Answered step by step

Verified Expert Solution

Question

1 Approved Answer

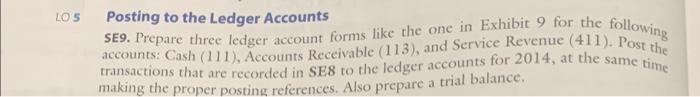

5 Posting to the Ledger Accounts SE9. Prepare three ledger account forms like the one in Exhibit 9 for the following accounts: Cash (111), Accounts

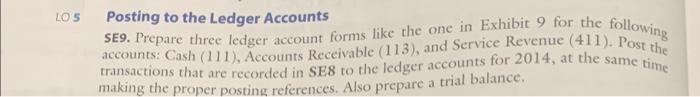

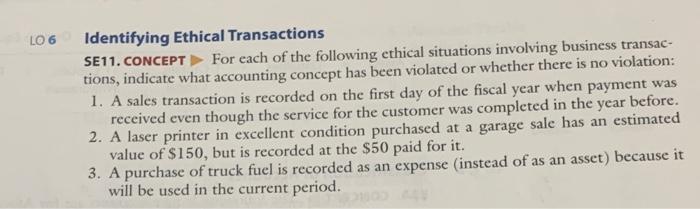

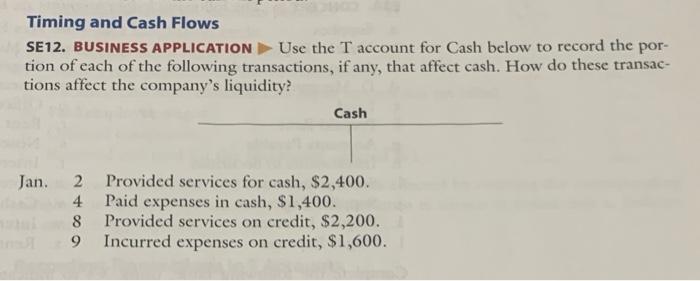

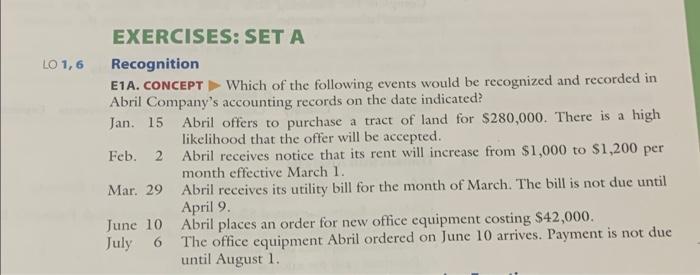

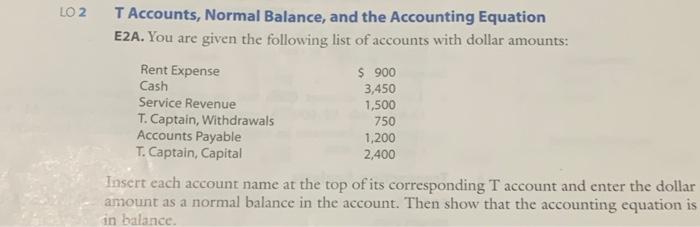

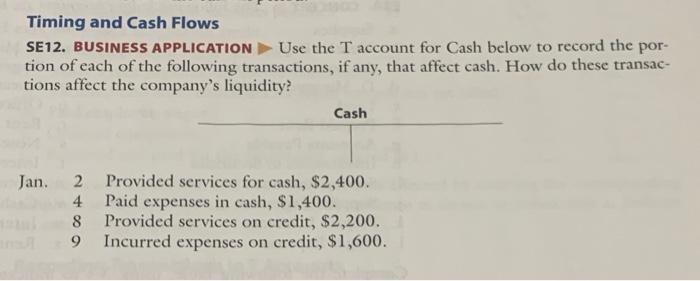

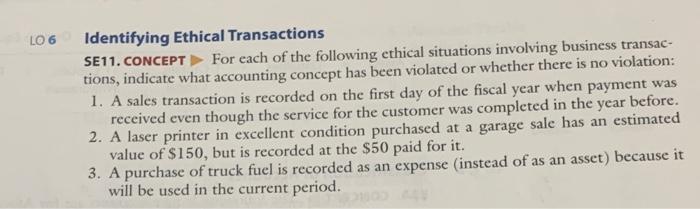

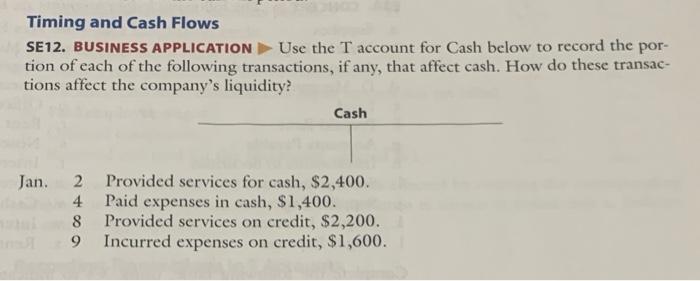

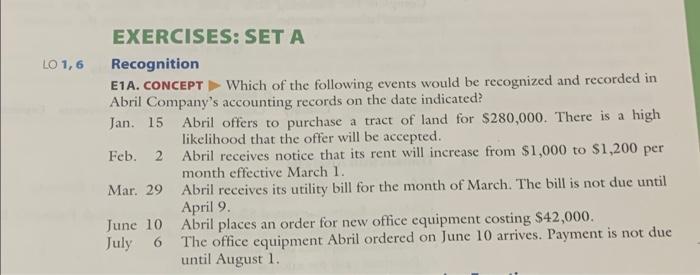

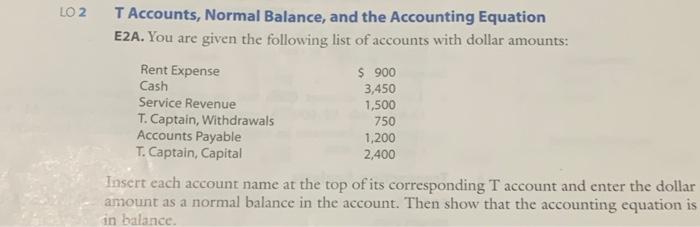

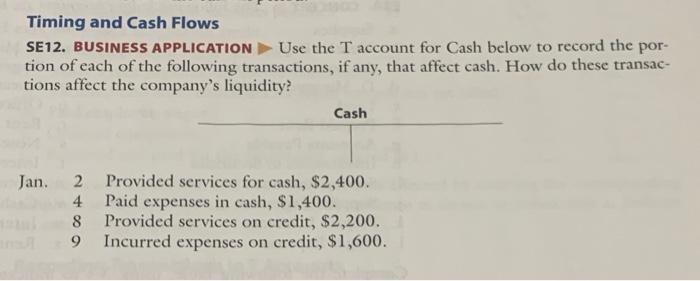

5 Posting to the Ledger Accounts SE9. Prepare three ledger account forms like the one in Exhibit 9 for the following accounts: Cash (111), Accounts Receivable (113), and Service Revenue (411). Post the transactions that are recorded in SES to the ledger accounts for 2014, at the same time making the proper posting references. Also prepare a trial balance. 6 Identifying Ethical Transactions SE11. CONCEPT > For each of the following ethical situations involving business transactions, indicate what accounting concept has been violated or whether there is no violation: 1. A sales transaction is recorded on the first day of the fiscal year when payment was received even though the service for the customer was completed in the year before. 2. A laser printer in excellent condition purchased at a garage sale has an estimated value of $150, but is recorded at the $50 paid for it. 3. A purchase of truck fuel is recorded as an expense (instead of as an asset) because it will be used in the current period. Timing and Cash Flows SE12. BUSINESS APPLICATION Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600. EXERCISES: SET A 1, 6 Recognition E1A. CONCEPT Which of the following events would be recognized and recorded in Abril Company's accounting records on the date indicated? Jan. 15 Abril offers to purchase a tract of land for $280,000. There is a high likelihood that the offer will be accepted. Feb. 2 Abril receives notice that its rent will increase from $1,000 to $1,200 per month effective March 1 . Mar. 29 Abril receives its utility bill for the month of March. The bill is not due until April 9. June 10 Abril places an order for new office equipment costing $42,000. July 6 The office equipment Abril ordered on June 10 arrives. Payment is not due until August 1. 