Answered step by step

Verified Expert Solution

Question

1 Approved Answer

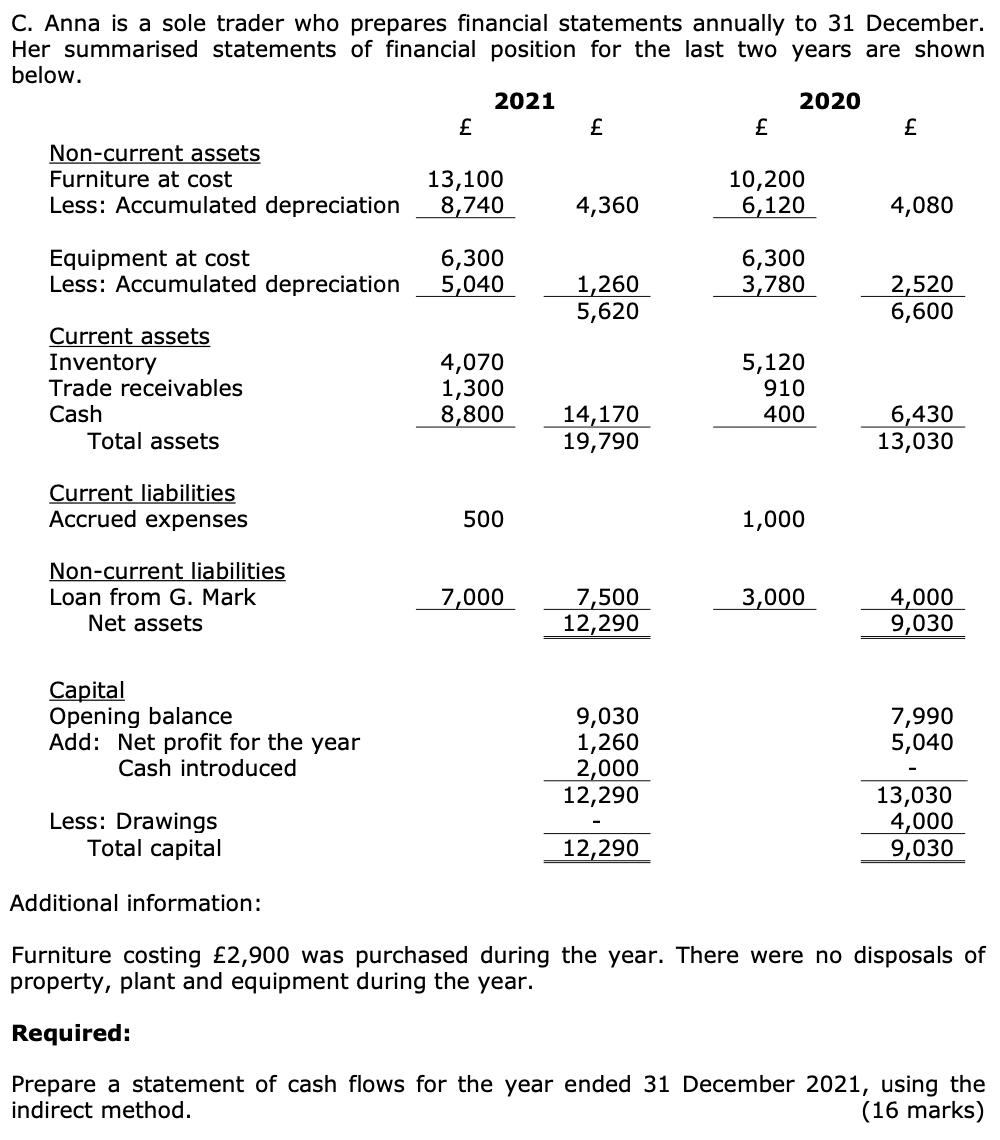

C. Anna is a sole trader who prepares financial statements annually to 31 December. Her summarised statements of financial position for the last two

C. Anna is a sole trader who prepares financial statements annually to 31 December. Her summarised statements of financial position for the last two years are shown below. 2021 2020 Non-current assets Furniture at cost Less: Accumulated depreciation Current assets Inventory Equipment at cost 6,300 Less: Accumulated depreciation 5,040 Trade receivables Cash Total assets Current liabilities Accrued expenses Non-current liabilities Loan from G. Mark Net assets Capital Opening balance Add: Net profit for the year Cash introduced Less: Drawings Total capital Additional information: 13,100 8,740 4,070 1,300 8,800 500 7,000 4,360 1,260 5,620 14,170 19,790 7,500 12,290 9,030 1,260 2,000 12,290 12,290 10,200 6,120 6,300 3,780 5,120 910 400 1,000 3,000 4,080 2,520 6,600 6,430 13,030 4,000 9,030 7,990 5,040 13,030 4,000 9,030 Furniture costing 2,900 was purchased during the year. There were no disposals of property, plant and equipment during the year. Required: Prepare a statement of cash flows for the year ended 31 December 2021, using the indirect method. (16 marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

C Anna Statement of Cash Flows For the year ended December 31 2021 Cash flows from operating activities Amount Amount Net profit for the year 1260 Non...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d774ac64df_175878.pdf

180 KBs PDF File

635d774ac64df_175878.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started