Answered step by step

Verified Expert Solution

Question

1 Approved Answer

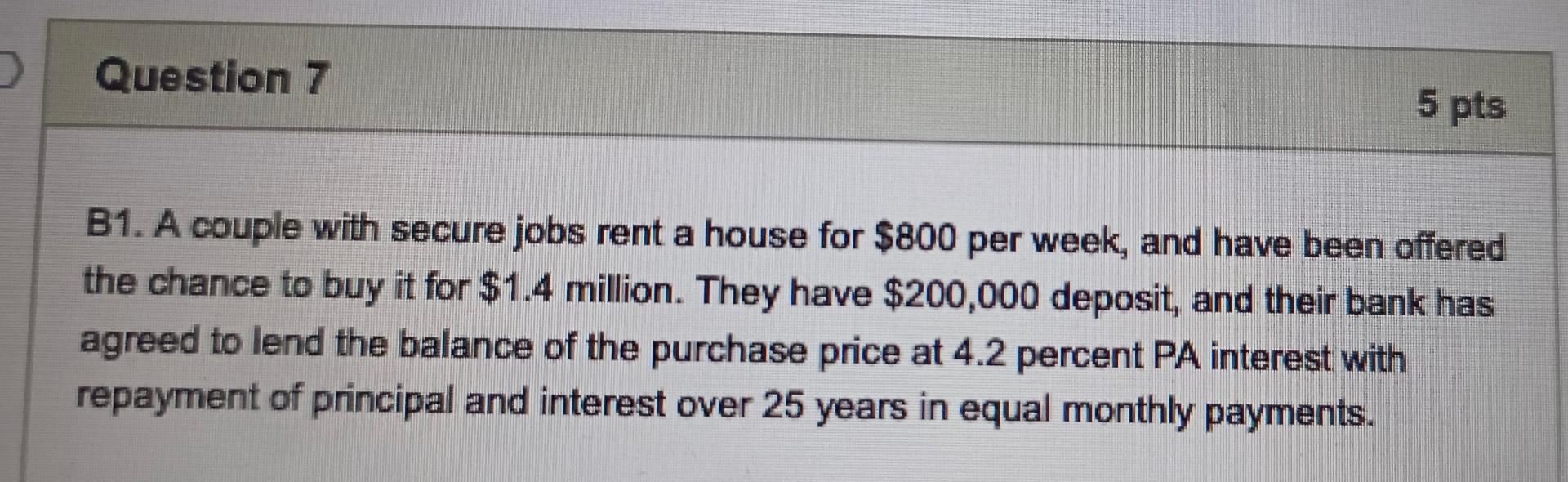

5 pts Question 7 B1. A couple with secure jobs rent a house for $800 per week, and have been offered the chance to buy

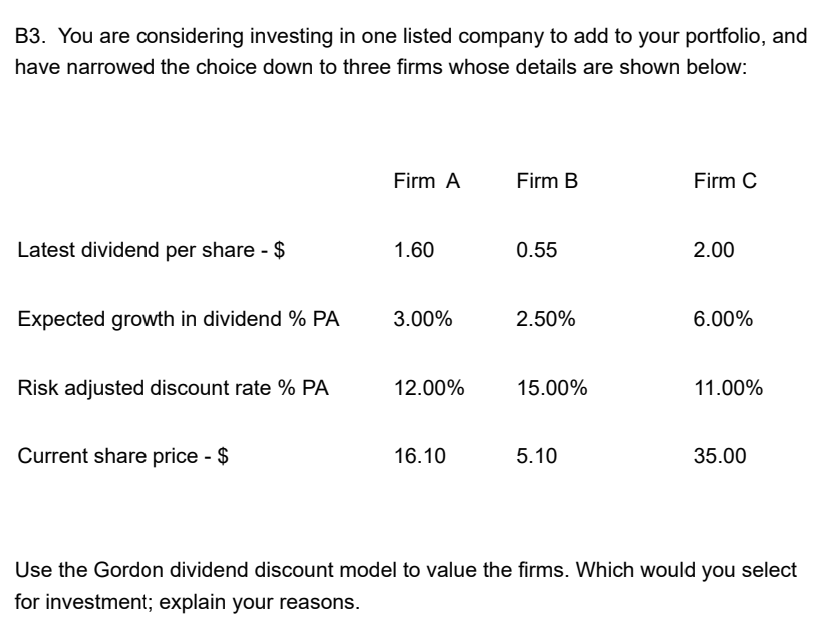

5 pts Question 7 B1. A couple with secure jobs rent a house for $800 per week, and have been offered the chance to buy it for $1.4 million. They have $200,000 deposit, and their bank has agreed to lend the balance of the purchase price at 4.2 percent P interest with repayment of principal and interest over 25 years in equal monthly payments. B3. You are considering investing in one listed company to add to your portfolio, and have narrowed the choice down to three firms whose details are shown below: Firm A Firm B Firm C Latest dividend per share - $ 1.60 0.55 2.00 Expected growth in dividend % PA 3.00% 2.50% 6.00% Risk adjusted discount rate % PA 12.00% 15.00% 11.00% Current share price - $ 16.10 5.10 35.00 Use the Gordon dividend discount model to value the firms. Which would you select for investment; explain your reasons

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started