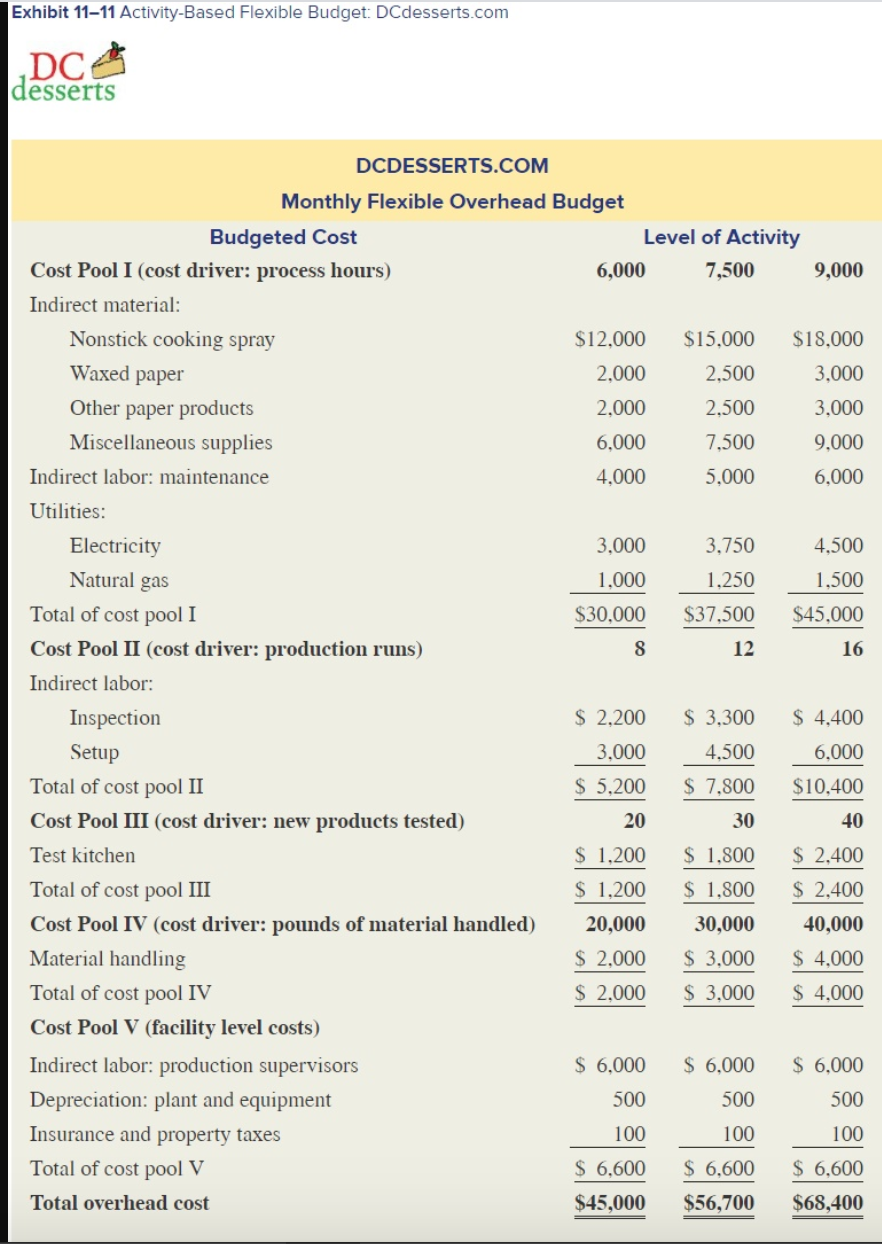

5 Refer to DCdesserts.com's activity-based flexible budget in Exhibit 11-11 Suppose that the company's activity in June is described as follows: 1 points Process hours Production runs New products tested Direct material handled (pounds) 9,000 8 40 30,000 eBook Print Required: 1. Determine the flexible budgeted cost for each item in the table below. 2-a. Compute the variance for setup cost during the month, assuming that the actual setup cost was $3,000. Use the activity-based flexible budget. 2-b. Compute the variance for setup cost during the month, assuming that the actual setup cost was $3,000. Use DCdesserts.com's conventional flexible budget (Exhibit 11-3). References Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Determine the flexible budgeted cost for each item in the table below. a. Indirect material b. Utilities c. Inspection d. Test kitchen e. Material handling f. Total overhead cost Exhibit 11-11 Activity-Based Flexible Budget: DCdesserts.com DC desserts Waxed paper DCDESSERTS.COM Monthly Flexible Overhead Budget Budgeted Cost Level of Activity Cost Pool I (cost driver: process hours) 6,000 7,500 9,000 Indirect material: Nonstick cooking spray $12,000 $15.000 $18.000 2.000 2,500 3,000 Other paper products 2,000 2,500 3,000 Miscellaneous supplies 6.000 7,500 9,000 Indirect labor: maintenance 4.000 5,000 6.000 Utilities: Electricity 3.000 3,750 4.500 Natural gas 1.000 1,250 1.500 Total of cost pool I $30,000 $37,500 $45,000 Cost Pool II (cost driver: production runs) 8 12. 16 Indirect labor: Inspection $ 2,200 $ 3,300 $ 4,400 Setup 3.000 4,500 6.000 Total of cost pool II $ 5,200 $ 7,800 $10,400 Cost Pool III (cost driver: new products tested) 20 30 40 Test kitchen $ 1.200 $ 1.800 $ 2.400 Total of cost pool III $ 1.200 $ 1.800 $ 2,400 Cost Pool IV (cost driver: pounds of material handled) 20,000 30,000 40,000 Material handling $ 2.000 $ 3.000 $ 4.000 Total of cost pool IV $ 2,000 $ 3,000 $ 4.000 Cost Pool V (facility level costs) Indirect labor: production supervisors $ 6.000 $ 6,000 $ 6,000 Depreciation: plant and equipment 500 500 500 Insurance and property taxes 100 100 100 Total of cost pool V $ 6,600 $ 6,600 $ 6,600 Total overhead cost $45,000 $56,700 $68,400 5 Refer to DCdesserts.com's activity-based flexible budget in Exhibit 11-11 Suppose that the company's activity in June is described as follows: 1 points Process hours Production runs New products tested Direct material handled (pounds) 9,000 8 40 30,000 eBook Print Required: 1. Determine the flexible budgeted cost for each item in the table below. 2-a. Compute the variance for setup cost during the month, assuming that the actual setup cost was $3,000. Use the activity-based flexible budget. 2-b. Compute the variance for setup cost during the month, assuming that the actual setup cost was $3,000. Use DCdesserts.com's conventional flexible budget (Exhibit 11-3). References Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Determine the flexible budgeted cost for each item in the table below. a. Indirect material b. Utilities c. Inspection d. Test kitchen e. Material handling f. Total overhead cost Exhibit 11-11 Activity-Based Flexible Budget: DCdesserts.com DC desserts Waxed paper DCDESSERTS.COM Monthly Flexible Overhead Budget Budgeted Cost Level of Activity Cost Pool I (cost driver: process hours) 6,000 7,500 9,000 Indirect material: Nonstick cooking spray $12,000 $15.000 $18.000 2.000 2,500 3,000 Other paper products 2,000 2,500 3,000 Miscellaneous supplies 6.000 7,500 9,000 Indirect labor: maintenance 4.000 5,000 6.000 Utilities: Electricity 3.000 3,750 4.500 Natural gas 1.000 1,250 1.500 Total of cost pool I $30,000 $37,500 $45,000 Cost Pool II (cost driver: production runs) 8 12. 16 Indirect labor: Inspection $ 2,200 $ 3,300 $ 4,400 Setup 3.000 4,500 6.000 Total of cost pool II $ 5,200 $ 7,800 $10,400 Cost Pool III (cost driver: new products tested) 20 30 40 Test kitchen $ 1.200 $ 1.800 $ 2.400 Total of cost pool III $ 1.200 $ 1.800 $ 2,400 Cost Pool IV (cost driver: pounds of material handled) 20,000 30,000 40,000 Material handling $ 2.000 $ 3.000 $ 4.000 Total of cost pool IV $ 2,000 $ 3,000 $ 4.000 Cost Pool V (facility level costs) Indirect labor: production supervisors $ 6.000 $ 6,000 $ 6,000 Depreciation: plant and equipment 500 500 500 Insurance and property taxes 100 100 100 Total of cost pool V $ 6,600 $ 6,600 $ 6,600 Total overhead cost $45,000 $56,700 $68,400