2 T Accounts, Normal Balance, and the Accounting Equation E2A. You are given the following list of accounts with dollar amounts: Insert each account name at the top of its corresponding T account and enter the dollar amount as a normal balance in the account. Then show that the accounting equation is in balance. Timing and Cash Flows SE12. BUSINESS APPLICATION - Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600. 5 Posting to the Ledger Accounts SE9. Prepare three ledger account forms like the one in Exhibit 9 for the following accounts: Cash (111), Accounts Receivable (113), and Service Revenue (411). Post the transactions that are recorded in SES to the ledger accounts for 2014, at the same time making the proper posting references. Also prepare a trial balance. 6 Identifying Ethical Transactions SE11. CONCEPT > For each of the following ethical situations involving business transactions, indicate what accounting concept has been violated or whether there is no violation: 1. A sales transaction is recorded on the first day of the fiscal year when payment was received even though the service for the customer was completed in the year before. 2. A laser printer in excellent condition purchased at a garage sale has an estimated value of $150, but is recorded at the $50 paid for it. 3. A purchase of truck fuel is recorded as an expense (instead of as an asset) because it will be used in the current period. Timing and Cash Flows SE12. BUSINESS APPLICATION Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600. EXERCISES: SET A 1, 6 Recognition E1A. CONCEPT Which of the following events would be recognized and recorded in Abril Company's accounting records on the date indicated? Jan. 15 Abril offers to purchase a tract of land for $280,000. There is a high likelihood that the offer will be accepted. Feb. 2 Abril receives notice that its rent will increase from $1,000 to $1,200 per month effective March 1 . Mar. 29 Abril receives its utility bill for the month of March. The bill is not due until April 9. June 10 Abril places an order for new office equipment costing $42,000. July 6 The office equipment Abril ordered on June 10 arrives. Payment is not due until August 1. 2 T Accounts, Normal Balance, and the Accounting Equation E2A. You are given the following list of accounts with dollar amounts: Insert each account name at the top of its corresponding T account and enter the dollar amount as a normal balance in the account. Then show that the accounting equation is in balance. Timing and Cash Flows SE12. BUSINESS APPLICATION - Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600

