Answered step by step

Verified Expert Solution

Question

1 Approved Answer

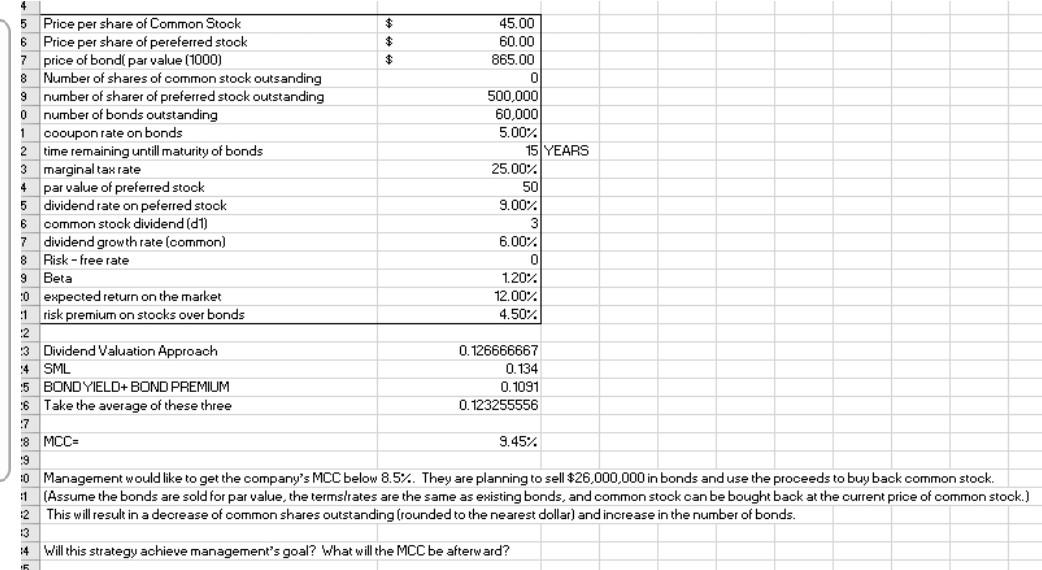

$ $ 5 Price per share of Common Stock 6 Price per share of pereferred stock 7 price of bond par value (1000) 8 Number

$ $ 5 Price per share of Common Stock 6 Price per share of pereferred stock 7 price of bond par value (1000) 8 Number of shares of common stock outsanding 9 number of sharer of preferred stock outstanding O number of bonds outstanding 1 cooupon rate on bonds 2 time remaining untill maturity of bonds 3 marginal tax rate par value of preferred stock 5 dividend rate on peferred stock 6 common stock dividend (21) 7 dividend growth rate (common) 8 Risk-free rate Beta :0 expected return on the market :1 risk premium on stocks over bonds 2 :3 Dividend Valuation Approach 14 SML :5 BOND YIELD+BOND PREMIUM 16 Take the average of these three :7 8 MCC- 45.00 60.00 865.00 0 500,000 60,000 5.00% 15 YEARS 25.00% 50 9.00% 3 6.00% 0 1.20% 12.00% 4.50% 4 9 0.126666667 0.134 0.1091 0.123255556 9.45%. 9 :0 Management would like to get the company's MCC below 8.5%. They are planning to sell $26,000,000 in bonds and use the proceeds to buy back common stock. 1 (Assume the bonds are sold for par value, the termstrates are the same as existing bonds, and common stock can be bought back at the current price of common stock.) This will result in a decrease of common shares outstanding (rounded to the nearest dollar) and increase in the number of bonds. 12 :4 Will this strategy achieve management's goal? What will the MCC be afterward? $ $ 5 Price per share of Common Stock 6 Price per share of pereferred stock 7 price of bond par value (1000) 8 Number of shares of common stock outsanding 9 number of sharer of preferred stock outstanding O number of bonds outstanding 1 cooupon rate on bonds 2 time remaining untill maturity of bonds 3 marginal tax rate par value of preferred stock 5 dividend rate on peferred stock 6 common stock dividend (21) 7 dividend growth rate (common) 8 Risk-free rate Beta :0 expected return on the market :1 risk premium on stocks over bonds 2 :3 Dividend Valuation Approach 14 SML :5 BOND YIELD+BOND PREMIUM 16 Take the average of these three :7 8 MCC- 45.00 60.00 865.00 0 500,000 60,000 5.00% 15 YEARS 25.00% 50 9.00% 3 6.00% 0 1.20% 12.00% 4.50% 4 9 0.126666667 0.134 0.1091 0.123255556 9.45%. 9 :0 Management would like to get the company's MCC below 8.5%. They are planning to sell $26,000,000 in bonds and use the proceeds to buy back common stock. 1 (Assume the bonds are sold for par value, the termstrates are the same as existing bonds, and common stock can be bought back at the current price of common stock.) This will result in a decrease of common shares outstanding (rounded to the nearest dollar) and increase in the number of bonds. 12 :4 Will this strategy achieve management's goal? What will the MCC be afterward

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started