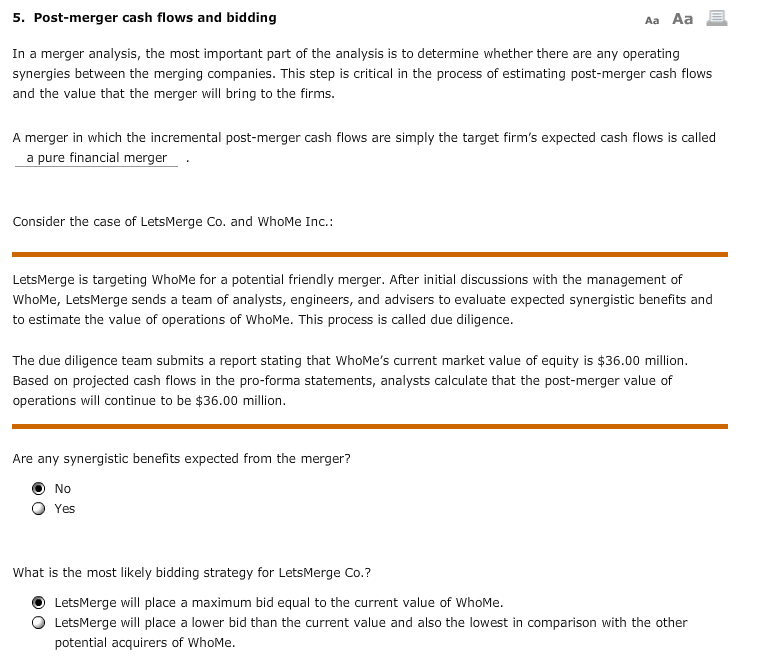

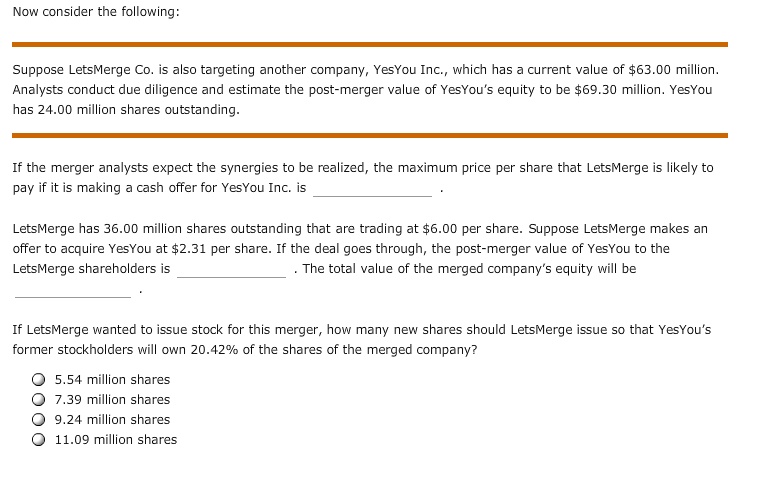

5. Post-merger cash flows and bidding Aa Aa In a merger analysis, the most important part of the analysis is to determine whether there are any operating synergies between the merging companies. This step is critical in the process of estimating post-merger cash flows and the value that the merger will bring to the firms. A merger in which the incremental post-merger cash flows are simply the target firm's expected cash flows is called a pure financial merger Consider the case of LetsMerge Co. and WhoMe Inc.: LetsMerge is targeting WhoMe for a potential friendly merger. After initial discussions with the management of WhoMe, LetsMerge sends a team of analysts, engineers, and advisers to evaluate expected synergistic benefits and to estimate the value of operations of WhoMe. This process is called due diligence. The due diligence team submits a report stating that WhoMe's current market value of equity is $36.00 million. Based on projected cash flows in the pro-forma statements, analysts calculate that the post-merger value of operations will continue to be $36.00 million. Are any synergistic benefits expected from the merger? No Yes What is the most likely bidding strategy for LetsMerge Co.? LetsMerge will place a maximum bid equal to the current value of WhoMe. LetsMerge will place a lower bid than the current value and also the lowest in comparison with the other potential acquirers of WhoMe. Now consider the following: Suppose LetsMerge Co. is also targeting another company, YesYou Inc., which has a current value of $63.00 million Analysts conduct due diligence and estimate the post-merger value of YesYou's equity to be $69.30 million. YesYou has 24.00 million shares outstanding. If the merger analysts expect the synergies to be realized, the maximum price per share that LetsMerge is likely to pay if it is making a cash offer for YesYou Inc. is LetsMerge has 36.00 million shares outstanding that are trading at $6.00 per share. Suppose LetsMerge makes an offer to acquire YesYou at $2.31 per share. If the deal goes through, the post-merger value of YesYou to the LetsMerge shareholders is The total value of the merged company's equity will be If LetsMerge wanted to issue stock for this merger, how many new shares should LetsMerge issue so that YesYou's C former stockholders will own 20.42% of the shares of the merged company? 5.54 million shares 7.39 million shares 9.24 million shares 11.09 million shares