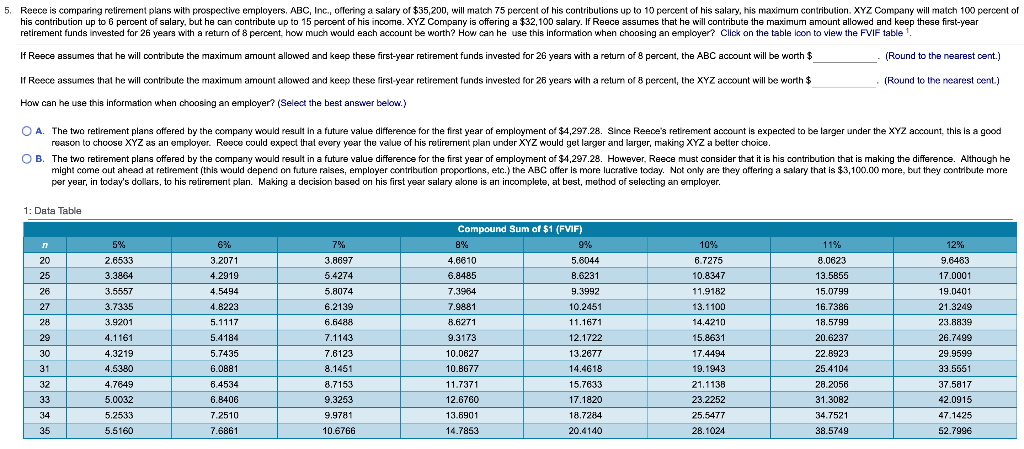

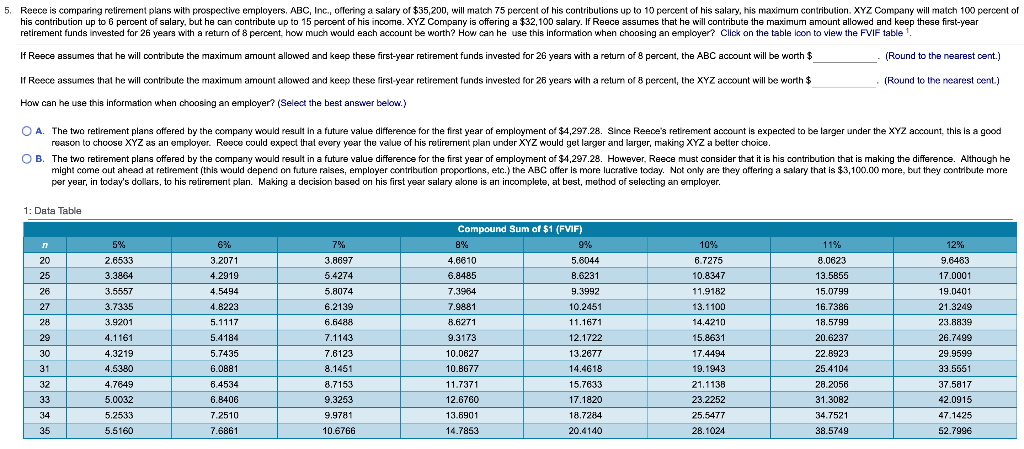

5. Reece is comparing retirement plans with prospective employers. ABC, Inc., offering a salary of $35,200, will match 75 percent of his contributions up to 10 percent of his salary, his maximum contribution. XYZ Company will match 100 percent of his contribution up to 6 percent of salary, but he can contribute up to 15 percent of his income.XYZ Company is offering a $32,100 salary. If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 26 years with a return of 8 percent, how much would each account be worth? How can he use this information when choosing an employer? Click on the table con to view the FVIF tablet If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 26 years with a return of 8 percent, the ABC account will be worth $ (Round to the nearest cent.) If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 26 years with a return of 8 percent, the XYZ account will be worth $ (Round to the nearest pent.) How can he use this information when choosing an employer? (Select the best answer below.) O A. The two retirement plans offered by the company would result in a future value difference for the first year of employment of $4,297.28. Since Reece's retirement account is expected to be larger under the XYZ account, this is a good reason to choose XYZ as an employer. Roece could expect that every year the value of his retirement plan under XYZ would get larger and larger, making XYZ a better choice. OB. The two retirement plans offered by the company would result in a future value difference for the first year of employment of $4,297.28. However, Reece must consider that it is his contribution that is making the difference. Although he might come out ahead at retirement (this would depend on future raises, employer contribution proportions, etc.) the ABC offer is more lucrative today. Not only are they offering a salary that is $3,100.00 more, but they contribute more per year, in today's dollars, to his retirement plan. Making a decision based on his first year salary alone is an incomplete, at best, method of selecting an employer. 1: Data Table n 7% 11%. 20 25 26 27 3.0623 13.5855 15.0799 16.7386 40 18.5799 5% 2.6533 3.3864 3.5557 A , 3.7335 3.9201 BG A1164 4.3219 4.5380 4.7649 5.0032 5.2533 5.5160 3.8697 5.4274 5.8074 6.2136 6.6488 7.1143 7.6123 8.1451 6% 6% 3.2071 4.2919 4.5494 4.8223 5497 5.1117 5.4184 4401 5.7435 6.0881 6.4534 6.8406 7.2510 7.6861 28 29 20 Compound Sum of $1 (FVIF) $) 8% 9% 4.6610 5.6044 6.8485 8.6231 7.3964 9.3992 7000 7.9881 102 10.2451 Bena 8.6271 14467 11.1671 99978 9.3173 12 1722 10.0627 13.2677 10.8677 14.4618 15.7633 12.6760 17.1820 13.8901 18.7284 14.7853 20.4140 10% 6.7275 10.8347 11.9182 13.1 100 14.4210 159694 15.8631 17.4494 19.1943 21.1138 23.2252 25.5477 28.1024 12% 9.6483 17.0001 19.0401 21.3249 DO 23.8839 20 7200 29.9599 29 9896 33.5551 20.6237 22.6923 11.7371 30 31 32 33 34 35 8.7153 9.3253 9.9781 10.6766 25.4104 28.2056 31.3082 34.7521 