Answered step by step

Verified Expert Solution

Question

1 Approved Answer

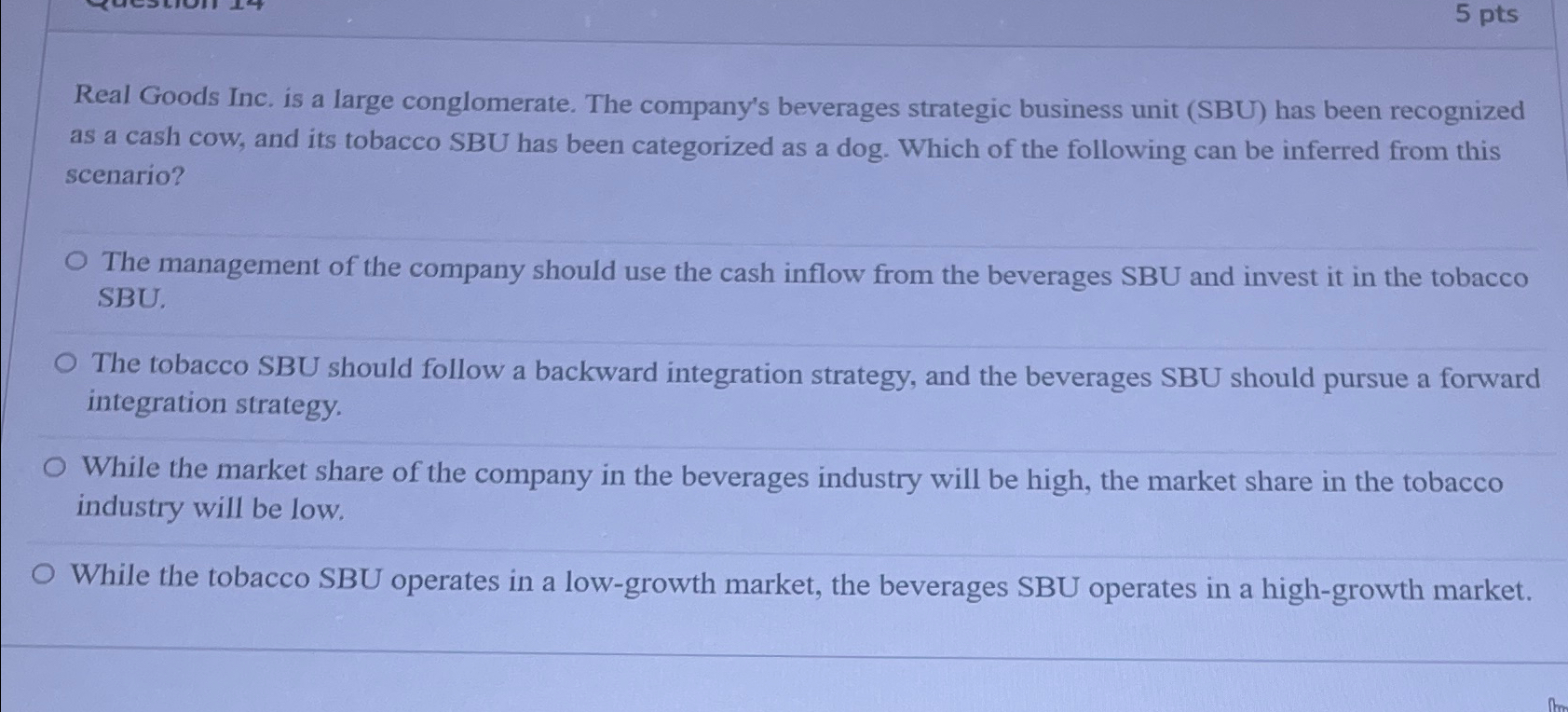

5 pts Real Goods Inc. is a large conglomerate. The company's beverages strategic business unit ( SBU ) has been recognized as a cash cow,

pts

Real Goods Inc. is a large conglomerate. The company's beverages strategic business unit SBU has been recognized as a cash cow, and its tobacco SBU has been categorized as a dog. Which of the following can be inferred from this scenario?

The management of the company should use the cash inflow from the beverages SBU and invest it in the tobacco SBU,

The tobacco SBU should follow a backward integration strategy, and the beverages SBU should pursue a forward integration strategy.

While the market share of the company in the beverages industry will be high, the market share in the tobacco industry will be low.

While the tobacco SBU operates in a lowgrowth market, the beverages SBU operates in a highgrowth market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started