Answered step by step

Verified Expert Solution

Question

1 Approved Answer

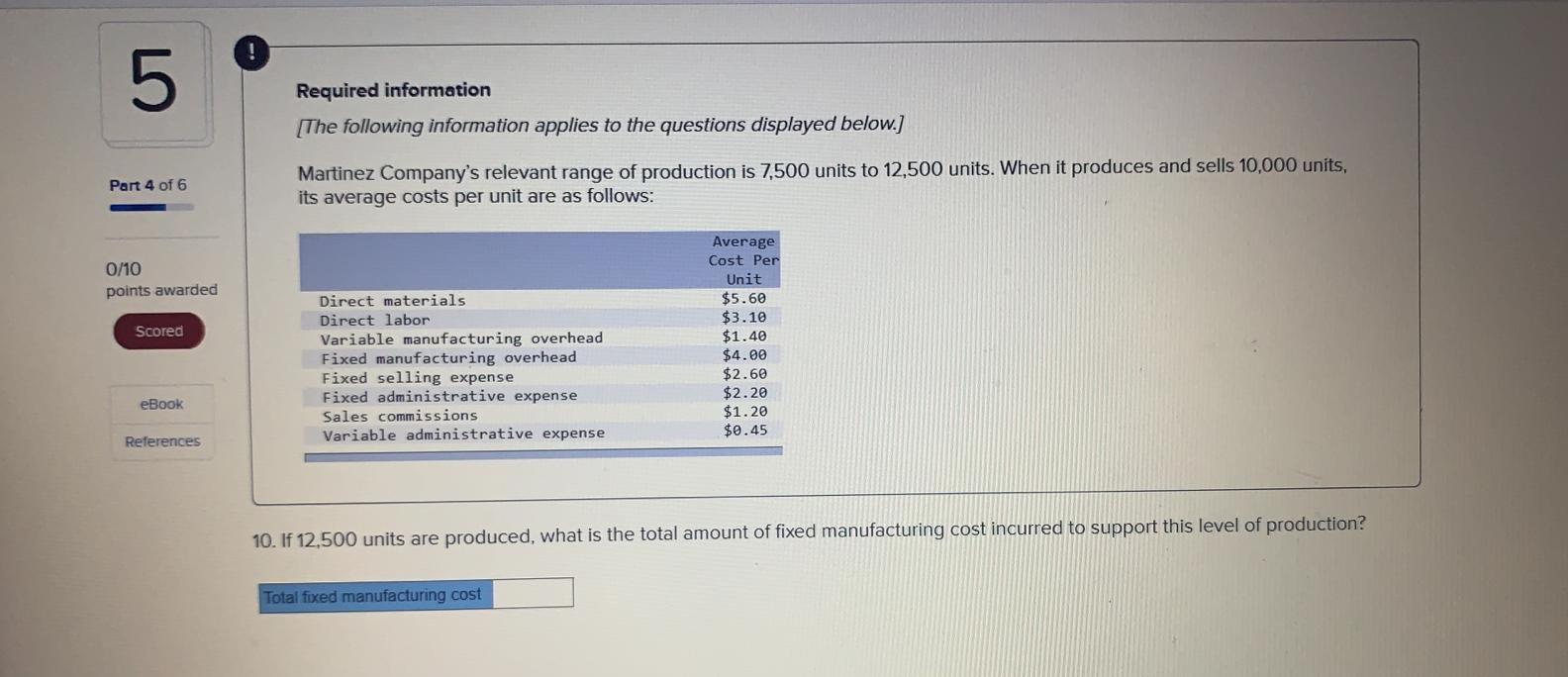

! 5 Required information [The following information applies to the questions displayed below.] Part 4 of 6 Martinez Company's relevant range of production is 7,500

