of security B? How much would you have to pay for this portfolio? For the first part of the question, specify the cash flows of this portfolio in the weak economy and in the strong economy. Note that the payoff of a portfolio in each state of the economy is the sum of the payoffs of the securities in the portfolio, for the corresponding state of the economy.\ b. What is the risk-free rate in this economy? Remember that the risk-free rate is the return on a security (or portfolio) that pays the same dollar amount in good and bad times.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started