Answered step by step

Verified Expert Solution

Question

1 Approved Answer

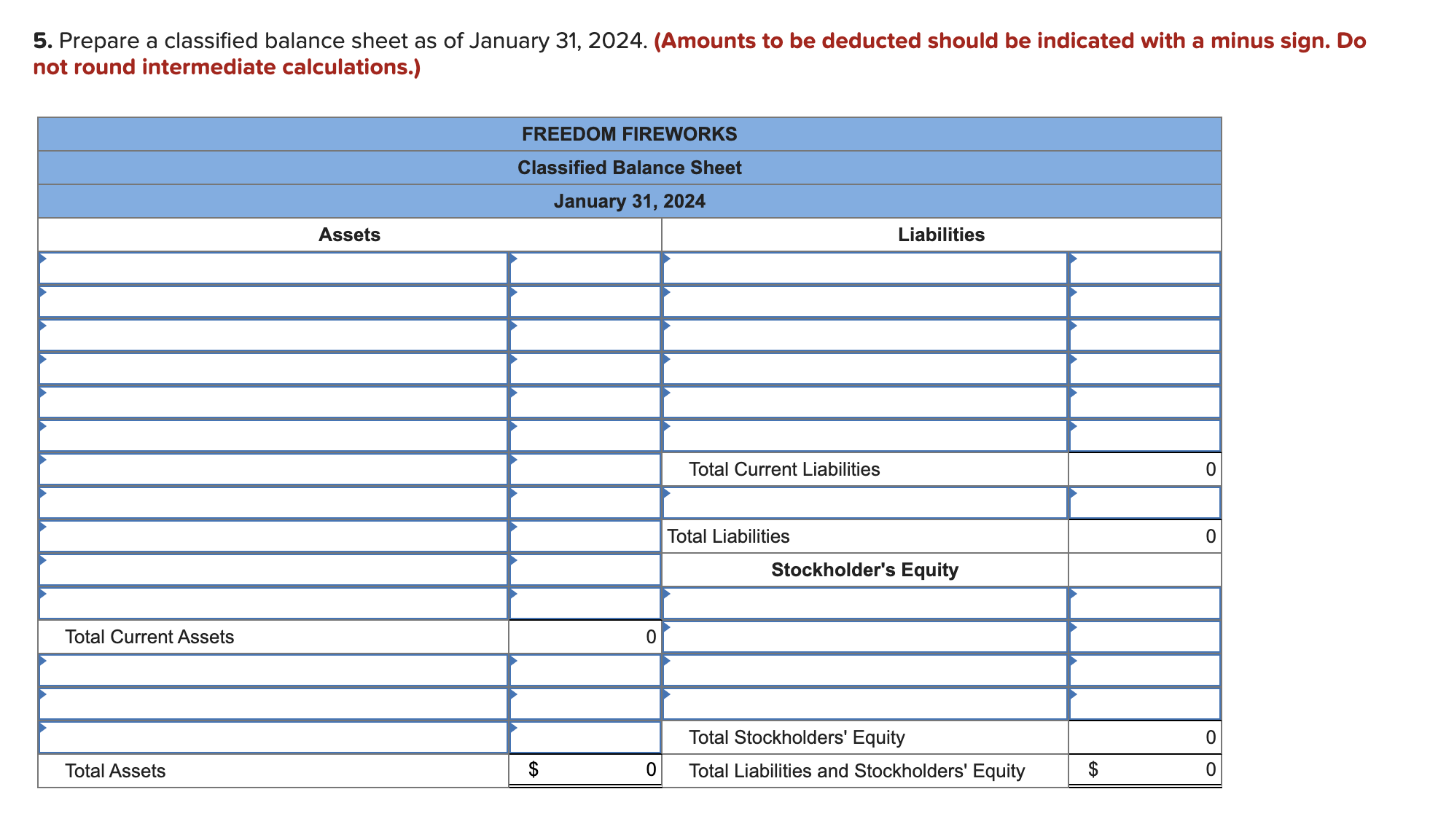

5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Do not round

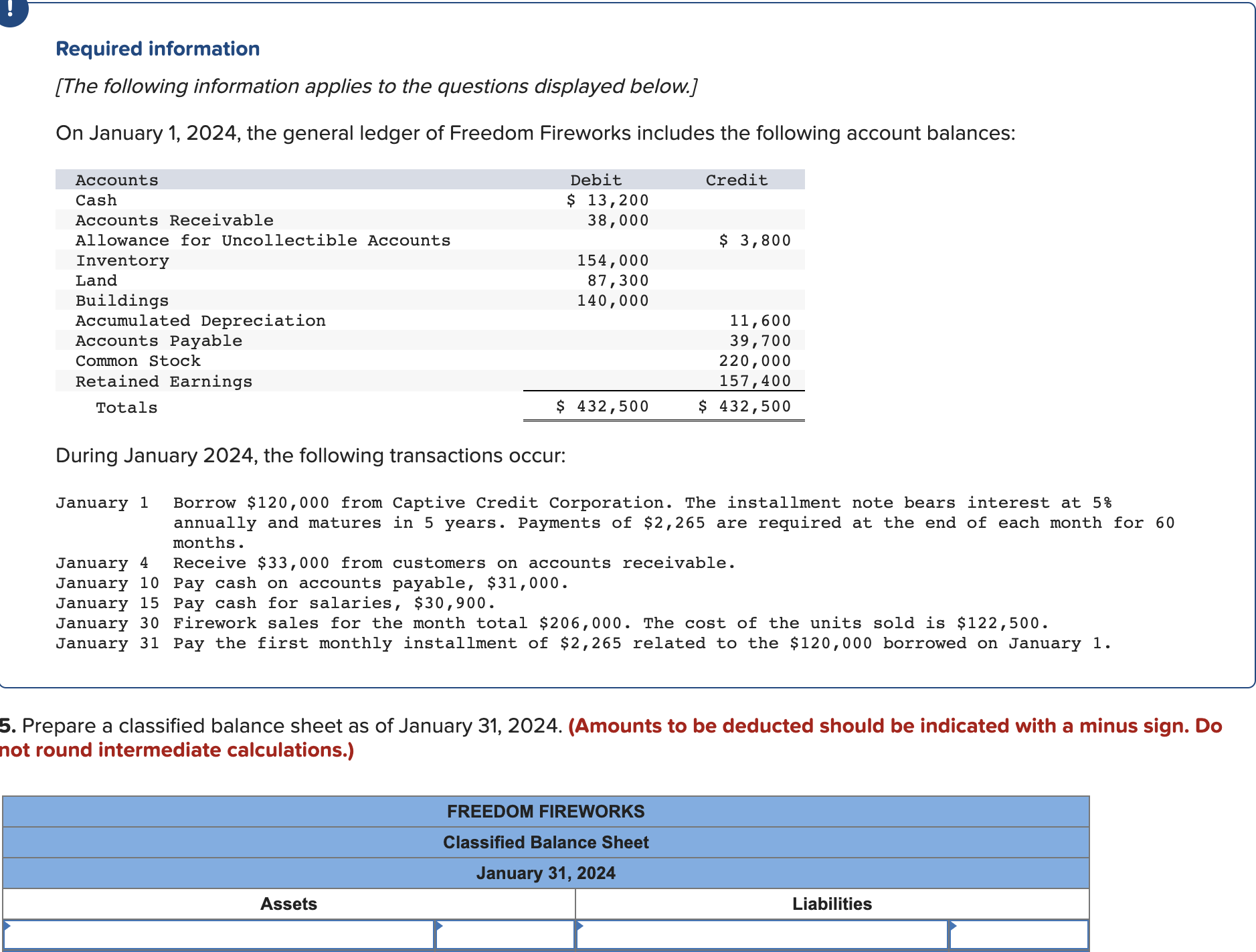

5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Borrow $120,000 from Captive Credit Corporation. The installment note bears interest at 5% annually and matures in 5 years. Payments of $2,265 are required at the end of each month for 60 months . January 4 Receive $33,000 from customers on accounts receivable. January 10 Pay cash on accounts payable, $31,000. January 15 Pay cash for salaries, $30,900. January 30 Firework sales for the month total $206,000. The cost of the units sold is $122,500. January 31 Pay the first monthly installment of $2,265 related to the $120,000 borrowed on January 1 . . Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. ot round intermediate calculations.) 5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Borrow $120,000 from Captive Credit Corporation. The installment note bears interest at 5% annually and matures in 5 years. Payments of $2,265 are required at the end of each month for 60 months . January 4 Receive $33,000 from customers on accounts receivable. January 10 Pay cash on accounts payable, $31,000. January 15 Pay cash for salaries, $30,900. January 30 Firework sales for the month total $206,000. The cost of the units sold is $122,500. January 31 Pay the first monthly installment of $2,265 related to the $120,000 borrowed on January 1 . . Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. ot round intermediate calculations.)

5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Borrow $120,000 from Captive Credit Corporation. The installment note bears interest at 5% annually and matures in 5 years. Payments of $2,265 are required at the end of each month for 60 months . January 4 Receive $33,000 from customers on accounts receivable. January 10 Pay cash on accounts payable, $31,000. January 15 Pay cash for salaries, $30,900. January 30 Firework sales for the month total $206,000. The cost of the units sold is $122,500. January 31 Pay the first monthly installment of $2,265 related to the $120,000 borrowed on January 1 . . Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. ot round intermediate calculations.) 5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Borrow $120,000 from Captive Credit Corporation. The installment note bears interest at 5% annually and matures in 5 years. Payments of $2,265 are required at the end of each month for 60 months . January 4 Receive $33,000 from customers on accounts receivable. January 10 Pay cash on accounts payable, $31,000. January 15 Pay cash for salaries, $30,900. January 30 Firework sales for the month total $206,000. The cost of the units sold is $122,500. January 31 Pay the first monthly installment of $2,265 related to the $120,000 borrowed on January 1 . . Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign. ot round intermediate calculations.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started