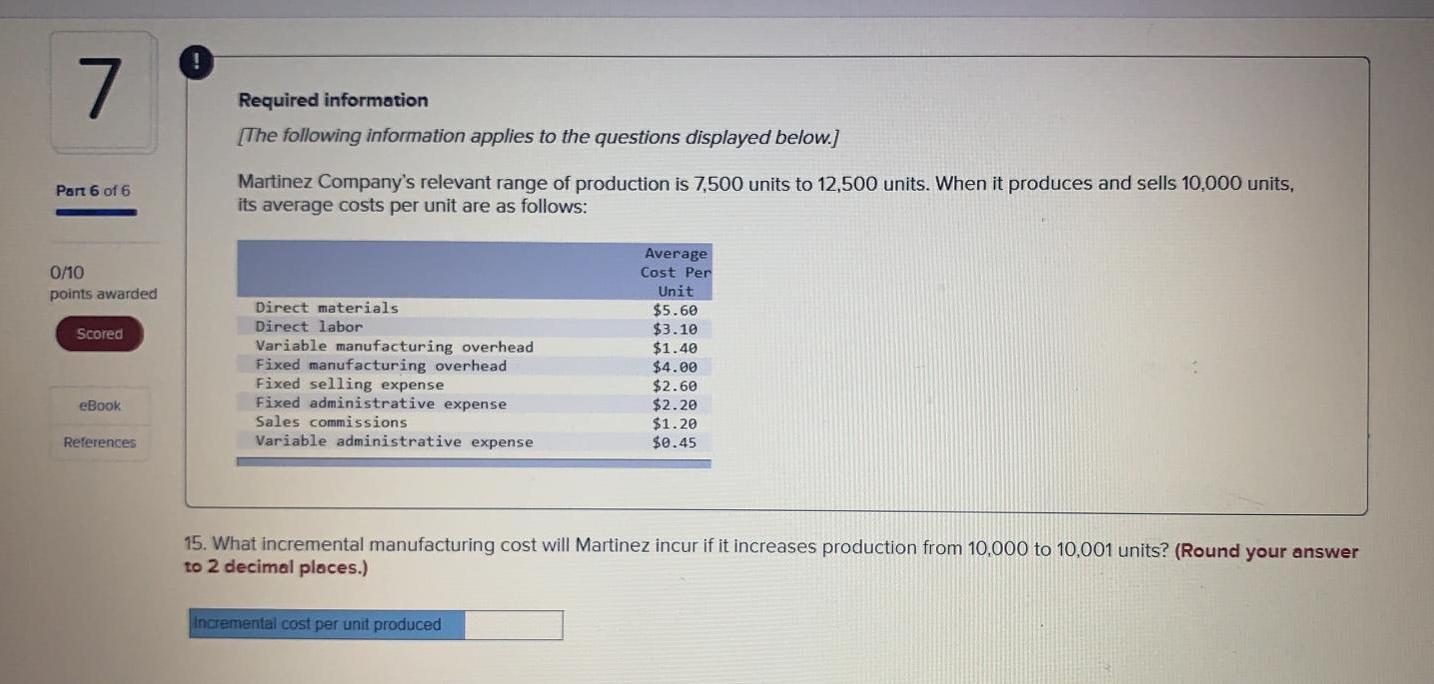

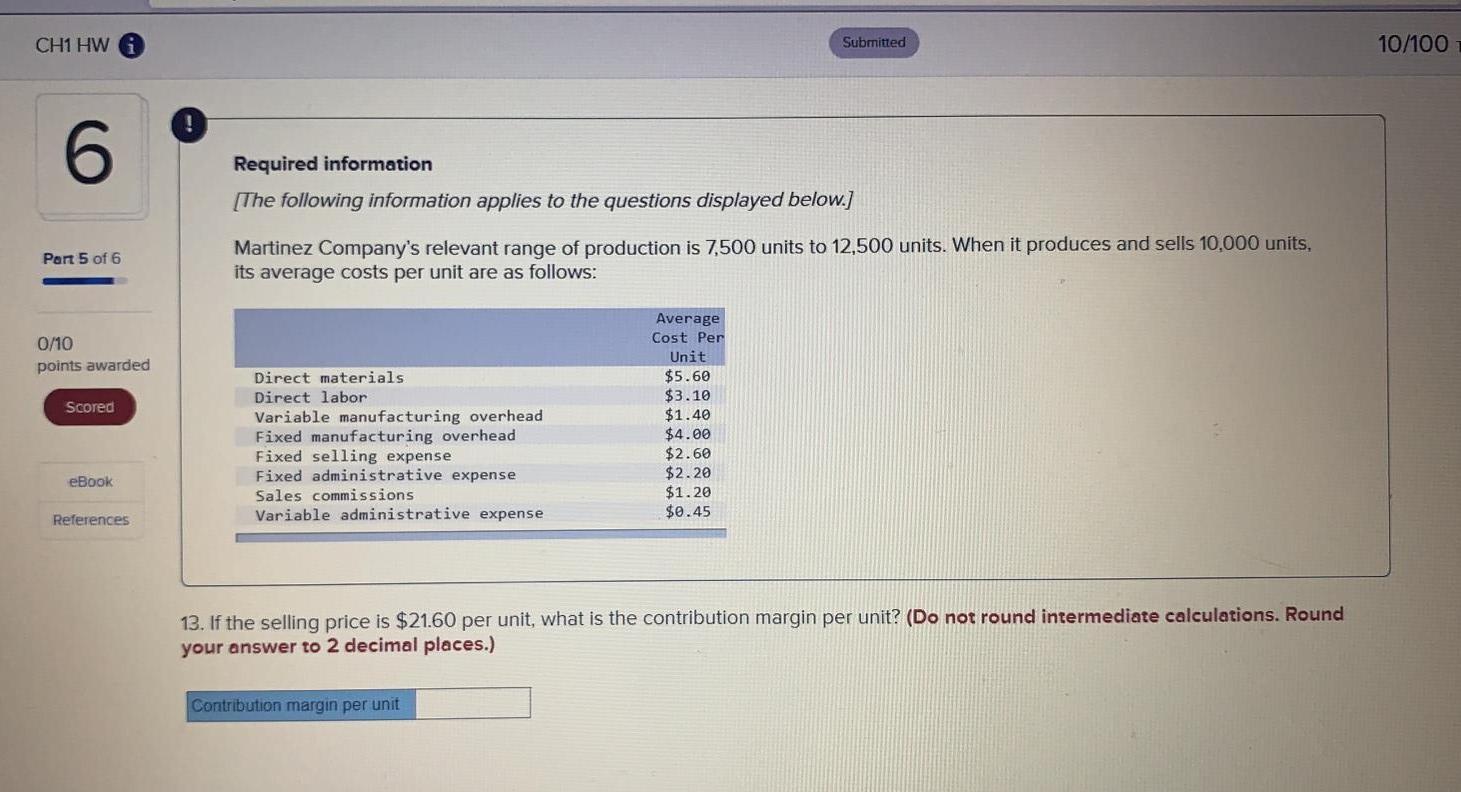

! 5 Required information [The following information applies to the questions displayed below.] Part 4 of 6 Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost Per 0/10 points awarded Unit Scored Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense $5.60 $3.10 $1.40 $4.00 $2.60 $2.20 $1.20 $0.45 eBook References 10. If 12,500 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production? Total fixed manufacturing cost ! 7 Required information [The following information applies to the questions displayed below.) Part 6 of 6 Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: 0/10 points awarded Scored Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $5.60 $3.10 $1.40 $4.00 $2.60 $2.20 $1.20 $0.45 eBook References 15. What incremental manufacturing cost will Martinez incur if it increases production from 10,000 to 10,001 units? (Round your answer to 2 decimal places.) Incremental cost per unit produced CH1 HW G Submitted 10/100 ! 6 Required information [The following information applies to the questions displayed below.] Part 5 of 6 Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: 0/10 points awarded Scored Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $5.60 $3.10 $1.40 $4.00 $2.60 $2.20 $1.20 $0.45 eBook References 13. If the selling price is $21.60 per unit, what is the contribution margin per unit? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Contribution margin per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started