5 Posting to the Ledger Accounts SE9. Prepare three ledger account forms like the one in Exhibit 9 for the following accounts: Cash (111), Accounts Receivable (113), and Service Revenue (411). Post the transactions that are recorded in SES to the ledger accounts for 2014, at the same time making the proper posting references. Also prepare a trial balance. 6 Identifying Ethical Transactions SE11. CONCEPT > For each of the following ethical situations involving business transactions, indicate what accounting concept has been violated or whether there is no violation: 1. A sales transaction is recorded on the first day of the fiscal year when payment was received even though the service for the customer was completed in the year before. 2. A laser printer in excellent condition purchased at a garage sale has an estimated value of $150, but is recorded at the $50 paid for it. 3. A purchase of truck fuel is recorded as an expense (instead of as an asset) because it will be used in the current period. Timing and Cash Flows SE12. BUSINESS APPLICATION Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600. EXERCISES: SET A 1, 6 Recognition E1A. CONCEPT Which of the following events would be recognized and recorded in Abril Company's accounting records on the date indicated? Jan. 15 Abril offers to purchase a tract of land for $280,000. There is a high likelihood that the offer will be accepted. Feb. 2 Abril receives notice that its rent will increase from $1,000 to $1,200 per month effective March 1 . Mar. 29 Abril receives its utility bill for the month of March. The bill is not due until April 9. June 10 Abril places an order for new office equipment costing $42,000. July 6 The office equipment Abril ordered on June 10 arrives. Payment is not due until August 1. 2 T Accounts, Normal Balance, and the Accounting Equation E2A. You are given the following list of accounts with dollar amounts: Insert each account name at the top of its corresponding T account and enter the dollar amount as a normal balance in the account. Then show that the accounting equation is in balance. Timing and Cash Flows SE12. BUSINESS APPLICATION - Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600. 5 Posting to the Ledger Accounts SE9. Prepare three ledger account forms like the one in Exhibit 9 for the following accounts: Cash (111), Accounts Receivable (113), and Service Revenue (411). Post the transactions that are recorded in SES to the ledger accounts for 2014, at the same time making the proper posting references. Also prepare a trial balance. 6 Identifying Ethical Transactions SE11. CONCEPT > For each of the following ethical situations involving business transactions, indicate what accounting concept has been violated or whether there is no violation: 1. A sales transaction is recorded on the first day of the fiscal year when payment was received even though the service for the customer was completed in the year before. 2. A laser printer in excellent condition purchased at a garage sale has an estimated value of $150, but is recorded at the $50 paid for it. 3. A purchase of truck fuel is recorded as an expense (instead of as an asset) because it will be used in the current period. Timing and Cash Flows SE12. BUSINESS APPLICATION Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600. EXERCISES: SET A 1, 6 Recognition E1A. CONCEPT Which of the following events would be recognized and recorded in Abril Company's accounting records on the date indicated? Jan. 15 Abril offers to purchase a tract of land for $280,000. There is a high likelihood that the offer will be accepted. Feb. 2 Abril receives notice that its rent will increase from $1,000 to $1,200 per month effective March 1 . Mar. 29 Abril receives its utility bill for the month of March. The bill is not due until April 9. June 10 Abril places an order for new office equipment costing $42,000. July 6 The office equipment Abril ordered on June 10 arrives. Payment is not due until August 1. 2 T Accounts, Normal Balance, and the Accounting Equation E2A. You are given the following list of accounts with dollar amounts: Insert each account name at the top of its corresponding T account and enter the dollar amount as a normal balance in the account. Then show that the accounting equation is in balance. Timing and Cash Flows SE12. BUSINESS APPLICATION - Use the T account for Cash below to record the portion of each of the following transactions, if any, that affect cash. How do these transactions affect the company's liquidity? Jan. 2 Provided services for cash, $2,400. 4 Paid expenses in cash, $1,400. 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started