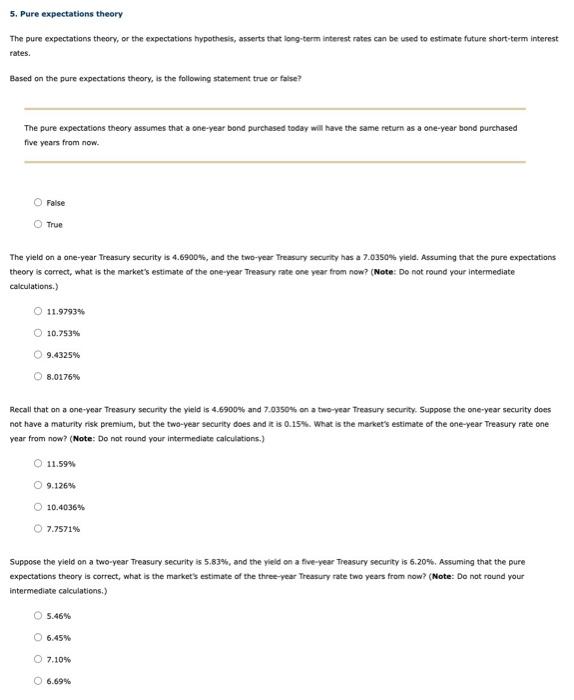

5. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the foliowing statement true or false? The pure expectations theory assumes that a one-year bond purchased today will have the same return as a one-year bond purchased five years from now. False True The vield on a one-year Treasury security is 4.6900 \%, and the two-year Treasury security has a 7.0350% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 11.9793% 10.753% 9.4325% 8.0176% Recall that on a one-vear Treasury secunty the wieid is 4.6900% and 7.0350% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and is is 0.15 . What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate caiculations.) 11.59% 9.126% 10.4036% 7.7571% Suppose the yieid on a two-year Treasury security is 5.83%, and the yield on a tive-year Treasury security is 6.20%, Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your intermediate calculations:) 5.46% 6.45% 7.10% 6.69% 5. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the foliowing statement true or false? The pure expectations theory assumes that a one-year bond purchased today will have the same return as a one-year bond purchased five years from now. False True The vield on a one-year Treasury security is 4.6900 \%, and the two-year Treasury security has a 7.0350% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 11.9793% 10.753% 9.4325% 8.0176% Recall that on a one-vear Treasury secunty the wieid is 4.6900% and 7.0350% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and is is 0.15 . What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate caiculations.) 11.59% 9.126% 10.4036% 7.7571% Suppose the yieid on a two-year Treasury security is 5.83%, and the yield on a tive-year Treasury security is 6.20%, Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your intermediate calculations:) 5.46% 6.45% 7.10% 6.69%