38.5749 37.5817 42.0915 47.1425 52.7996 5. Reece is comparing retirement plans with prospective employers. ABC, Inc., offering a salary of $35,200, will match 75 percent of his contributions up to 10 percent of his salary, his maximum contribution. XYZ Company will match 100 percent of his contribution up to 6 percent of salary, but he can contribute up to 15 percent of his income.XYZ Company is offering a $32,100 salary. If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 26 years with a return of 8 percent, how much would each account be worth? How can he use this information when choosing an employer? Click on the table con to view the FVIF tablet If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 26 years with a return of 8 percent, the ABC account will be worth $ (Round to the nearest cent.) If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 26 years with a return of 8 percent, the XYZ account will be worth $ (Round to the nearest pent.) How can he use this information when choosing an employer? (Select the best answer below.) O A. The two retirement plans offered by the company would result in a future value difference for the first year of employment of $4,297.28. Since Reece's retirement account is expected to be larger under the XYZ account, this is a good reason to choose XYZ as an employer. Roece could expect that every year the value of his retirement plan under XYZ would get larger and larger, making XYZ a better choice. OB. The two retirement plans offered by the company would result in a future value difference for the first year of employment of $4,297.28. However, Reece must consider that it is his contribution that is making the difference. Although he might come out ahead at retirement (this would depend on future raises, employer contribution proportions, etc.) the ABC offer is more lucrative today. Not only are they offering a salary that is $3,100.00 more, but they contribute more per year, in today's dollars, to his retirement plan. Making a decision based on his first year salary alone is an incomplete, at best, method of selecting an employer. 1: Data Table n 7% 11%. 20 25 26 27 3.0623 13.5855 15.0799 16.7386 40 18.5799 5% 2.6533 3.3864 3.5557 A , 3.7335 3.9201 BG A1164 4.3219 4.5380 4.7649 5.0032 5.2533 5.5160 3.8697 5.4274 5.8074 6.2136 6.6488 7.1143 7.6123 8.1451 6% 6% 3.2071 4.2919 4.5494 4.8223 5497 5.1117 5.4184 4401 5.7435 6.0881 6.4534 6.8406 7.2510 7.6861 28 29 20 Compound Sum of $1 (FVIF) $) 8% 9% 4.6610 5.6044 6.8485 8.6231 7.3964 9.3992 7000 7.9881 102 10.2451 Bena 8.6271 14467 11.1671 99978 9.3173 12 1722 10.0627 13.2677 10.8677 14.4618 15.7633 12.6760 17.1820 13.8901 18.7284 14.7853 20.4140 10% 6.7275 10.8347 11.9182 13.1 100 14.4210 159694 15.8631 17.4494 19.1943 21.1138 23.2252 25.5477 28.1024 12% 9.6483 17.0001 19.0401 21.3249 DO 23.8839 20 7200 29.9599 29 9896 33.5551 20.6237 22.6923 11.7371 30 31 32 33 34 35 8.7153 9.3253 9.9781 10.6766 25.4104 28.2056 31.3082 34.7521 38.5749 37.5817 42.0915 47.1425 52.7996